Chilled beef and lamb exports performing well

Key points

- Exports of chilled beef are back just 2% on 2019 for the year-to-October

- Chilled lamb exports to the US are up 20% on 2019 levels

- Resurgence in mutton export demand from China after recent downturn

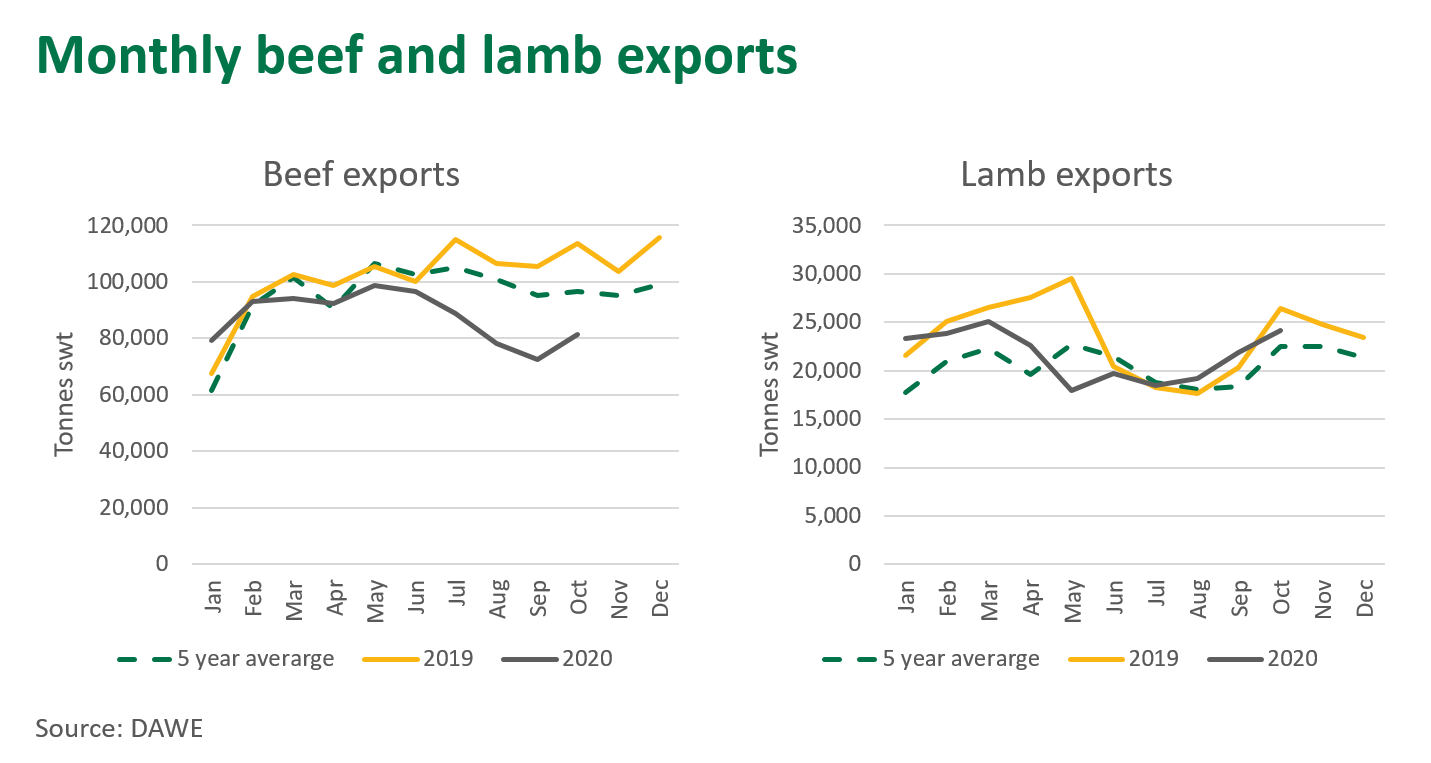

Australian beef exports continue to sit well below year-ago numbers, as tight levels of cattle slaughter restrict the availability of beef. Beef exports in October were 81,300 tonnes shipped weight (swt), a 28% decline on the same month last year, with year-to-October beef exports now 13% down on 2019.

