Store market continues to ease

Key points

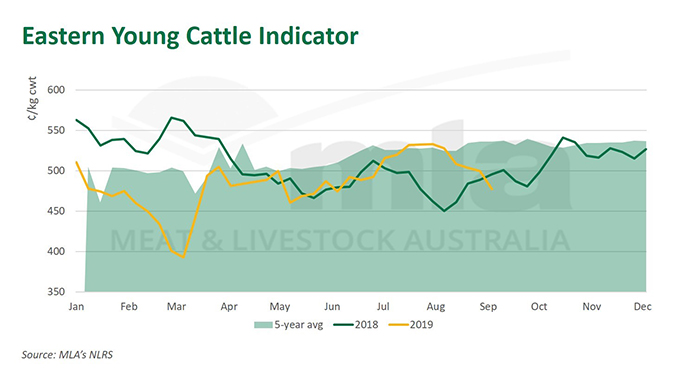

- Eastern Young Cattle Indicator (EYCI) back below year-ago levels

- Young cattle well supplied as dry conditions persist

- Feeder buyers maintain premium in store market

Since hitting a 2019 high in August, the store cattle market has continued to ease this week, dropping back below year-ago levels.

The Eastern Young Cattle Indicator (EYCI) dropped 11¢ for the week, closing Tuesday at 475¢/kg cwt. When assessing the EYCI at a state level last week, NSW and Queensland recorded the largest declines, at 4% and 5%, respectively.

Hot, dry conditions across the east coast have seen high offerings, and buyer confidence has been stifled by the Bureau of Meteorology’s (BOM) latest three-month outlook, indicating a hotter and dryer remainder of the year for much of the nation.

Tuesday’s yardings at Roma store sale remained elevated despite easing 300 head on the week prior. At Dalby, yardings lifted by 1,880 head, as the supply of store cattle continues to outstrip demand for stock returning to the paddock, underpinning declines in the store market. Wagga sale saw supplies of lighter-weight cattle ease however restocker competition was reported as inconsistent.

Restockers remained largely inactive in the store market, accounting for only 34%, or 6,000 purchases, while feeder buyers remained the dominant force and were responsible for 44%, or 7,800 acquisitions. Feeder buyers were averaging 505¢/kg carcase weight (cwt), a premium of 30¢ to processors and 62¢ to restockers, for EYCI eligible cattle sold last week.

Spring prospects

The three-month weather outlook offers little reprieve to east coast producers and should a failed spring come to fruition, it would require ample northern summer rain to kick start the store market.

Young cattle prices did find support during spring in 2017 and 2018, lifting 5% and 8% from 1 September to 1 December, respectively. However, on both occasions the lift was offset by declines during the summer months, in the absence of adequate rainfall. Many producers have now ceased speculating on when conditions will improve, instead waiting on a definitive break to reinvigorate market interest.

It remains a matter of when, not if, the store market experiences a significant increase, however the upside, when conditions do turn, will likely start off a lower base from current levels - as at Tuesday, the EYCI was reported 44¢ below the five-year average. While domestic influences will be the overarching driver to how the store market tracks in the short-term, there is perhaps an added element of downward pressure filtering through from US futures.

© Meat & Livestock Australia Limited, 2019