US market favourable for Australian lamb exports

Key points

- US domestic supply tight, this will lend support to Australian lamb export prices into the new year

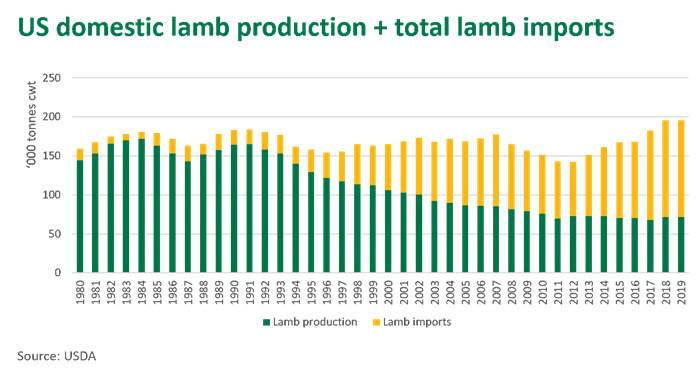

- US increasingly reliant on imports to fulfil growing domestic lamb consumption needs

- Imported lamb from Australia up 9.3% for the year-to-August

A tight supply situation within the US should offer favourable price support for Australian lamb exports as the end-of-year holiday season nears, a period of seasonal peak demand. The number of Colorado lambs on feed is estimated to be down 37% from August 2018. Given that the majority of US lambs are finished within feedlots, this figure indicates that less lambs will be coming through to processing plants for slaughter over the coming months. This highlights potential risk for domestic supply later in the year and the opportunity for imports to meet holiday demand.

The US market for imported lamb continues to grow, with entire imports in 2019 (year-to-July) increasing by 31% relative to the 2014–2018 five year average. Over 60% of total lamb consumption in the US now consists of imported product, with Australia contributing 73% of this total. As consumer demand for lamb continues to grow, particularly amongst millennials and through the foodservice channel, Australia’s foothold in the market should provide ongoing opportunities for exporters.

The decline in US consumption of locally produced lamb has been an apparent long term trend, likely underpinned by US production systems unable to match their Australian and New Zealand counterparts on efficiency and quality. But high costs of production, competing farm business enterprises, predation and limited genetic improvements are other factors restricting US production capabilities.

US lambs typically have longer turnoff times and heavier carcase weights (31kg average for 2019 – Steiner Consulting), resulting in a fattier end product. Accordingly, the finished US product often offers different taste profiles and cut sizes to lamb raised in Australia or New Zealand.

However, more recently, the decline in domestic production has been arrested, even as imports have grown, and the overall size of the lamb pie has expanded. Per capita US consumption has largely increased over the past eight years after a long period of contraction, hitting approximately 0.57kg per person in 2018, based on disappearance of lamb.

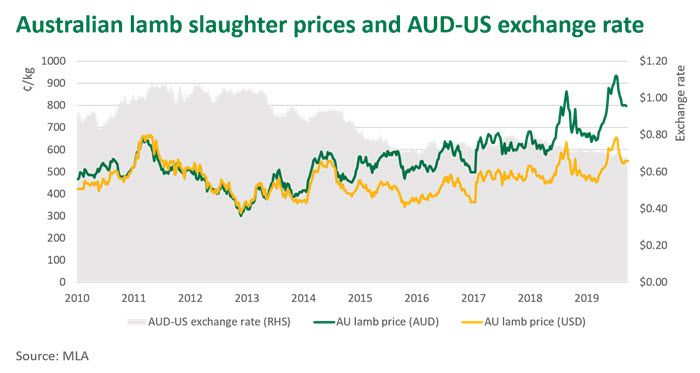

Exports from Australia continue to benefit from a low exchange rate with the US. Over the course of the past five years as the Australian dollar has declined against the US, lamb prices in Australia have gradually risen, even to record levels in the past few months. However, as highlighted below, this rise in price isn’t apparent in US dollars, helping keep Australian product affordable for overseas consumers.

Looking forward, a tight US domestic market, strong international demand and favourable economic conditions should support lamb exports and prices, even as seasonal supplies ramp up in coming months. For more detailed information on the US lamb market, please read the recent report.

© Meat & Livestock Australia Limited, 2019