Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Trade lambs break through 700¢

11 April 2019

With the exception of weekly slaughter data, all major signs point towards an impending lamb shortage during winter.

The Eastern States Trade Lamb Indicator (ESTLI) averaged 708¢/kg carcase weight (cwt) on Wednesday, up 22% year-on-year. At this level, the indicator remains 176¢ below the all-time high reached in August last year. However, if the anticipated supply shortage comes to fruition, price volatility may return.

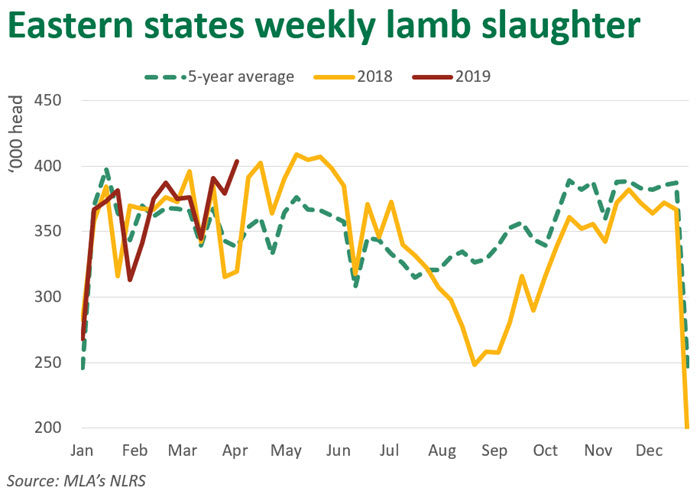

Considering the recent high sheep slaughter, poor seasonal conditions and reported low marking rates, the supply of lambs has remained surprisingly reliable throughout 2019. For the year-to-date (through 5 April), eastern states lamb slaughter averaged 360,000 head per week, up 2% on 2018.

A look back at 2018 demonstrates just how responsive prices can become when supply levels change. For the month of May 2018, eastern states lamb slaughter averaged in excess of 400,000 head per week, while the ESTLI averaged 604¢/kg cwt.

By August, slaughter had fallen 31% to average 280,000 head per week, as deteriorating seasonal conditions hampered the supply of finished lambs. In response to the shortfall, the ESTLI averaged 815¢/kg cwt in August, which was 35% higher than the May average.

As it stands, many national sheep production regions are yet to receive any decent rainfall this year. The challenging conditions look increasingly likely to have a strong impact on lamb supply at some point during winter. Hence, the timing of any southern break is more pertinent to the lamb market than ever.