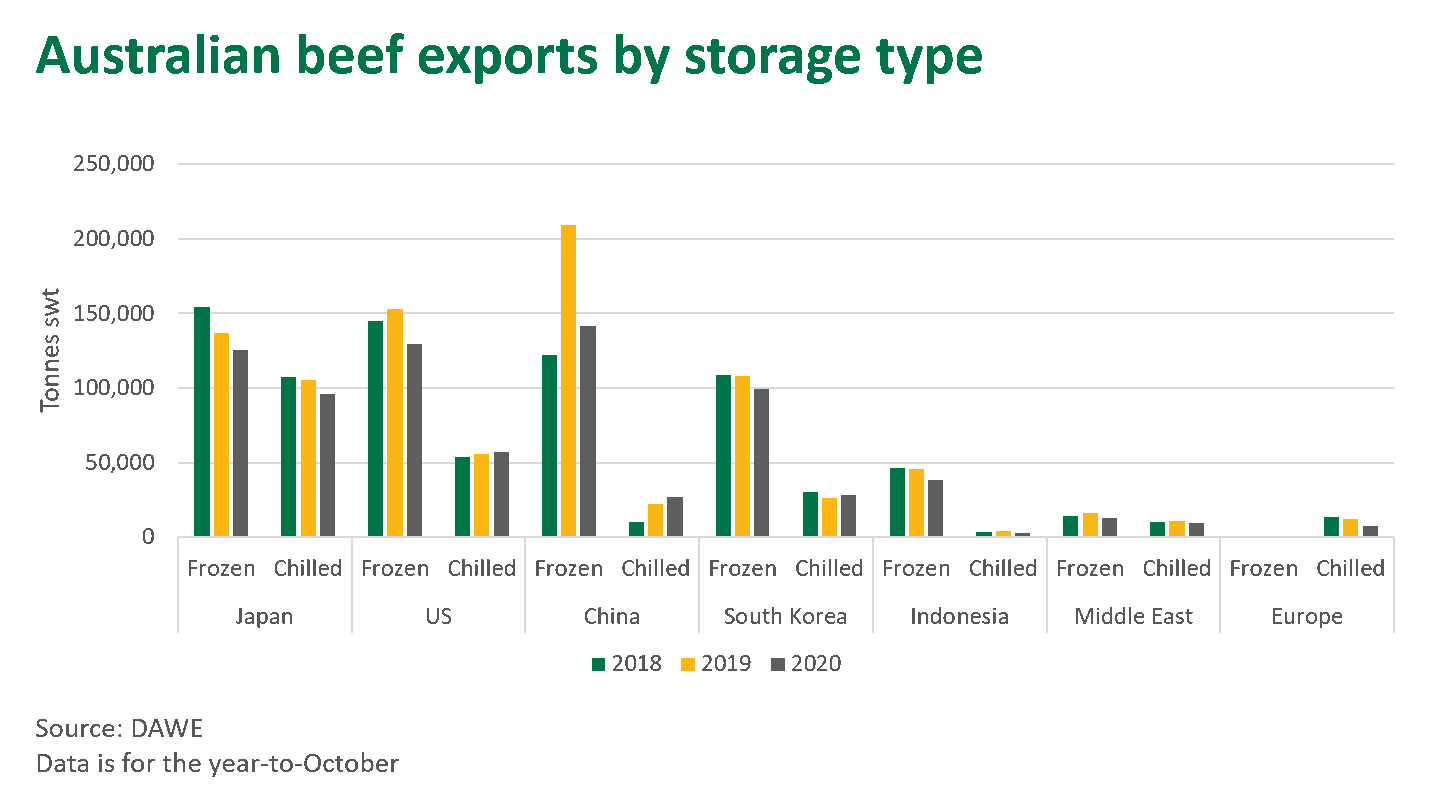

Across markets, Japan was the top destination in October, taking 22,300 tonnes swt, leading the US at 14,500 tonnes swt. Year-to-October exports to Japan and the US are now back 9% and 11%, respectively.

