US beef on the move - marbled product an ongoing priority

Key points

- Composition of US beef continues to shift towards higher marbled product

- Half of beef consumed in the US is in the form of ground product – a blend of domestic and imported beef

- Lean manufacturing trim imported from Australia remains a critical component of US value chain.

Like Meat Standards Australia grading system, American beef undergoes a similar process of grading to identify carcases of differing quality. This is a voluntary process however the majority of US fed cattle are graded through this system.

US beef grades:

- Prime grade: high quality, abundant marbling (8-13% fat)

- Choice grade: high quality, less marbling than prime grade (4-10% fat)

- Select grade: uniform in quality, some marbling (2-4% fat)

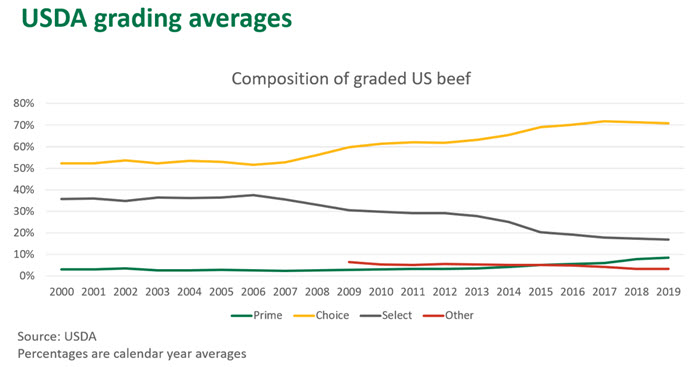

Over the past ten years, the composition of US beef has shifted, with higher marbled beef becoming much more prominent due to strong price-grid premiums. Marbling underpins much of the segmentation and price differentiation of US prime cuts within the domestic and international markets.

The percentage of US ‘Prime’ and ‘Choice’ graded beef has continued to lift, as more product with higher levels of intra-muscular fat is produced, an outcome of a production system centred almost entirely on feedlots. ‘Select’ grade beef made up just 17% of all US graded beef in 2019, down from 36% at the beginning of the millennium.

US beef consumption

Over half of US beef is consumed as ground product, with the burger the most popular item consumed through the vast array of fast foods chains that stretch across the country. Over the decades burgers have remained a mainstay of the US diet and underpinned the beef trade from Australia – trim from US fed cattle is typically too fatty to simply grind into a desirable chemical lean (CL) burger mix and requires blending with leaner product.

If US feedlots continue striving to create this densely marbled beef, this will uphold the need for leaner imported trim to supplement the blending process. With the US fast food industry expected to continue growing, these factors should help to underpin demand for Australian lean manufacturing beef.

US beef exports grow

US beef exports have been growing; in 2019 they exported 966,000 tonnes swt, up 33% on 2010’s figure of 727,000 tonnes swt. In particular, key Asian markets such as Japan and South Korea now account for approximately half of all US exports. These markets in particular value high quality marbled beef, a product which the US is very well suited to produce and deliver.

In 2019, the US exported 11% of its total beef production; this percentage is only expected to grow. Fuelled by African Swine Fever (albeit stalled because of the Coronavirus), international demand is expected to continue drawing product offshore. With US grading figures suggesting the production of a higher quality, more marbled product, this will likely foster further competition for Australia grainfed beef within Asian markets.

© Meat & Livestock Australia Limited, 2020