Lamb supply remains low

Key points

- Eastern states slaughter impacted by shortened processing week

- foodservice disruptions continue to impact the sheepmeat supply chain

- significant lift in lamb supply not expected until spring

Despite a slight uptick on the week prior to Easter, lamb and sheep yardings remained subdued last week. Although shortened trading weeks usually coincide with a decline in supply, lamb yardings have been trending lower in the last month, largely due to improved domestic conditions driving restocker competition. While record high prices attracted bigger yardings during January and February, lamb supply is still expected to contract sharply through winter, similar to 2018 and 2019 trends.

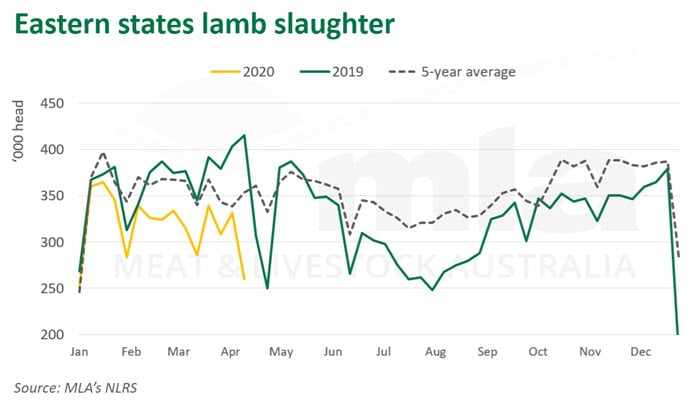

Last week, New South Wales accounted for 53% of total lamb yardings at 57,000 head followed by Victoria at 48,400 head. Last year’s supply figures for the same week accounted for an extra public holiday (ANZAC day), making a year on year comparison challenging. However, eastern states’ lamb slaughter continued to move lower, to 244,700 head for the week ending 17 April, back 6% on the week before Easter.

During winter in 2018 and 2019, declining supply levels were met by strong price increases across all categories. Light lambs heading back to the paddock this year could well find similar support during the winter, as the availability of lambs is anticipated to be limited. The National Livestock Reporting Service (NLRS) CV-19 national restocker indicator, remains at historically high levels on a dollar per head basis, reported at $159/head on Tuesday.

Heavy lambs destined for key export markets may not find similar levels of support this year, given the impact of COVID-19 on foodservice demand in key export markets. However, any improvement in demand in the coming months would lend support to prices through winter, in particular for heavy lambs. The NLRS CV-19 national processor indicator has shown an easing trend this week, reported at $214/head on Tuesday.

Balancing domestic supply with COVID-19 disruptions will be a challenge for stakeholders across the supply chain. However, at a domestic level, anecdotal evidence suggests restockers remain buoyed by the improvement in domestic conditions. New South Wales restockers in particular have increasingly turned to neighbouring states to secure livestock. Early reports also suggest positive scanning rates this season, lending support to lamb supply towards the end of the year and into 2021.

© Meat & Livestock Australia Limited, 2020