Supply dip boosts sheep market

The sheep and lamb market has risen strongly during the past month, with market signals indicating the anticipated lamb shortage may have arrived.

Key points:

- A number of sheep and lamb pricing indicators broke records during the week.

- Weekly slaughter data tracking below year-ago levels.

- The outlook for lamb supply remains poor, with seasonal conditions yet to improve.

Prices

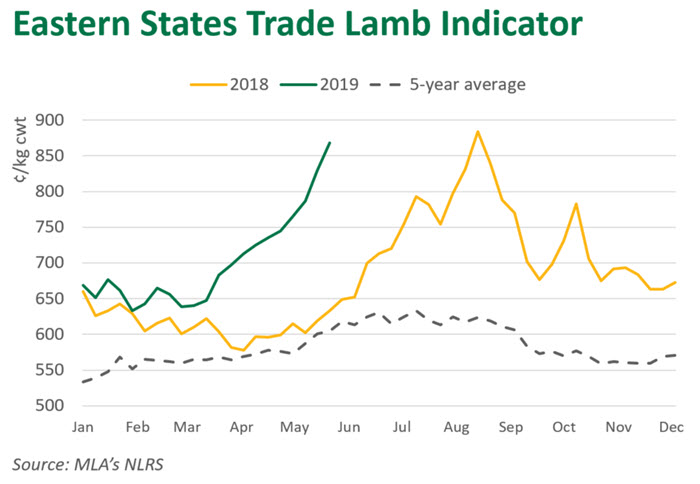

The Eastern States Trade Lamb Indicator (ESTLI) rose to 868¢/kg carcase weight (cwt) on Tuesday, up 8% week-on-week and just 2% below the all-time high of 884¢/kg cwt (August 2018).

Looking to other eastern states indicators, merino lambs surpassed 800¢/kg for the first time, averaging 822¢/kg cwt for the week ending 28 May. Mutton also set a new record, rising above 600¢/kg for the first time to average 602¢/kg cwt.

For producers selling direct to works, over-the-hooks (OTH) indicators saw strong gains over the past week, albeit remaining below saleyard indicators. Heavy trade lambs averaged 820¢/kg cwt in NSW, 776¢/kg cwt in Victoria and 685¢/kg cwt in WA.

Supply

Due to the seasonality in Australia’s production system, winter typically marks a low-point in lamb numbers. In the months before the southern ‘spring flush’, old season lambs and early new season lambs out of NSW often fill an important supply gap.

Due to seasonal difficulties (as discussed in previous articles), fewer lambs are expected through winter and spring. With the majority of key production regions yet to receive a decent break in the season, challenges will persist in finishing lambs to slaughter ready weights.

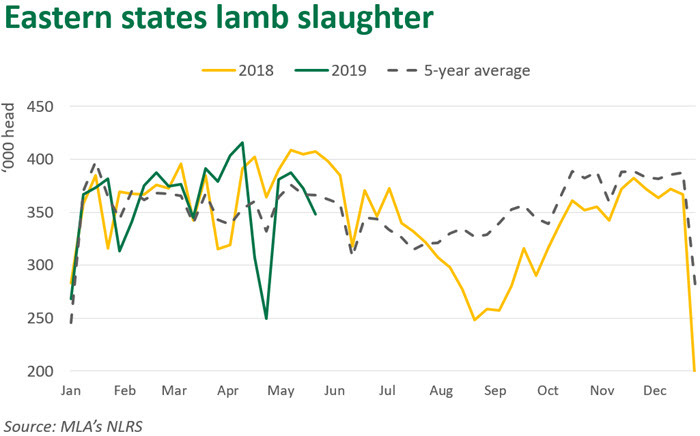

After remaining fairly consistent with 2018 levels for most of the year, NLRS reported weekly slaughter figures began to fall below year-ago levels in mid-April. Eastern states lamb slaughter declined 7% on the previous week to 348,000 head, down 15% on year-ago levels.

Outlook

In 2018, poor conditions during winter challenged lamb finishing operations. This culminated in a lamb supply shortage during August and September – pushing prices to record highs. Similar dynamics were expected influence markets again in 2019, albeit a little earlier in the year.

Recent data suggests the anticipated shortage may be approaching – and will potentially continue through until spring. It appears fewer producers have been selling direct to works in recent weeks as a result of the strong price incentives at the saleyards, with processors competing fiercely for slaughter ready lambs. Considering the supply dynamics currently at play, prices will likely find support until lamb supply begins to rise.

© Meat & Livestock Australia Limited, 2019

You are not permitted to re-transmit, alter, distribute or commercialise this article or its contents without seeking prior written approval from Meat & Livestock Australia Limited.