Japanese retail and foodservice sectors see growth

19 April 2016

Australian beef exports to Japan started 2016 with subdued volumes, however the market has recently been showing positive signs, with businesses focusing on changing consumer preferences.

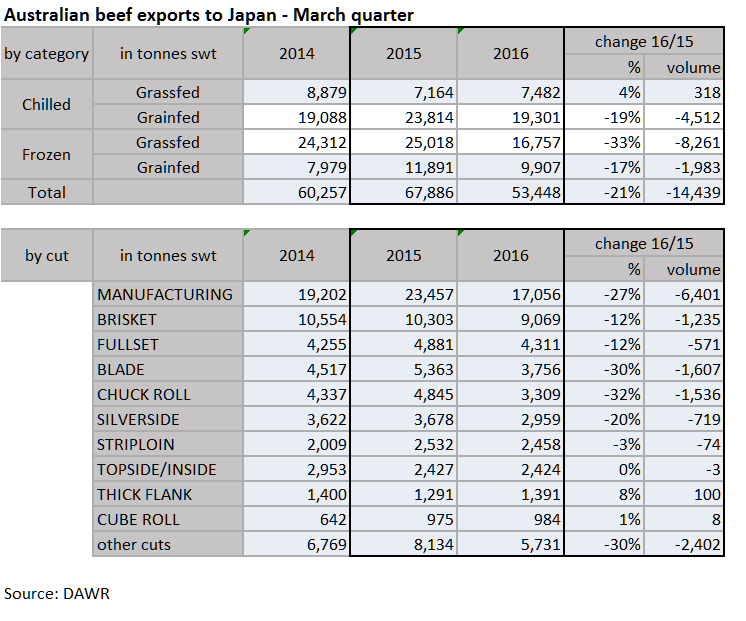

Australian beef exports to Japan – March quarter volume reduced

Australian beef exports to Japan during the March 2016 quarter declined 21% year-on-year to 53,448 tonnes swt, with volumes easing across all sectors, particularly in frozen grassfed beef.

Besides tight supply conditions in Australia, other key influencing factors include:

- Increased availabilities of cheap proteins in the market – imports of pork and chicken into Japan during January and February this year increased 27% to 137,065 tonnes swt, and 13% to 95,865 tonnes swt, respectively, while beef imports reduced 12% year-on-year, to 60,283 tonnes swt. Subsequently, some foodservice and value-add users reportedly shifted from beef to less expensive proteins.

- Increased intake of chilled US beef (up 52% from very low levels last year, to 10,917 tonnes swt).

- Relatively high level of frozen Australian beef stocks in the market, and importers managing the volume and price balance by avoiding over-supply of chilled products.

- Cautious consumers – while prices, wages and household expenditures are slowly increasing, many consumers (seniors in particular) remain mindful about their purchases, resulting in softening of business confidence.

While the total beef export value to Japan in 2015 increased 15% from 2014 to A$1.89 billion, despite a 2% decline in volume, the export earnings so far this year are down 23% from the same time last year, with the total for the two months (January and February) amounting A$192 million.

Retail landscape – businesses focusing on healthy attributes

- Food sales at supermarkets have seen positive year-on-year growth in 2016, both in food overall and livestock product categories (data by the Japan Chain Stores Association).

- Japan’s Nikkei newspaper reported strong sales outcomes for the fiscal year ending February 2016 by food supermarkets (as opposed to GMS, or general merchandise stores). Many of these outlets leveraged demand for cooked meals from working couples of senior households, with some chains taking advantage of the “strong interest from consumers for certain nutritional claims such as reduced salt or sugar”.

- Nikkei also noted strong performance by Lawson (convenience store), of which sales were lifted by success of health-oriented drinks.

Foodservice landscape – McDonalds on its recovery trajectory

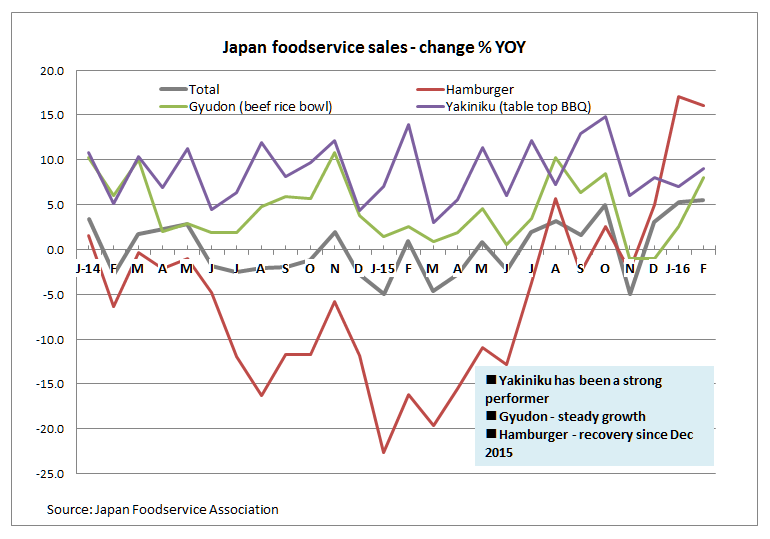

- For the first two months of 2016, overall sales, customer numbers and spend per customer have all improved year-on-year in the foodservice sector (data by the Japan Foodservice Association).

- By category, western fast food sales in February increased 16% year-on-year, largely attributed to improving performance of McDonalds. The company’s recovery was first noted in December 2015, with strong demand for the latest menu ‘Grand Big Mac’ contributing to recent growth.

Foodservice trends – businesses expanding operations, markets

Recent trends led by Japan’s major foodservice operators include:

- Fast food chains diversifying their offerings (Moss Burger launching a new pasta chain, KFC offering barista made coffee and evening alcohol services)

- Continuing expansion to ASEAN markets (Yakiniku Anraku-tei, Sagami noodle chain, and affordable Japanese meal outlet Yayoi-ken), as well as new entries to the US (Ikinari Steak – standing only steak bar, steak chain Mo Mo Paradise)

- Menu development for overseas visitors to Japan (halal gyoza – meat dumpling with halal ingredients)