Price incentives drive up northern supply

Key points

- Strong cattle prices drive elevated numbers in northern markets

- NSW indicators maintain a premium to Queensland indicators

- Store cattle still in high demand from restocker buyers

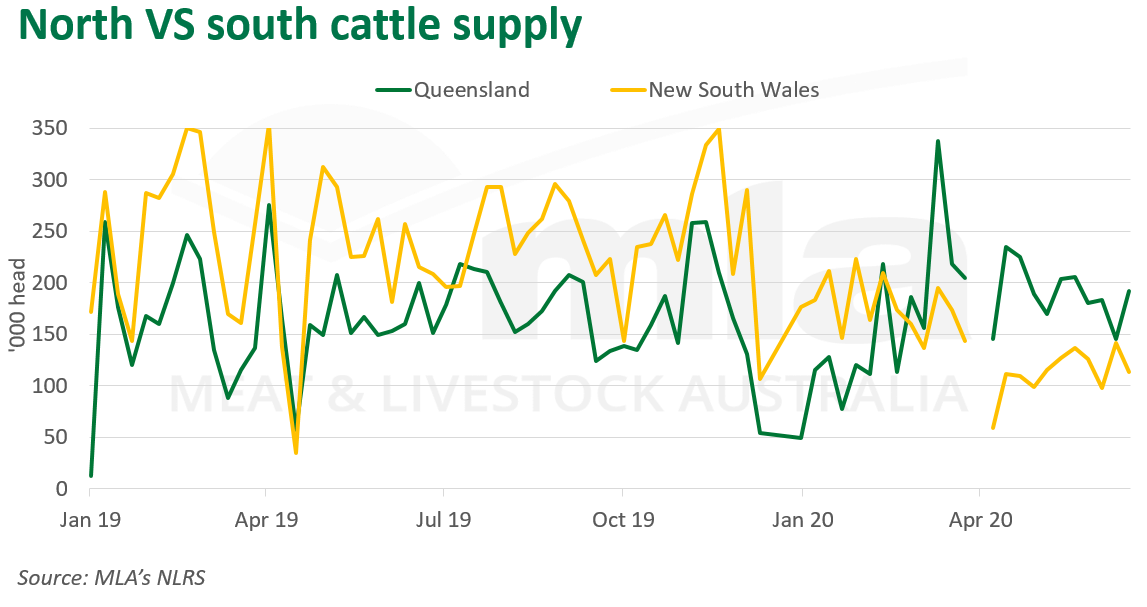

This week saw modest declines in eastern states indicators across most categories, with elevated throughput in northern markets a key driver of this. However, cattle indicators remain significantly elevated year-on-year, the result of fewer store cattle and elevated restocker competition.

Yardings in Queensland lifted 20% on the previous week to 22,745 head, albeit remaining steady on year-ago levels. Saleyard throughput was consistently high last year, driven by sustained dry conditions, while this year’s winter supply has been bolstered by strong price incentives, especially for young cattle.

Last week saw major selling centers such as Roma and Gracemere reporting increases of 1,700 and 2,100 head respectively, with yearling steers and heifers making up close to 80% of supply at Roma for the week ending 26 June. Despite increased northern supply, the Eastern Young Cattle Indicator (EYCI) only saw a modest decline of 2%, to 754c/kg carcase weight (cwt). Strong competition from southern markets has supported store prices, with fewer numbers yarded in NSW at 11,000 head, back 47% on year-ago levels.

Unsurprisingly, southern markets have maintained a premium over their northern counterpart, with vealer steers trading at 815c/kg cwt in NSW this week, a 48c/kg difference to Queensland vealer steers trading at 767c/kg cwt. For trade steers, NSW averaged 754c/kg cwt, up 63c/kg to the Queensland trade steer indicator, which averaged 691c/kg cwt.

© Meat & Livestock Australia Limited, 2020