New season lamb supply building

Key points

- New season lamb yardings up 53% on year-ago levels for the first three weeks of August

- Improved lamb survival and marking rates expected to contribute to higher throughput

- Demand uncertainty will continue to provide price headwinds

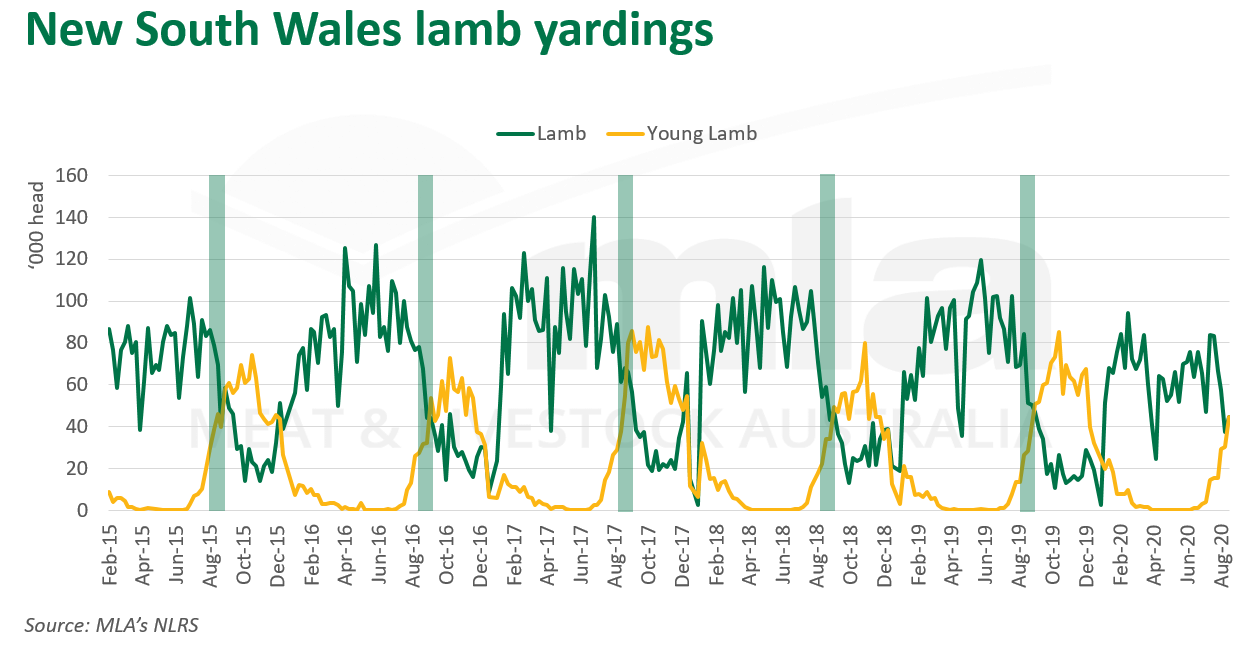

For the first three weeks of August, New South Wales saleyards have reported 104,265 head of new season lambs, an increase of 53% from the same period last year and 25% higher than the five-year average. Of total lamb throughput in the state since the start of August, new season lambs have accounted for 43%, which is 18% higher on year-ago levels.

Wagga Wagga and Griffith saleyards have reported the largest yardings through August, accounting for 26% and 20% respectively of total new season lambs in New South Wales. At Corowa, Forbes, Deniliquin and Yass total new season lamb yardings have also seen large increases in August, although this is coming from a low base the year prior.

In recent years, new season lambs have started filtering through New South Wales saleyards towards the end of August, later than seen in 2020. In 2018 and 2019, the impact of severe drought resulted in challenging conditions for finishing lambs and restricted the supply pool.

The available supply of new season lambs this year will continue to lift in the coming weeks, driven by the Victoria spring flush. Anecdotal reports of increased lamb survival and marking rates across the eastern states will also likely support saleyard throughput and encourage the flock rebuild.

In recent weeks, eastern states lamb indicators have continued to ease, with all reported below year-ago levels. On Wednesday 26 August, the eastern states trade lamb indicator was reported at 652¢/kg carcase weight (cwt), 152¢ below year-ago levels, while heavy lambs have reported the largest year-on-year decline of all categories, back 195¢ to 611¢/kg cwt.

The anticipation for greater throughput of new season lambs entering the market in the coming months, combined with sustained demand pressures, will continue to provide headwinds for the lamb market. This could be further compounded by logistical challenges in the domestic market, with processor shutdowns still in place in Victoria.

© Meat & Livestock Australia Limited, 2020