When restocker lambs surged

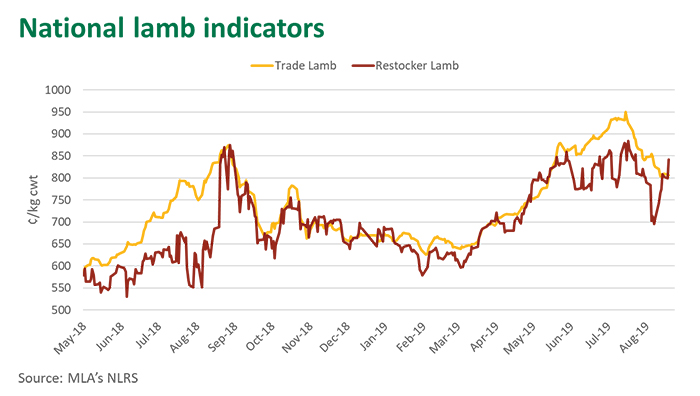

A year ago this week, the sheep market experienced one of the biggest day-on-day changes in recent history with the eastern states restocker lamb indicator rising 126¢/kg cwt.

A combination of severe drought keeping restockers out of the market and strong demand from processors driving prices for trade and heavy weight lambs, had created a significant premium of over 150¢/kg for trade lambs (18.1-22kg cwt) over lighter restocker lambs (0-18kg cwt).

It was a crunch moment in the market, when the margin in fattening light lambs to slaughter weights moved to a point that was still attractive despite the intensive drought and high grain prices. The restocker indicator rose another 22¢ on the Tuesday that week and 29¢ more on Thursday. A week after closing the Friday at 691¢/kg cwt, the eastern states restocker lamb indicator had risen 194¢ and its discount to trade lambs had disappeared.

Since that point, buyers have been much more aware of when the price gap widens between slaughter ready lambs and lighter categories, with restocker and feeder buyers quickly entering the market, closing any premium. The season has dictated that the difficulty of growing a lamb to slaughter weight still warrants a premium, although in the last 12 months trade lambs have averaged just 26¢ more than restockers on a per/kg basis.

On Tuesday this week (27 August), the restocker indicator rose 31¢ to 856¢/kg cwt, 21¢ above year-ago levels. It is also a 47¢ above the trade lamb indicator, pushed forward by some strong sales in southern NSW and an increase in demand as for the new season lambs that are entering the market.

Lamb yardings have continued to reduce, the average weekly yarding in August has been 152,500 head, back from 168,500 in July and 205,500 in June. While there is often a lag period between the end of last season’s lambs and the beginning of the new season, the supply shortage has been exaggerated this year, August averages are down 15% on the weekly yardings from a year ago.

© Meat & Livestock Australia Limited, 2019