Record weights and prices flow to processors

Key points

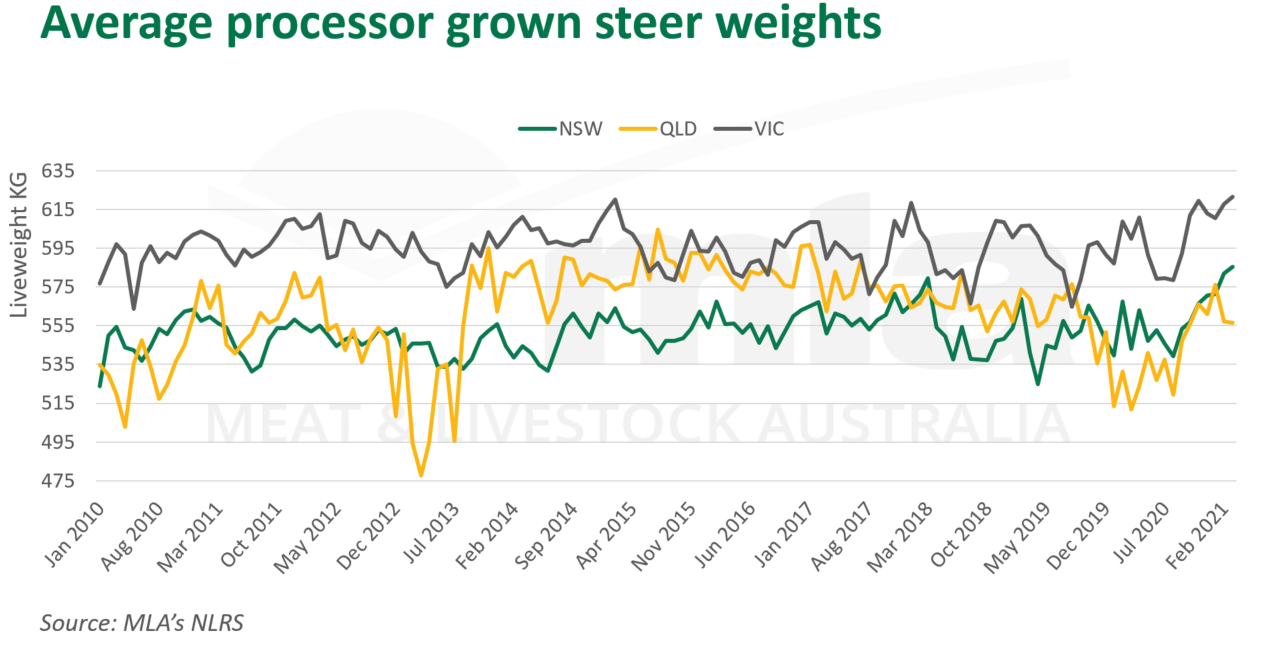

- Grown steer saleyard weights in NSW and Victoria achieve record levels in March 2021

- Rise in weight still not enough to offset larger rise in price

- Processors face external pressures on top of domestic market factors

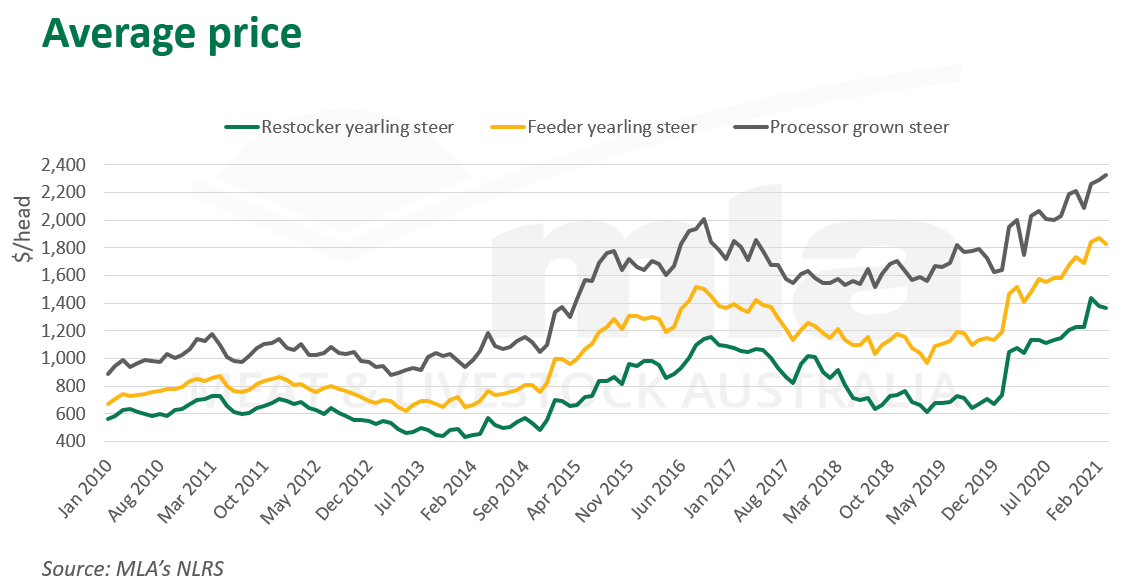

Yearling steers at a restocker and feeder level rose significantly in NSW during 2020 and into 2021. However, this wasn’t enough to offset the rise in prices, fuelled by heightened demand as supply tightened and grass was abundant. Despite Queensland weights not increasing to nearly the same extent, prices were able to launch comparatively higher, as increased southern and feeder demand was brought on by larger supply in parts of Queensland.

