Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

US imported beef market facing challenges

28 January 2021

Key points:

- US imported 90CL prices rose to A640¢/kg for the week ending 21 January

- Tight supplies from Australia and New Zealand are limiting product availability for the US

- Exchange rate movements combined with rising wholesale prices are also challenging US buyers.

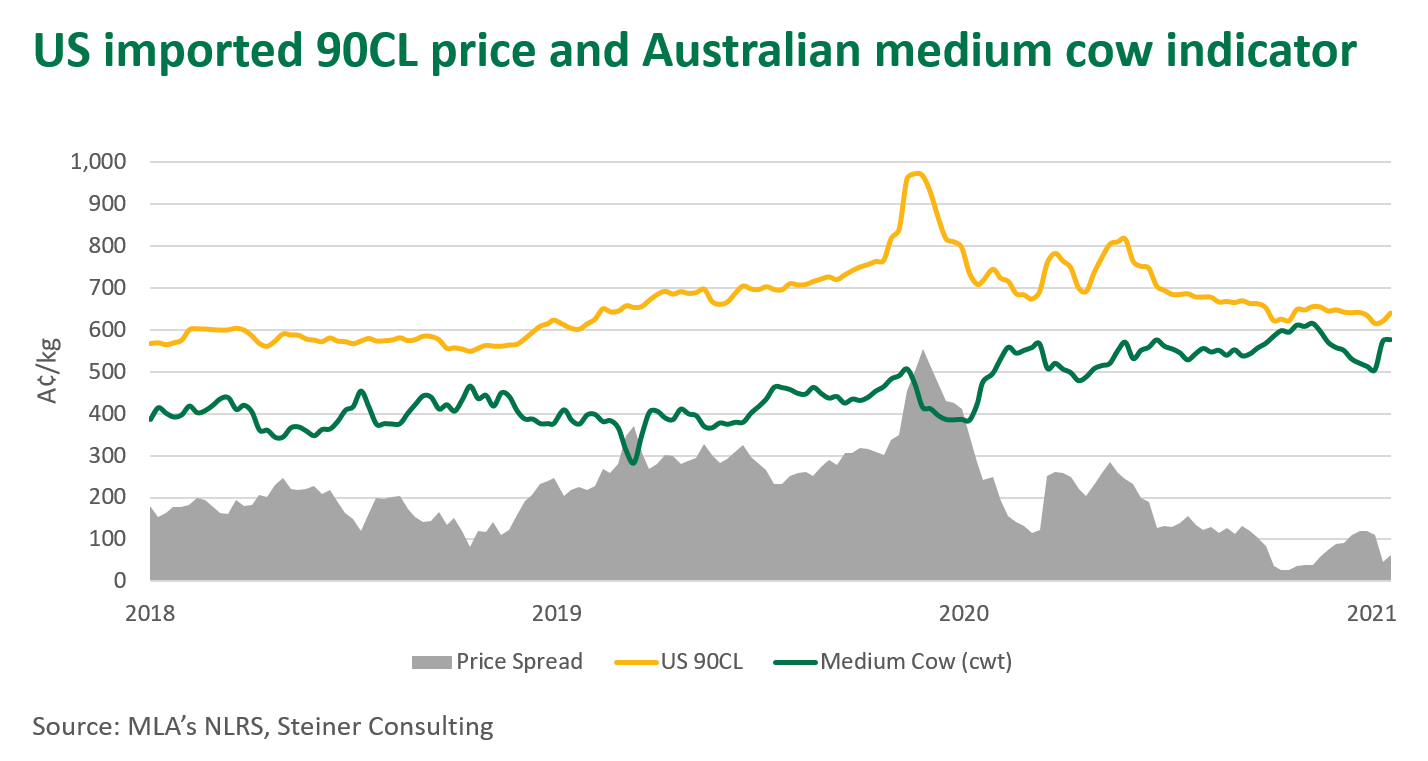

The 90CL (Chemical Lean) US imported beef indicator (a benchmark price for frozen manufacturing beef into the US) lifted last week, reaching A640¢/kg for the week ending 22 January, sitting 6% above the five-year average. Tight Australian cattle supplies remain a key challenge for the US market, while wholesale beef prices in the US are trending higher, with demand emerging as buyers look to bolster inventories with the spring season just around the corner.

The gap between the US imported 90CL indicator and Australian Medium Cow Indicator has rapidly converged. Typically, these two price indicators are intrinsically linked, as one often responds to movements in the other. Following the recent spike in Australian cattle prices (the Medium Cow Indicator is now up 12% on its position at the start of the year), the price spread between the two indicators has now shrunk to just A63¢/kg, undoubtedly creating pressure for market participants.

The weak US dollar continues to work against US buyers. Typically, as the value of the US dollar declines, this tends to be inflationary for imported beef values by making the US market less attractive for Australian or New Zealand packers. The Australian dollar is currently worth US77¢, up 15% on this time last year.

Growing uncertainty regarding the availability of product from South and Central America is also a concern for US buyers. Exports from Nicaragua remain below year-ago levels, while Argentina is constrained by a 20,000 tonne quota. This, combined with tight supply availability from Australia and New Zealand, are key factors that are likely to support higher imported beef prices in the coming weeks.

For more detail, see this week’s US imported beef market update, provided by Steiner Consulting.

© Meat & Livestock Australia Limited, 2021