US grinding beef price hike

US imported grinding beef prices have risen to levels not seen since late 2015 as buyers eye-off a tight supply outlook.

An estimated 50% of all beef consumption in the US is in the form of ground beef, the staple component of the traditional hamburger. Ground beef demand remains constant throughout the year but hits peak demand during the summer months as ‘grilling season’ sweeps across the US, typically opening with Memorial Day in May.

Demand for grinding beef in the US has been excellent and record levels of beef production has supported domestic consumption. Despite a shift to chilled-only burger menu items by a number of foodservice outlets, imported frozen grinding beef forms an essential component of the manufacturing process in the US.

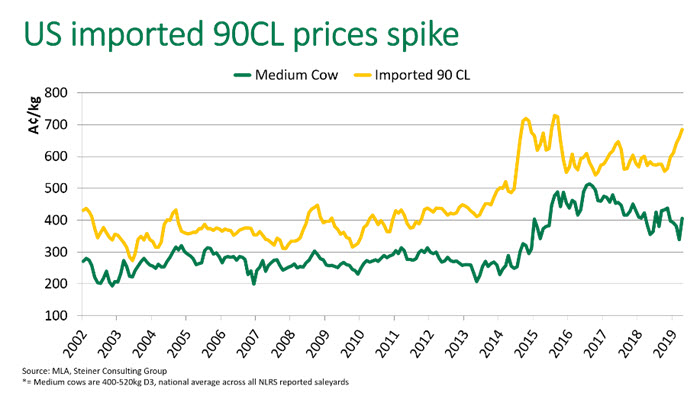

In recent weeks, the US imported 90CL (90% chemical lean) beef indicator has risen to levels not seen since October 2015, currently trading at 684A¢/kg CIF, up 99¢/kg compared to year-ago-levels.

Imported grinding beef has commanded a premium to chilled US domestic product throughout the entirety of 2019. The spread has been driven by restricted availability from key suppliers – Australia and New Zealand – and any convergence of prices looks set to be driven by US domestic grinding beef gaining value in the short term. US retailers will shift to featuring more beef for spring grilling needs, meaning prices could stay elevated through until the end of May.

New Zealand

Total New Zealand cattle slaughter – despite a slow start to the season – is currently running 14% higher year-on-year. However, a greater volume of product has been diverted to China, with year-to-February exports to China are up 55% and exports to the US back 24% over the same period.

Australia

For the calendar year-to-March, Australian beef shipments to the US were 16% higher compared to last year and the manufacturing component was up 20% over the same period. Elevated cow slaughter in Australia during the first quarter, the result of sustained dry conditions, pushed more manufacturing beef onto the market. However, overall supplies heading to the US remain constrained relative to demand and, like New Zealand, a greater proportion of Australian exports have shifted to North Asia, in particular China.

Price movements

There has been a sustained lift in the US imported 90CL beef indicator since the beginning of the year, up 61¢/kg, which is largely the result of US end users facing heightened competition. However, in recent weeks, prices have accelerated, fuelled further by rainfall in Queensland. US buyers appear concerned with the supply outlook over the peak demand period and have sought to find cover were possible.

The Australian saleyard medium cow indicator has appreciated 20% since last month, currently trading at 405A¢/kg, having averaged 339A¢/kg during March. The increase in US imported 90CL beef prices has outstripped gains made by the medium cow indicator, with the spread between the two currently at 279A¢/kg. The current disparity between the two indicators demonstrates that export markets are generating strong returns and domestic prices are yet to fully react.

Outlook

US imported grinding beef supplies may remain restricted in the near term, as North Asia continues to provide strong competition for Australian and New Zealand beef. Should Australia receive much-needed follow up rain, producer intentions will quickly switch to rebuilding herds and retaining cows will be a priority. In addition, the Easter and Anzac Day holidays will result in two consecutive weeks of reduced slaughter.

The US will remain the predominant market for Australia manufacturing beef however there has been consistent growth in high value chilled grassfed primal exports to the market. Combined with the prospect of sustained growth from developing Asian markets, the dynamics of the trade may shift in the future.