In October, beef export volumes to China were 12,600 tonnes swt, down a staggering 59% on the same month last year, when the African Swine Flu induced pork shortage was really starting to impact the China market. This year, Chinese trade suspensions placed on five Australian export plants, combined with increasing levels of competition from South American suppliers, has meant beef trade with China remains well back on 2019 levels.

With just two months left in the year, Australian beef exports for 2020 are forecast to slightly exceed one million tonnes, as highlighted in MLA’s October Cattle Projections.

Chilled beef exports performing well amid constraints

Despite COVID-19 challenges and tightening levels of cattle slaughter, chilled beef exports only trail 2019 levels by 2%. While Australia’s primary chilled beef market – Japan – remains the top destination, the US, South Korea and China continue to show promise as growing markets for chilled beef. In China and South Korea, exports have been performing well for forequarter cuts such as brisket, blade and chuck roll. Meanwhile in the US, exports of rib eye, striploin and blade are growing.

In contrast, Australian exports of frozen beef are back 17% on 2019 levels. China remains the top destination for frozen beef, although much of this volume was sent earlier in the year. As demand from China has waned in recent months, the US and Japan have re-emerged as the top markets for frozen beef, mainly due to the steady performance of large fast food industries throughout COVID-19.

Chilled lamb exports to the US exceptional

Lamb export volumes continue to build, and in October totalled 24,100 tonnes swt, the largest total since March earlier in the year. For the year-to-October, lamb export volumes remain unchanged from the difference for the year-to-September, down 7%. These export volumes align with numbers seen in previous years, as lamb slaughter picks up with a spring flush of lambs coming to market.

The US remains the pivotal market for lamb, having surpassed China as the top destination In August. In October, the US took 5,500 tonnes swt, matching last year’s volumes. Chilled lamb remains a key category for the US, and last month exports were 3,800 tonnes swt, up 24% on the same month last year and a remarkable 34% higher than the five-year average. US consumers have good familiarity with lamb and it appears demand is holding up amid the complications of COVID-19, particularly through retail channels.

Lamb exports to China in October were 4,600 tonnes swt, a slight improvement on August and September volumes, but total exports remain 9% back for the year-to-October on 2019 levels.

For the Middle East, lamb exports were 4,600 tonnes swt in October. As seen in markets around the world, the economic impacts of COVID-19 are taking a toll on the Middle East, with exports for the year-to-October now back 30% on 2019.

