Australian red meat into ASEAN: Part 1 – strengths, challenges and key insights

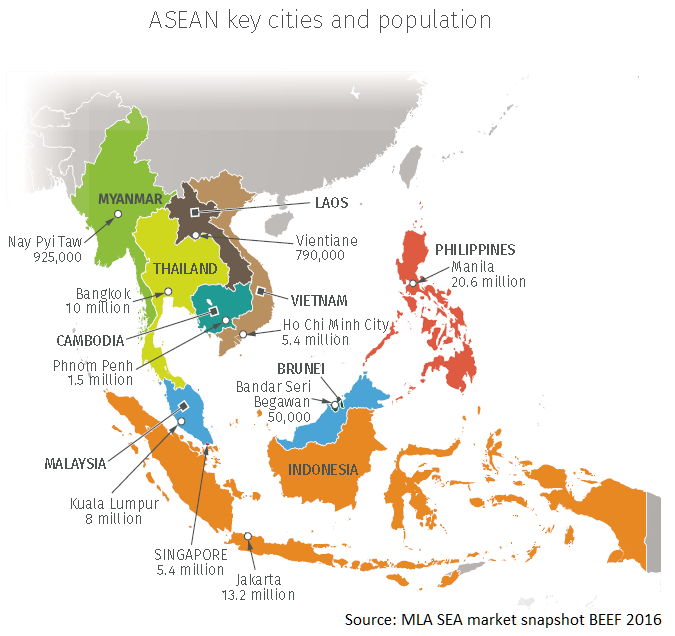

ASEAN, or The Association of Southeast Asian Nations, comprises of 10 countries* in South East Asia, and has grown as one of critically important destinations for Australian red meat, offal and live cattle. In value terms, trade with the region collectively delivered A$1.95 billion in 2015, a growth of 352% in comparison with 1995.

(*Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam)

Following topics will be discussed in this two part article on the ASEAN region:

- Historical growth of Australian red meat trade with the region

- Strengths and challenges

- March 2016 quarter trade summary

- ASEAN consumer trends and insights from a recent MLA workshop

Steady growth of economy and trade

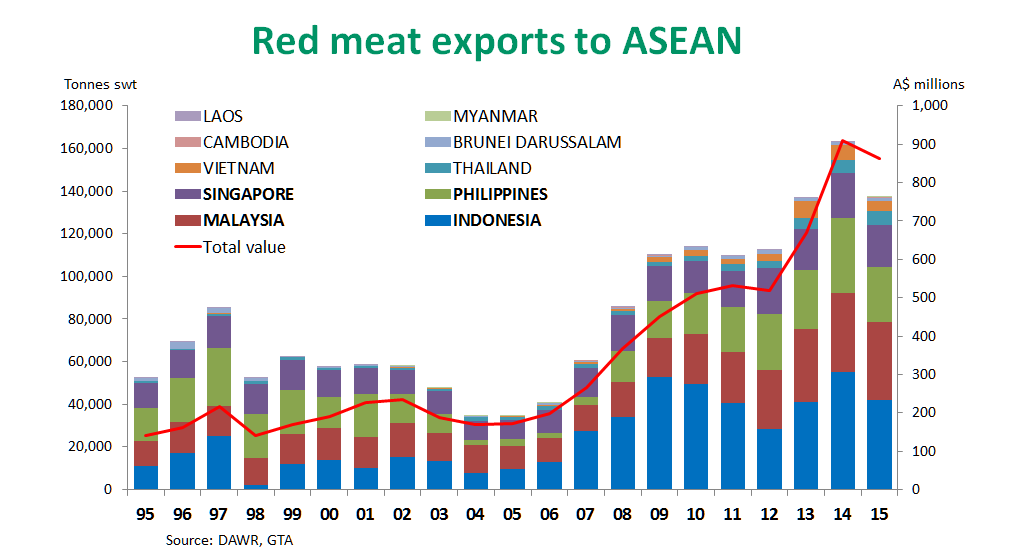

In 1995, nominal GDP of ASEAN 10 countries totalled US$660 billion, and Australian red meat trade to the region delivered A$141 million to the industry. Fast forward 20 years, and the region grew to a US$2.5 trillion economy (nominal GDP based, 2015), with A$862 million worth of Australian red meat shipments to the market during the year.

