Australian red meat into ASEAN: Part 2 – strengths, challenges and key insights

ASEAN, or The Association of Southeast Asian Nations, comprises of 10 countries* in South East Asia, and has grown to be a critically important market for Australian red meat.

(*Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam)

Part 1 of this article outlined Australia’s red meat trade growth in the ASEAN region, and the market’s strengths and challenges.

This second part examines:

- The region’s economic diversity

- ASEAN ‘new middle class’ consumers

- What is the ‘new normal’ for ASEAN?

Economic diversity

As stated in Part 1, one of multiple challenges in the region for trade is its economic diversity – both among countries and within each country.

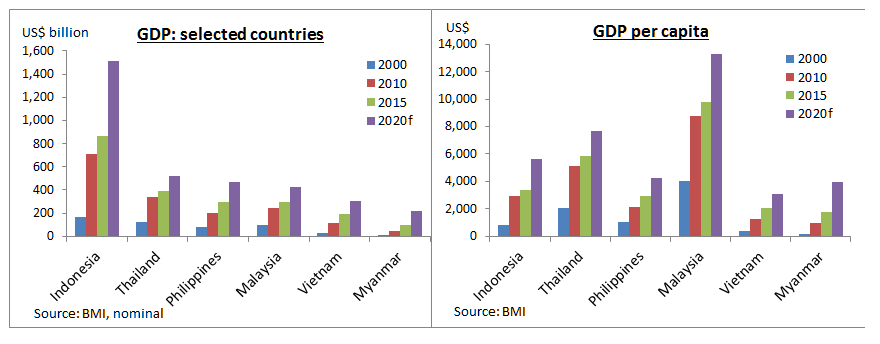

In terms of the country level, total size of the market, and the purchasing power of individual consumers (demonstrated as GDP per capita in this case), should be taken into consideration separately.

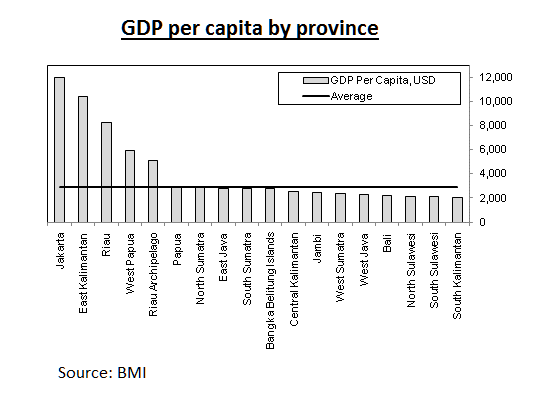

Secondly, ‘country average’ data needs further interpretation, due to income disparity within the market. For instance, while Indonesia is a key economic driver in ASEAN, its economic landscape is vastly variable by city and region*.

(*some provinces have small populations with large natural resource revenues, and therefore GDP Nominal does not fully reflect consumer demand)

Whether it is breakfast, lunch or dinner, middle income consumers in Jakarta would have multiple options – similar to consumers in Sydney, Tokyo or London. In contrast, choices would be limited for consumers who live in less urbanized provinces in Indonesia, due to their income level, supply chain infrastructure, and availability (or lack) of commercial premises.

‘New middle class’ in ASEAN cities

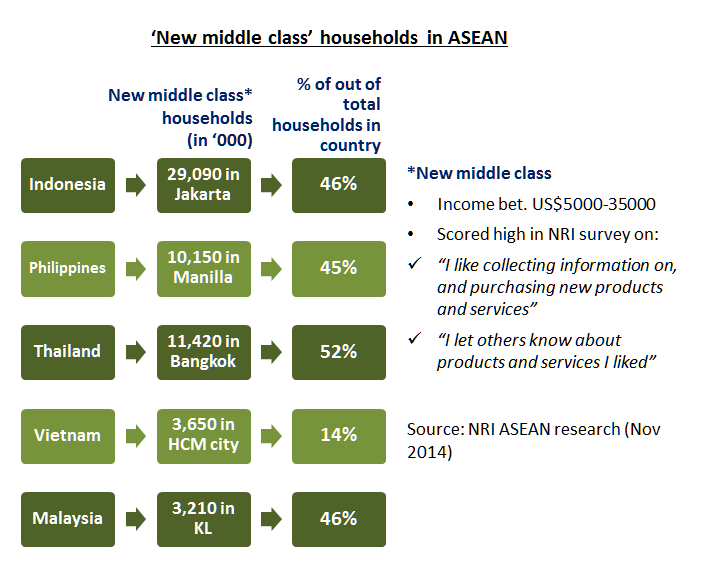

Seeing great growth opportunities in ASEAN, as well as a need to segment key consumer groups within countries, Japan’s Nomura Research Institute (NRI) released a study paper on ASEAN middle class consumers in 2015. From this, NRI extracted a ‘new middle class’ in selected cities using a unique definition, as below.

While this illustrates the potential size of segments where Australian red meat products could penetrate, further study would be required to identify food and meat consumption patterns of these consumers to capture targeted opportunities.

An article by McKinsey & Company remarks the importance of “identifying clusters of similar consumers across multiple markets”, and provides some keys to understanding diverse needs in emerging markets:

- Consumers ability to afford a given product – including their willingness to “stretch” to buy less-affordable product – needs to be assessed.

- Are consumer needs fundamentally global or local? Would they choose a global brand, or a localised product, or would the choice vary depending on occasions?

What is the ‘new normal’ in ASEAN?

Key global food trends, explored by Julian Mellentin from New Nutrition Business during an MLA workshop, included;

- Premiumisation (the majority of premium consumers in Asia are female between 25 to 44 year old)

- Seniors (aging is quietly progressing even in seemingly young ASEAN region), and

- Snacking (emergence of snacks that were traditionally considered as meal ingredients, such as meats and vegetables).

Julian noted “Adapting products to consumers’ needs for snacking and single-serve isn’t a choice, it’s the new normal. It’s also a world of opportunity for people willing to move quickly.”

With consumers in ASEAN and their needs rapidly changing, the importance of identifying and leveraging the ‘new normal’ in targeted segments would likely to assist the growth of red meat trade from Australia to the region.

Julian’s presentation was a part of Insights2Innovation – ASEAN workshop, held by MLA. The initiative is one of five key programs under Rural R&D for Profit Market and Consumer Insights to Drive Food Value Chain Innovation and Growth (Insights2Innovation) Project. For more information about this program, please contact insights2innovation@mla.com.au