US importers chase leaner product

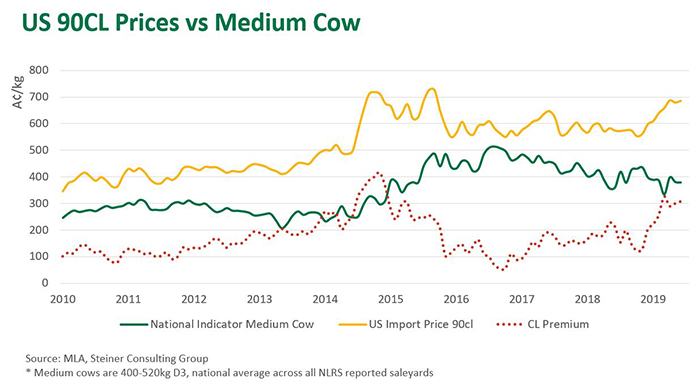

The continued expansion of US beef production is generating additional demand for leaner manufacturing product, as US grinders seek to offset swelling supplies of domestic fatty trim. Combined with a softer Australian dollar and strong Asian demand, Australian 90CL export prices are at levels not seen since 2015.

Key Stats

- The imported US 90CL beef indicator – the key benchmark price for Australian manufacturing beef exports – has risen 75¢ so far in 2019, currently at 686A¢/kg CIF.

- The spread between the 90CL beef indicator and the Australian medium cow indicator currently sits at 307c/kg, well above the five-year average of 198c/kg, due to ongoing dry conditions.

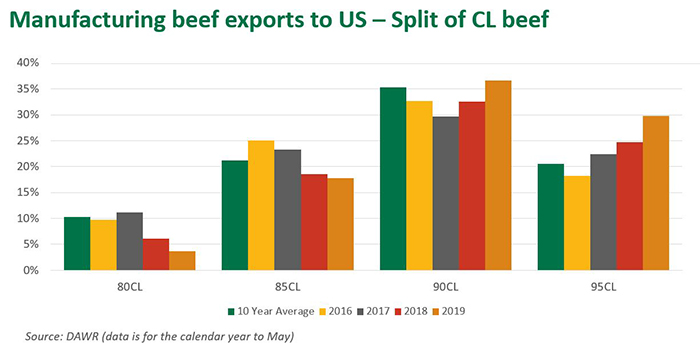

- Manufacturing beef exports to the US are up 12% over the year-to-May period and have shifted to leaner categories, as fattier US trim supplies grow with swelling fed cattle slaughter.

It is slowing but US beef supplies have been increasing over the past few years, with year-to-May growth of 5% in 2017, 4.4% in 2018 and 1% for 2019. Predominantly producing heavier, grain-fed cattle, the US generates a higher percentage of fattier trim beef than Australia. Subsequently, US grinders import leaner Australian frozen beef (90-95CL manufacturing beef) and blend with domestic product to manage fat content in burger patties.

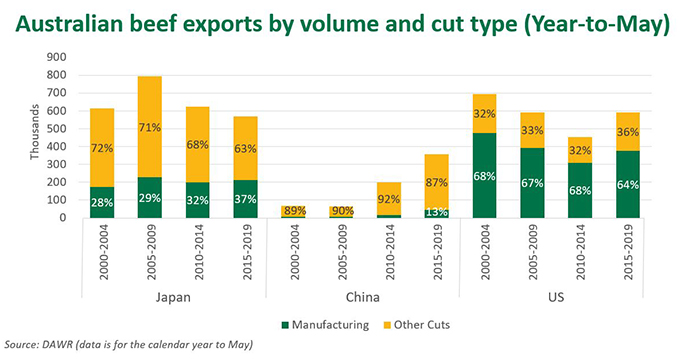

Approximately two thirds of beef exported to the US is manufacturing beef, with the remaining third prime cuts. As highlighted below, the proportion of leaner Australian manufacturing beef exports has been steadily rising over the last few years, while fattier grades have been in decline.

While there has been a shift in the make-up of the US imported beef complex, the total volume of Australian exports to the market has also expanded (up 12% year-on-year so far in 2019), highlighting even the world’s largest beef producer cannot produce the range of products to meet domestic requirements.

As US manufacturing demand shifts towards a leaner profile, Asia has emerged as a major buyer of manufacturing beef in general, particularly at the fattier end of the spectrum. While China has become a big buyer of beef over the past decade – Australia has sent 20% of its beef exports to China so far in 2019, up from 10% five years ago – Japan remains a major market for manufacturing beef and primal cuts.

For Japan and China, the percentage of manufacturing beef (compared to prime cuts) being imported is rising. In particular, fattier trim such as 50-65CL beef is increasingly popular. Growth in Japan is being driven by a shift in consumer diets that are typically becoming much more Western. US buyers now import very little fatty trim in comparison to their Asian counterparts. In 2018, 83% of manufacturing beef exports to China were 50-65CL (22,700 tonnes swt), 51,300 tonnes swt went to Japan (42% of their manufacturing trim) while the US only imported 670 tonnes swt (0.5% of their manufacturing trim).

Prices

The Australian saleyard medium cow indicator has been steady for the majority of 2019 but has dropped 13% since last year’s November high of 436¢/kg cwt. However, strong global demand and rising manufacturing beef prices means there is upward potential for cow prices if seasonal conditions improve, subsequently increasing restocker demand and narrowing the spread on the manufacturing market.

The US imported 90CL beef indicator is holding strong, averaging 685c/kg for the past three months. The CL premium (spread between the saleyard medium cow indicator and US imported 90CL indicator) is currently at 307c/kg. This is 55% above the five-year average and approaching the peak recorded in November 2014, when the spread surpassed 400c/kg.

© Meat & Livestock Australia Limited, 2019