Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Vic young cattle premium holds

27 June 2019

The Eastern Young Cattle Indicator (EYCI) has been bouncing along for the last three months without too much fluctuation. However, while all animals are equal, those in Victoria and those bought by feedlots are slightly more equal than others.

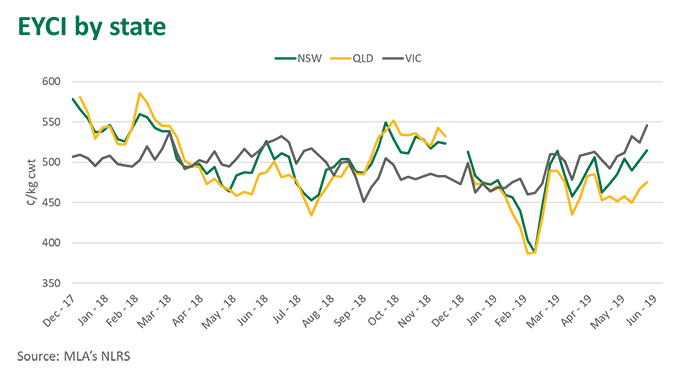

Young cattle price by state

Since the beginning of 2019, 6% of cattle measured in the EYCI have been sold through Victorian saleyards. While the vast majority of the eastern seaboard has struggled through one of the worst seasons on record, prices for young cattle in Victoria have held on better than their northern counterparts. The average price for an EYCI-eligible beast in Victoria has been 488¢/kg cwt, a 13¢ premium to NSW and 32¢ above the equivalent offerings in Queensland.

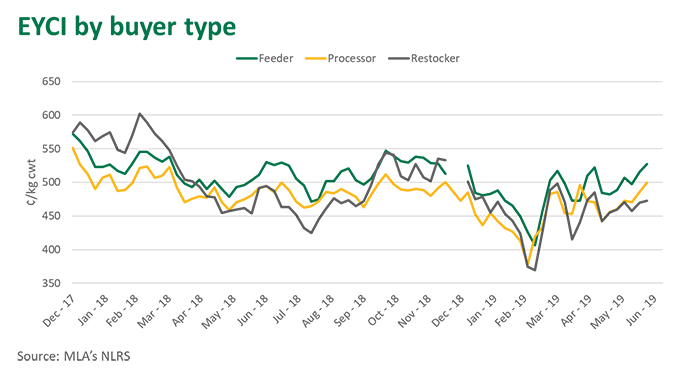

The price disparity between states can partly be attributed to the breakdown of buyers operating in the specific markets. Across all three states, feedlots are responsible for the purchase of between 40-50% of EYCI-eligible cattle. However, where NSW and Queensland processors purchase 15% and 10% of young cattle respectively, Victorian processors purchase 50% of the EYCI-eligible cattle offered via saleyards, and do so at a 46¢ premium to NSW processors and 81¢ to those in Queensland.

Restocker buyers have been willing to pay similar prices across all three states so far in 2019. The average in Victoria (461¢) has been slightly higher than Queensland (457¢) and NSW (454¢). More recently, southern markets have been stronger for cattle returning to the paddock, with Victoria last week, on average, 36¢ more expensive than NSW and 47¢ more than Queensland. However, with restockers only making up 10% of Victoria’s buyer portfolio, the lower prices offered have a lesser effect on averages.

Feedlot buyers have continued to pay a premium, and do so generally for the top quality offerings. Across all cattle measured in the EYCI, 46% are purchased by feedlots. This level has been driven by strong demand for grainfed beef in the international market, as well as the shortage in feed driving up prices for finished cattle, maintaining feedlot margins despite high grain prices.

© Meat & Livestock Australia Limited, 2019