Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Modelling the impact from the US-China Phase-One Agreement on the Australian beef industry

09 April 2020

In 2019, China emerged as Australia’s largest and most valuable beef export market – injecting A$2.67 billion dollars into the Australian industry, more than double the year prior. As the world grapples with the fallout from COVID-19, China is one of the few markets showing some green shoots after the crisis, although it’s by no means in the clear.

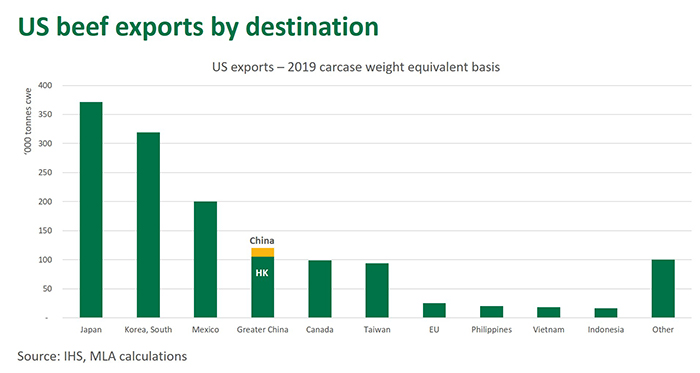

China is not only important for Australian beef exporters – it’s also the top beef market for New Zealand, Brazil, Argentina and Uruguay. China is also a major buyer of Indian buffalo meat via informal grey channels. In fact, the United States is the only major global exporter who doesn’t have a significant share of the China imported beef market. The US-China Phase-One Agreement has potential to correct that, through its relaxation of hormone growth promotant (HGP) restrictions and large purchase commitments (see earlier article What can be made from the US-China Phase-One agreement?).

The US was granted beef access to the China market in 2017 but Hormone Growth Promotant (HGP) and Ractopamine bans (estimated to equate to about a 60% tariff equivalent) made the trade prohibitive for most US exporters. The escalation of tariffs as part of the US-China trade war made this business even more difficult. The US has continued to channel some beef through Hong Kong however China has also clamped down on the grey trade over the last two years, in its endeavour to formalise trade and prevent the US from using a backdoor.

In 2019, the US shipped 10,500 tonnes shipped weight (swt) of beef to China, up from 3,000 tonnes swt in 2017, and 73,000 tonnes to Hong Kong, back from 110,700 tonnes swt in 2017.

The CIE impact analysis of the US-China Phase-One Agreement

Recent analysis by the Centre for International Economics (CIE), commissioned by MLA, has sized up the potential beef trade that could develop between the US and China and estimated the displacement it could have upon Australian product in the market. As there is still a great deal of uncertainty – e.g. Ractopamine-treated US beef is still not approved by China and trade-war tariff exemptions are provisionally being applied on US product – the CIE modelled a range of scenarios to cater for the dynamic environment.

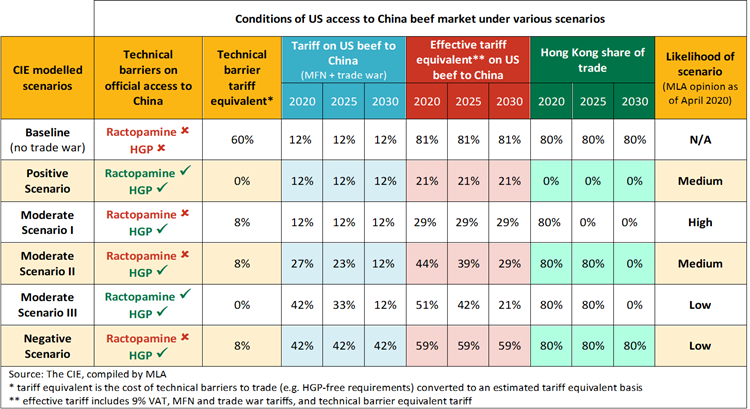

The table below summarises the conditions of the various scenarios modelled. The Moderate Scenario I, with the ractopamine-treated beef ban in place but exemptions to trade war tariffs being provided to importers, reflects the current market landscape to the greatest degree.

As it becomes wealthier, China’s meat needs are expanding but the market is facing a massive supply shortfall due to African Swine Fever. The beef market remians predominantly supplied by domestic sources, while a range South American and Indian (in terms of buffalo meat via grey channels) exporters supply an expanding imported commodity beef market. Australian beef captures more premium segments in China and, as an early entrant in the market, has been able to build a consumer brand and differentiate itself. Hence, the impact upon Australia from the addition of US beef into the market will be softened, as the market is rapidly expanding and the displacement will be shared across a range of sources. Moreover, as modelled by the CIE, the greatest change under various scenarios is a shift in US beef going via Hong Kong to more official channels in mainland China.

