Australian lamb prices surge ahead of NZ

There have been upward movements in global lamb prices in recent weeks, assisted by stronger export demand, some rainfall in Australia’s largest lamb producing regions and the anticipation of tighter supplies in coming months from the world’s two largest lamb exporters – New Zealand (NZ) and Australia (AgriHQ NZ).

So, how do Australian and NZ lamb prices compare?

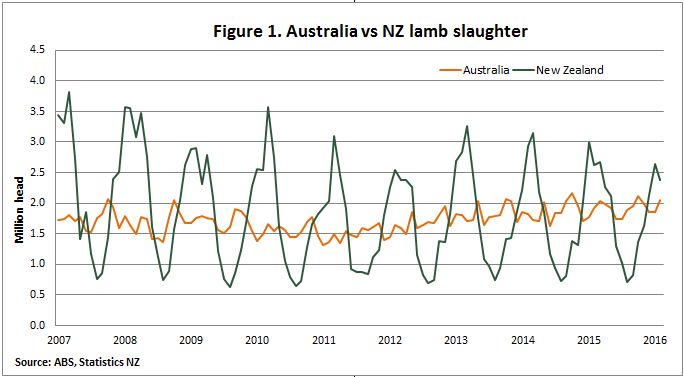

Firstly, we need to look at production in each country, and NZ’s system is much more seasonal than Australia, as illustrated in Figure 1.

In NZ, the production season runs from October to September, with the peak lamb processing period typically occurring between January and April. During these peak months, NZ lamb slaughter can exceed Australian lamb slaughter by up to 2 million head each month (Statistics NZ, ABS). However, towards the tail-end of the NZ season, in August and September, NZ lamb processing winds right down, to around 1 million head below Australian levels.

A further interesting point to note is that the peak turn-off period for NZ has been trending lower over the past 10 years, as the growing dairy industry has offset area for sheep and lamb production.

Also illustrated in Figure 1, Australia’s lamb production is considerably more consistent throughout the year, although supplies do reach a peak during spring (September to November).

The varying production cycles have a big influence on prices within and between each country.

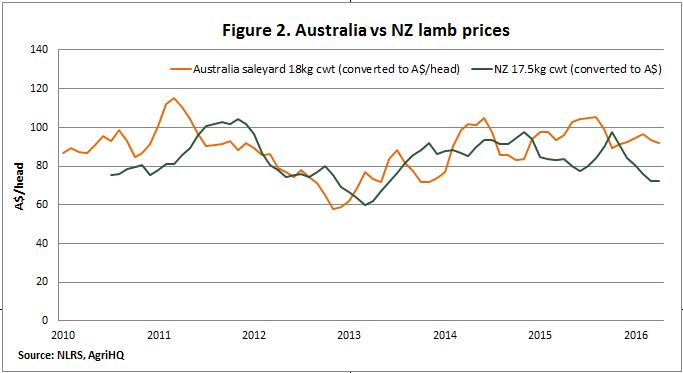

To examine this, we have compared the NZ 17.5kg cwt lamb farm-gate price (from AgriHQ) and the Australian 18kg cwt lamb saleyard indicator (NLRS) – and converted both to A$/head.

Figure 2 demonstrates that, over the last five years, the two indicators have followed each other relatively closely (influenced by similar trading partners).

The strong influence of each country on one another can be seen during the months when Australian lamb slaughter is at an annual peak (September to November) causing NZ lamb prices to be at a premium to their Australian equivalents, and vice versa.

Interestingly, over the last three years, the margin between Australian and NZ lamb prices during the Australian peak supply period has progressively narrowed. In other words, the annual low point of the average Australian trade lamb (18kg cwt) price has become higher each year (as illustrated by the three black arrows). The reason is primarily due to the progressively lowering peak in the NZ production cycle mentioned earlier, meaning competition on the global front for Australian lamb at that time of the year has been reducing.

At present, even though it is the peak turn-off time for NZ, the discount in price to Australia is greater than normal, largely due to sluggish export demand. However, as stated by AgriHQ NZ, this pressure may have eased giving reason to believe that the normal seasonal rise in NZ prices about to occur may be greater than usual.

For Australia, even though tighter lamb supplies are expected (in Australia and NZ) over the coming months, prices may be tested if the A$ remains strong and the BOM’s positive three-month (May to July) rainfall outlook fails to come to fruition, following the very dry April.