Have the higher weights and price trends flowed through to the processor level?

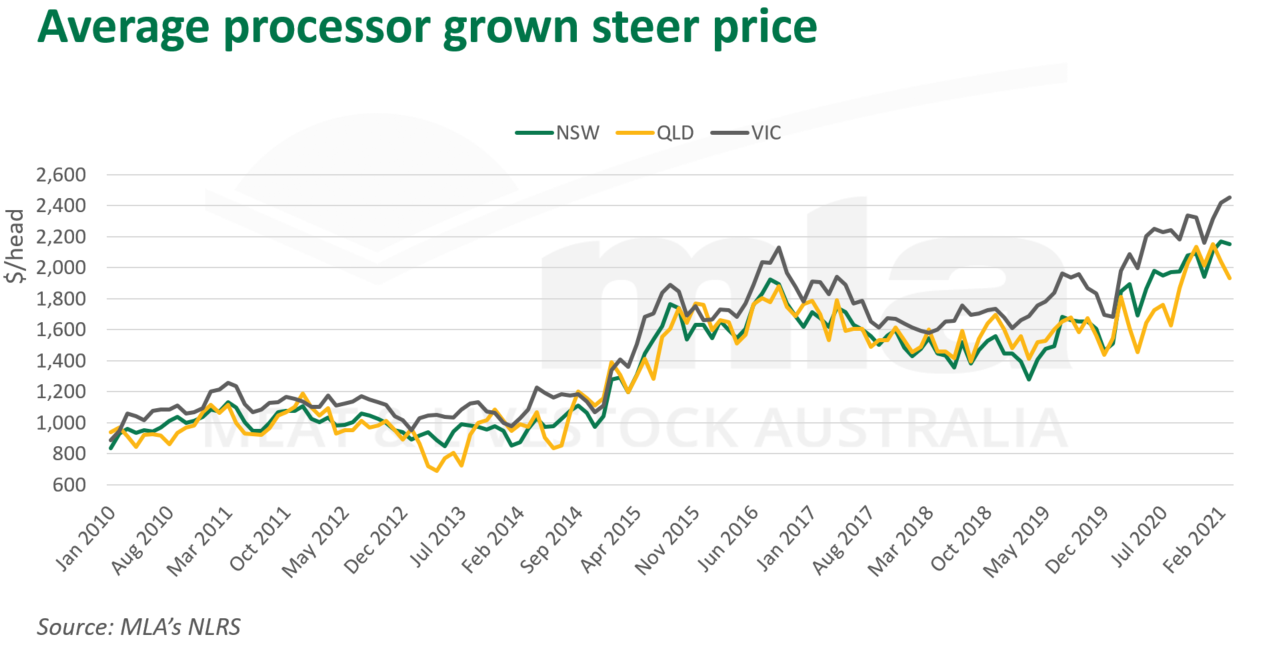

NSW and Queensland grown steer weights have jumped 7% and 10%, respectively, in the past 12 months, with Victoria producing the heaviest steers, however, only rising 3%, while $/head prices have lifted 14%, 20% and 17%, respectively. Price growth has certainly continued to outweigh the rise in weights, highlighting increased liveweight price gains across the eastern states. Up until this point, domestic factors have driven the cattle market, with rainfall the main factor coming out of severe drought.

As evidenced by the above graphs, processors still had to buy in at high rates, spurred on by restockers and feeders. This was further exacerbated by the rise in weight when looking at total investment. This means processors had to compete with not only high domestic prices and low supply, but also external factors as they push product into overseas markets. These pressures have clearly not flowed down the supply chain to the same degree, as high prices continued to be paid in a restocker-driven market.

What are the main external factors applying pressure?

COVID-19 has reduced foodservice demand in many destinations for Australian product. Processors have had to be more agile and try to maximise the carcase by leveraging different cuts and channels depending on demand. This, along with logistical and political challenges, has made maximising carcase value harder.

The rising AUD has also made buying meat more expensive for importers. In the last 12 months:

1 AUD = 0.76 US dollars, rising 30%

1 AUD = 82 Japan Yen, rising 26%

1 AUD = 4.96 China Yuan, rising 19%

These are significant lifts in a short amount of time.

The higher prices paid would have helped to offset lower production volumes somewhat and the global appetite for beef remains strong and should continue to improve once vaccines are implemented. There is, however, a reduced appetite for importers to pay those corresponding levels, when domestic prices are higher than other key exporters and facing less currency pressure. Until there is a significant increase in supply as rebuilding kicks in, seasonal conditions deteriorate or the dollar depreciates, these trends are expected to continue.

© Meat & Livestock Australia Limited, 2021