Key strengths of the region for the Australian red meat industry include:

- Population of over 620 million, which is expected to increase by 29 million people by 2020

- Steady economic growth (average of 4.4% to 5.3% towards 2020*)

- Growth in modern retail and foodservice sectors, especially in ‘mega cities’ such as Manilla, Jakarta, Bangkok, Kuala Lumpur, and Ho Chi Minh city

- Rising incomes and subsequent increases of middle class consumers who are adopting more modernised diets and lifestyles

- Growing interest in safe, convenient and quality food

(*ASEAN 6 – Indonesia, the Philippines, Malaysia, Thailand, Singapore and Vietnam, forecast by IMA Asia)

Key challenges include:

- Uncertainties of import regulations by the Indonesian government – the largest destination in the region for both beef and live cattle from Australia

- Diversity of language, culture, economic status, policy and regulatory requirements within the region

- Economic diversity within countries - 'country average' figures can be misleading due to a large income disparity between urban and rural consumers

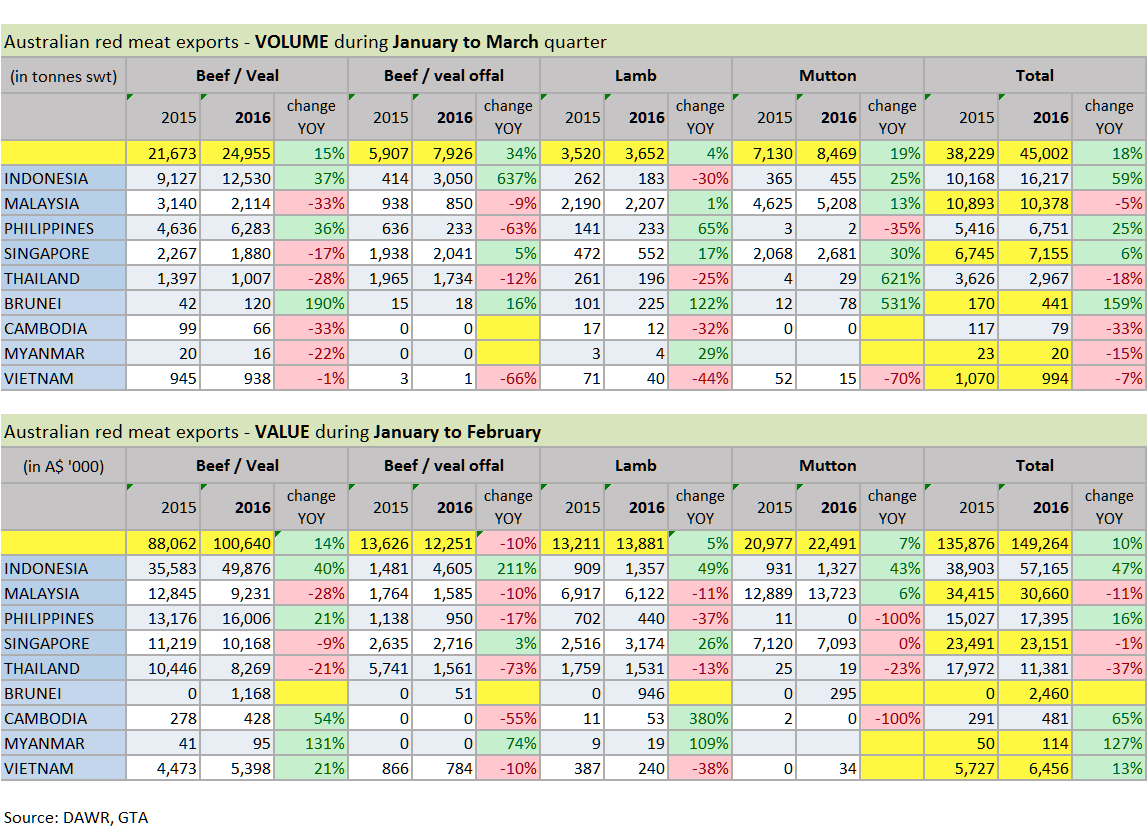

March quarter exports – up 18% year-on-year

After peaking in 2014, Australia’s meat trade with the region declined in 2015, largely due to import cut restrictions posed by the Indonesian government. Exports in 2016 were forecast to be constrained by tight beef supplies from Australia, however the first quarter resulted in a positive upturn, underpinned by relaxation of import protocols into Indonesia.

Underneath the volume

Australia’s red meat export volumes to the region will continue to be influenced by the country level factors including the economy, import policies and market access. At the same time, it is also becoming critical to identify focus segments in the ASEAN region – rather than seeing each country as one market – as protein demand and consumer choice diversify, underpinned by their economic status.

Food trend expert Julian Mellentin who spoke at a recent MLA workshop, believes that "high income, well-educated consumers in major ASEAN cities would have more things in common with consumers in London, New York and Sydney, than their own country people who are living in rural areas with significantly lower income".

While cultural context and preferences are still to be taken into consideration, his comment reinforces the region’s fast changing consumer landscape, driven by rapid urbanization and a widening gap in income, lifestyle and diet between urban and rural consumers.

ASEAN consumer trends and insights from a recent MLA workshop will be discussed in the second part of this article.