Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

US imported beef continues to trade at a premium

08 February 2019

Imported beef prices traded notably higher last week and continue to demand a premium to chilled US domestic grinding beef. Limited availability out of New Zealand, improved end user demand and a lift in domestic lean grinding beef prices all supported rising imported beef prices.

The imported 90CL beef indicator lifted US6¢, to US201¢/lb CIF (AUD613.89¢/kg CIF).

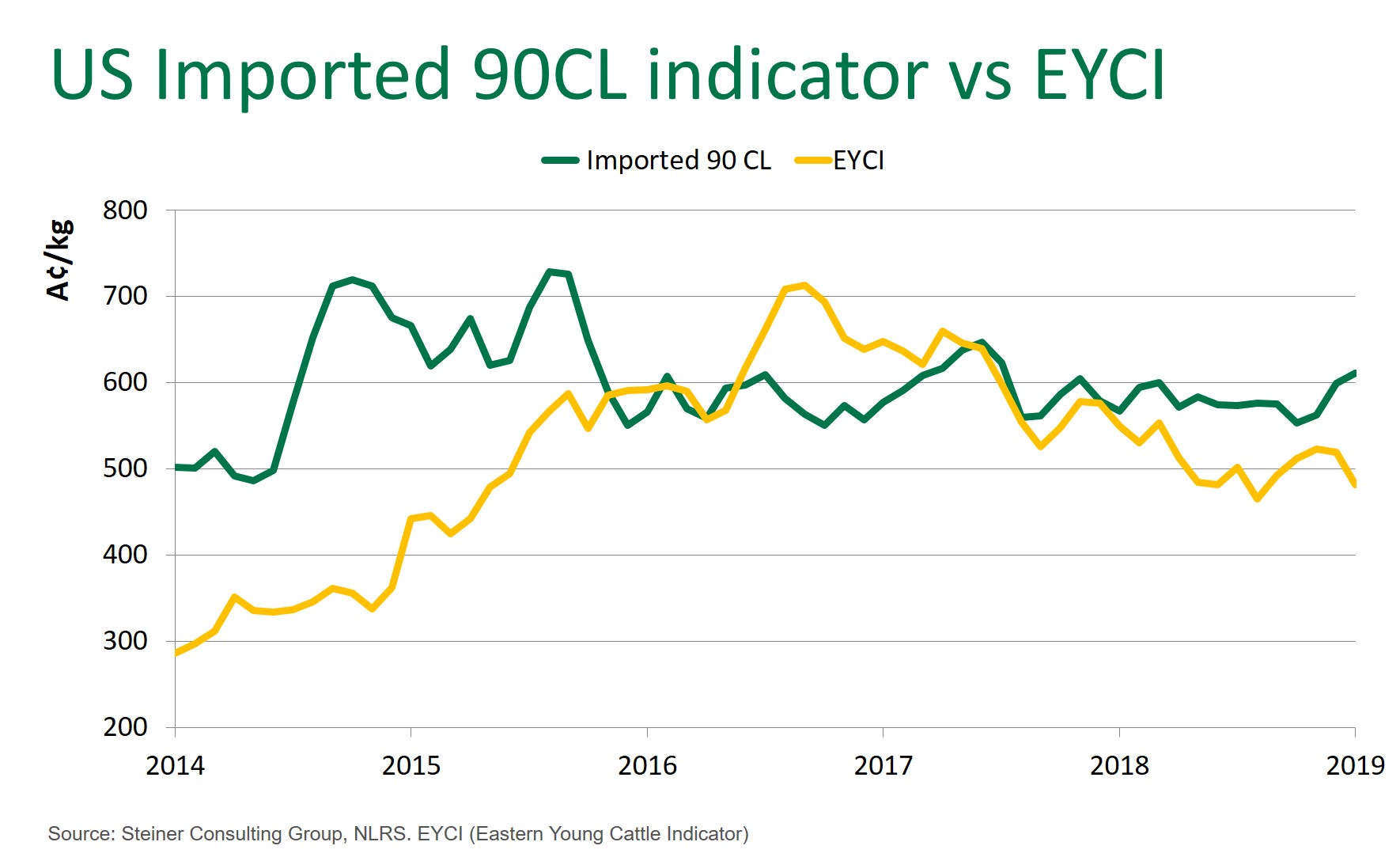

In Australia, the market for younger and lighter weight cattle has come under pressure due to subdued restocker demand, as dry conditions continue to hamper large parts of the country. The downwards pressure on the EYCI has created a divergence between itself and the US imported 90CL indicator in recent weeks. The EYCI did experience a slight uptick earlier this week from some substantial falls in far north and central Queensland. However, any significant spike will be dependent on good falls further south. The imported 90CL indicator will continue to trend above the EYCI – as has been the case since May 2017 – until a shift in restocker demand takes hold or US end user demand subsides.

Highlights from the week ending 1 February:

- New Zealand beef exports to China were sharply higher in December and New Zealand beef exports to China in Q4 of 2018 surpassed exports to the US.

- Extreme cold conditions likely affected fast food demand last week but broader trends continue to suggest ongoing strong foodservice demand in the US.

View the Steiner Consulting US imported beef market weekly update