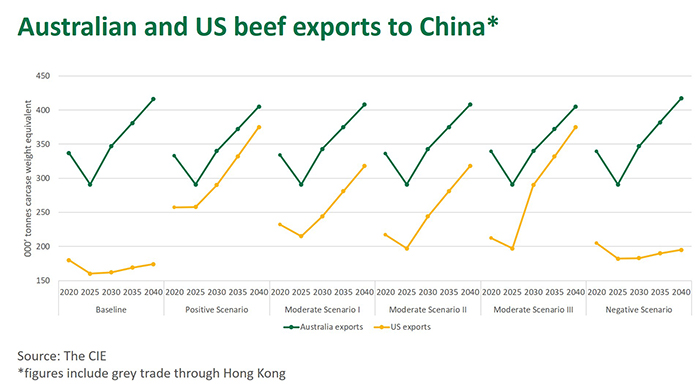

The chart below illustrates the modelled Australian and US export volume under the range of scenarios summarised above. The dip in 2025 is due to an assumed recovery in the China pig herd and production. Given the modelling was attempting to isolate the impact from the Phase-One Agreement, a Baseline Scanerio, which included the technical barriers but assumed the trade war tariffs never occurred, was also conducted for a comparison.

Summary of scenarios

- Under the Moderate Scenario 1, total US exports to China (including grey trade via Hong Kong) in 2020 were modelled to increase to 232,000 tonnes carcase weight equivalent* (cwe), with further growth potential over the longer term.

- If, for instance, ractopamine was also approved by China, reflecting conditions under the Positive Scenario, US exports to China were modelled to increase to 257,000 tonnes cwe in 2020.

- In contrast, however, if China ceases the program of trade-war tariff exemptions and maintains a ban on ractopamine, reflecting the Negative Scenario, the US beef trade to China would only be 205,000 tonnes cwe in 2020, with most of that product coming via Hong Kong.

- Across all scenarios, the negative impact on Australian exports from the US-China Phase-One Agreement, in comparison to the Baseline Scenario, is minimal. Even under the best-case scenario for the US, the displacement of Australian beef in China, as a direct result of the Phase-One Agreement, is only 4,000 cwe in 2020 and 7,000 tonnes cwe by 2030.

Putting these figures into context

The CIE scenarios can be a useful gauge to understand the potential beef trade that could emerge between the US and China, and the economic and technical barriers that will influence it. However, no model can incorporate the full complexity of the world. In particular, the wide-sweeping way covid-19 is transforming the world has not been captured in the scenarios above.

In light of this, the actual trade volumes may differ substantially from the modelled ones, at least in the short term. For example, if the US economy were to fall into a deep recession and foodservice remained closed for an extended period, the US beef industry may find it has huge volumes of cheap loin cuts it can flood into Asian markets, including China. Meanwhile, the success of the battle against African Swine Fever will continue to weigh heavily on global meat markets and trade in years to come.

That said, a US beef export trade to China (including Hong Kong) of 232,000 tonnes cwe in 2020 and expanding to 281,000 tonnes cwe by 2030 (Moderate Scenario 1) is in the ballpark of previous MLA and other industry commentator estimates (note, estimates also vary based on carcase weight or shipped weight units). For context, US beef exports, converted to carcase weight equivalent, to Japan and Korea were 371,000 tonnes cwe and 319,000 tonnes cwe, respectively, in 2019. The combined US beef shipments to China and Hong Kong in 2019 was already 120,000 tonnes cwe.

In terms of Australian farm-gate cattle prices, the impact from the US-China Phase-One Agreement, on its own, may be limited. However, the deal does remove significant barriers to the US exporting markedly greater volumes of beef direct to China – under certain global conditions this may equal heightened competitive pressure. The trouble is, global conditions are anything but certain in these fast-evolving times.

*The CIE models trade volumes on an estimated carcase weight equivalent (cwe) basis, as it allows for a like-for-like comparison with production and consumption figures. This is done by applying a conversion factor to boneless shipped weight (swt) product and, as such, carcase weight equivalent estimates are always higher than those reported on a shipped weight basis. MLA uses the same approach when generating the industry projections, as do various other agencies.

© Meat & Livestock Australia Limited, 2020