Mutton exports bounce back

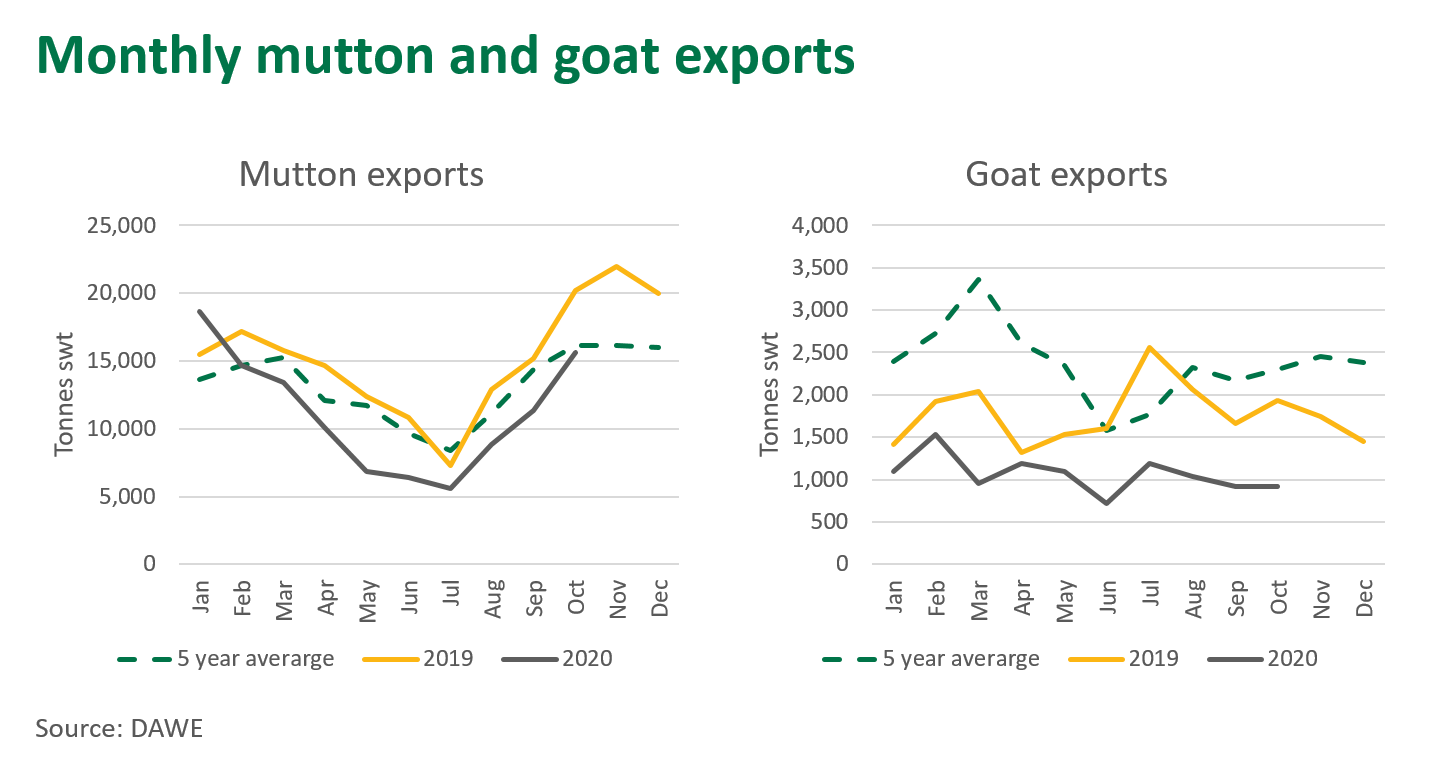

Mutton exports bounced back in October, reaching 15,600 tonnes swt, the highest volume since January this year. However, after some lean shipments through much of winter, mutton exports for the year-to-October remain back 21% on 2019.

October mutton exports to China were remarkable, at 9,100 tonnes swt, marking the largest month since November last year when 12,500 tonnes swt was exported. China accounted for 59% of all mutton exports last month, incredible considering that prior to October average monthly market share for China this year was 33%. With the Chinese New Year celebrations nearing, China will be looking to build stocks of frozen sheepmeat in order to stabilise food supplies and meet the expected wave of consumer demand come January and February.

Mutton exports to the Middle East in October were back 54% on year-ago levels, with competition from Asia, combined with tight Australian supplies, limiting availability. The price of crude oil has recently surged upwards, which should provide some economic relief for parts of the Middle East. This could, in turn, lead to a resurgence of demand for sheepmeat.

‘Big picture drivers’ remain unchanged

While global markets continue to face uncertainty from COVID-19's economic impacts, international demand for Australian red meat remains buoyant. The global 'mega-trends' of growth in population and middle-class incomes, combined with the continuing impact of African Swine Fever (ASF) on Chinese pork supply, underpin the strong appetite for Australian beef.

© Meat & Livestock Australia Limited, 2020