Young cattle in demand

While patchy in some areas, recent rain has lifted the mood of the cattle market significantly, with the EYCI averaging 505¢/kg cwt on Tuesday, rising more than 100¢ in a fortnight for the first time on record.

Regional reports suggest more follow-up rain is required to rescue the season. However, markets responded quickly and decisively to recent falls. On Monday, the Eastern Young Cattle Indicator (EYCI) rose above 500¢/kg cwt for the first time since January.

Cows saw the strongest fortnightly gains, with the eastern states medium cow indicator rising 43% to average 197¢/kg live weight on Monday.

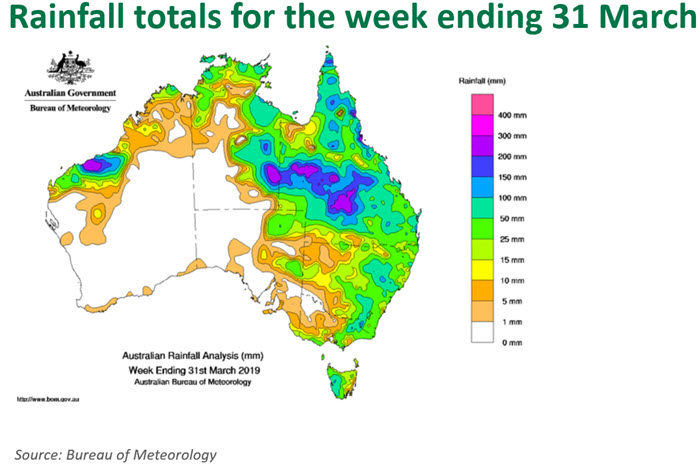

Labelled a godsend by producers, some regions saw falls in excess of 100mm, including parts of western Queensland and areas in the Liverpool Plains in NSW. As always, pastures will take time to respond, particularly given we are almost half-way through autumn.

Using data sourced through MLA’s NLRS, a buyer-breakdown of the EYCI demonstrates which buyer type is driving the market - restockers, lotfeeders or processors. The data suggests restockers have begun to compete with a little more confidence, however, feedlot buyers remain the driving force.

When the EYCI bottomed at 385¢/kg cwt on 12 March, restockers accounted for 35% of all EYCI sales, paying on average 7% less than their competition. On Monday, restockers accounted for 40% of EYCI sales, with the price discount reducing to just 2% on the overall indicator.

This information paints a bright picture for future prices in the event of further widespread rain, which would allow restockers to re-enter the market at scale.

Feedlot buyers have generally accounted for 40-50% of all EYCI sales in recent weeks, paying a 2-7% premium over other buyers. This data demonstrates the important role the lotfeeding sector continues to play in absorbing the excess supply of young cattle during dry times.

While rising young cattle prices pose challenges for the lot feeding industry, softening grain prices and strengthening prices for finished cattle have provided some relief on margins. Since peaking in October, wheat delivered Darling Downs has eased 11% to $410/tonne on 29 March. At this level, prices are 23% higher year-on-year.