Japan top beef destination in February as China demand wavers

Key points

- Demand from China has slowed significantly following Chinese New Year and the impact of Covid-19

- Japan was the top destination for beef in February, purchasing 23,700 tonnes swt

- US was the top destination for lamb in February, purchasing 6,400 tonnes swt

Australian beef exports were 93,000 tonnes shipped weight (swt) in February, just 2% behind this month last year. Taking into account January volumes, 2020 is ahead of 2019 on a year-to-date basis, however, with cattle slaughter taking a significant dip in recent weeks, export volumes will ease in the coming months.

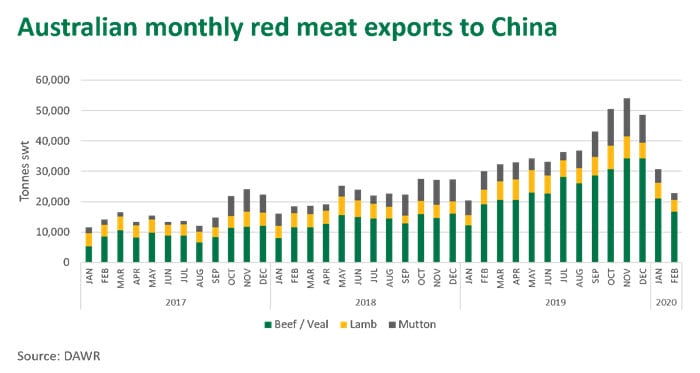

While total Australian beef exports for the month are relatively flat, the impact that the Coronavirus has had upon China demand is evident to see. February beef exports to China were 16,700 tonnes swt, less than half of the volume sent in December. While demand from China is currently volatile, there is confidence that it will recover in the long term, underpinned by growing consumer wealth and the gap in domestic pork supply, resulting from African Swine Fever.

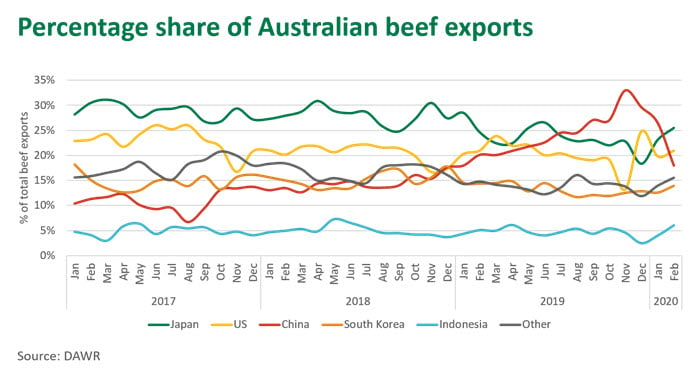

Supplying 16% of the worlds exported beef, Australia has wide market access and strong credentials as a beef supplier. While exports to China have dropped significantly in the past two months, other markets have responded to the shift in market dynamics.

Exports to Japan were 23,700 tonnes swt in February, up 1% year-on-year. This marks the first time that Japan has been the top export destination since June, when China demand really began to ramp up. Other key performers so far in 2020 are the United States, which is tracking 5% ahead of year-ago levels and the majority of South-East Asia, where exports are up 17%. A key watch out in coming months will be an increase in competition in many market as suppliers redirect product that would have previously been sold into China.

Sheepmeat

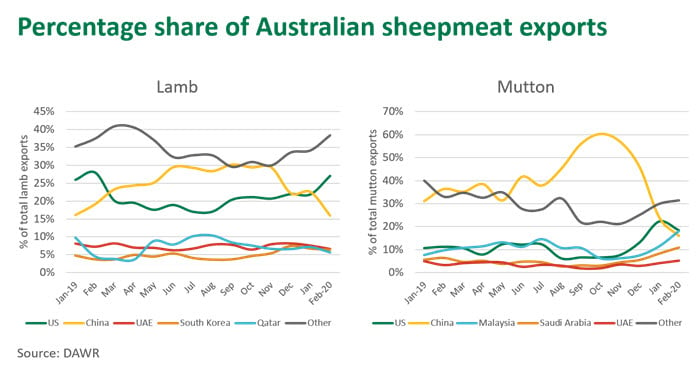

Exports of lamb in February were 23,800 tonnes swt, back 5% year-on-year as a result of dropping domestic supply. The US is the top destination for lamb once again (6,400 tonnes swt in February), ending the 11 month streak that China had in the top spot. With the USDA recently reporting the lowest lamb inventory on record, any increase in demand will need to be sourced from imported product.

Total mutton exports in February were 14,700 tonnes swt, back 15% on 2019; the reduction largely attributed to a slowdown in sheep slaughter combined with the drop in demand from China. Mutton exports to China peaked last November with 12,500 tonnes swt, however in February exports were down to just 2,300 tonnes swt. Sheep slaughter has continued to be particularly tight in recent weeks, so March mutton exports are expected to remain low.

© Meat & Livestock Australia Limited, 2020