China’s record high pork prices prompt several price control measures

Pork prices in China have recently reached all-time highs, prompting the implementation of several price control measures, including increased pork imports and the use of domestic pork reserves.

According to Business Monitor International (BMI) Research, China's pork sector is going through another of its recurring boom and bust cycles. The market has shifted from an oversupply situation in 2012-2014 to a tight market in 2015, sending local pork meat prices and import volumes to record highs in 2016.

According to China’s National Statistics Bureau, pork production in 2015 decreased 3% from the previous year, and the first quarter of 2016 was down 5.9% year-on-year, to 14.66 million tonnes – the lowest quarterly volume since 2012. Three years of low pork profitability, since 2012, along with stricter environmental regulations led to significant destocking. However, BMI also forecasts that production will start recovering in 2017.

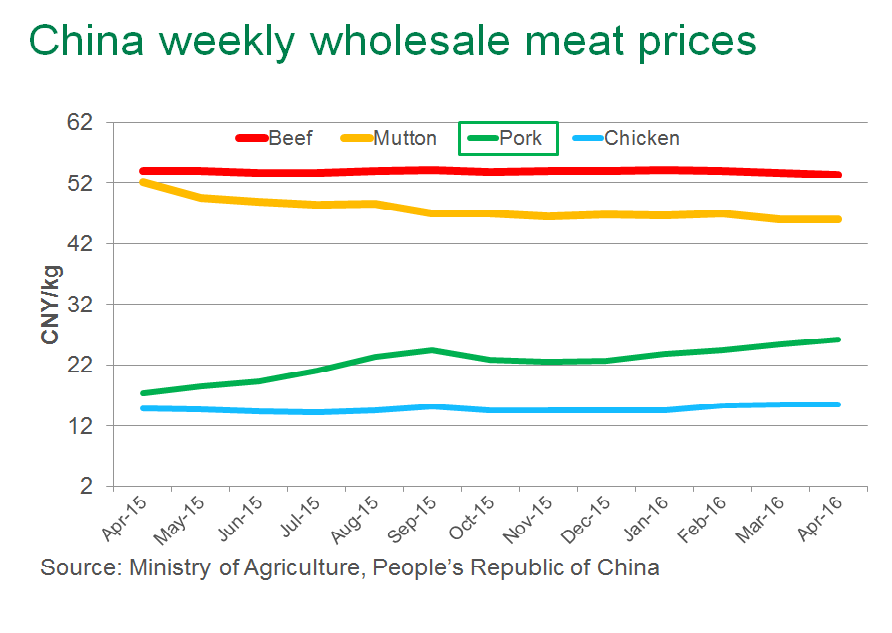

As of the week commencing 9th May 2016, China’s average weekly wholesale price for pork was a record CNY26.58/kg, up 41.4% year-on-year (Ministry of Agriculture, PRC).

Despite higher prices, the domestic industry is reportedly unable to fully capitalise on this positive price movement due to restrictions on capital and increasingly strict environmental laws, hence the tight market (BMI).

Pork prices are a particularly sensitive issue in China, not only because pork is the most popular protein but also because it contributes significantly to the Consumer Price Index (CPI).

In 2015, China had the highest per capita consumption of pork of all countries – at 31.8kg (FAO-OECD). The next highest pork consumers are in the EU-28 at 31kg per capita.

In 2016, the Chinese CPI in February and March was up 2.3%, while the food component was up 6.7% in February and 7.6% in March, compared to 2015. Higher pork and vegetable prices have been the main drivers of this inflation, but particularly pork, since it has accounted for about 3% of the total CPI basket. Interestingly, China’s National Bureau of Statistics has somewhat reduced the proportion that pork and food contribute to the CPI this year – reducing pork’s share to about 2%.

One result of the rises in pork prices has been a significant increase in China’s pork imports in 2015, which is expected to continue during 2016. China Customs statistics show that pork imports in February 2016 were 74,371 tonnes, an increase of 111% year-on-year.

Apart from increasing imports, another mechanism of price control available to the Chinese government is its pork reserve. The Chinese government created the world’s first and only frozen pork reserve in 2007, which it uses to help stabilise prices. In September 2015, the government released 102,000 tonnes from the pork reserves into the market to lower prices for the Mid-Autumn Festival and the National Day holidays. Over the past few weeks, local governments of Beijing, Dalian, Xi’an, Qingdao and Guiyang have begun to put reserve pork into the market to try to ease prices, although this has had limited impact so far, according to Steiner Consulting.

Although Chinese per capita consumption rates of all proteins are increasing, the share of proteins other than pork has been growing, particularly for poultry, but also beef, fish and sheepmeat. Pork now accounts for around 60% of total meat consumption, compared to over 90% 30 years ago (FAO-OECD). As urbanisation and growing wealth swell the Chinese middle class, there is greater desire for variety in both taste and nutrition, including in proteins.

Certainly, China’s direct imports of beef have seen strong growth in 2016, with a total of 138,956 tonnes swt imported in the first quarter (Jan-Mar) – a 90% increase on the corresponding period in 2015 (Global Trade Atlas, China Customs).