Shifting global supply dynamics

Robust demand from China is having a considerable impact on global market dynamics and this is likely to continue in 2020, with recent forecasts indicating global supply will remain tight.

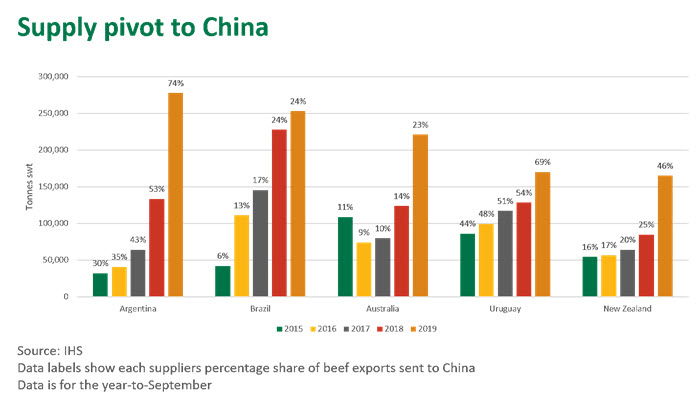

Supply shift to China

The pork shortfall created by African Swine Fever (ASF) in China has been the driving factor behind an increasingly competitive market for beef in 2019. With Australia’s beef production forecast to decline in 2020, China will increasingly lean on other suppliers to meet their expanding needs. This demand is expected to provide support to beef prices in the year ahead. South American suppliers are expected to continue building a presence in China – the result of their growing supply capability and favourable price point.

In September, 17 Brazilian processors were approved for export to China. The effect of this was made evident last month, as Brazil shipped 65,000 tonnes shipped weight (swt) of beef to China, highlighting the booming Chinese demand as they prepare for their holiday period. Beef exports to China for the year-to-September are now up 11% on 2018. According to Steiner, Middle Eastern buyers have fallen off the radar for Brazilian meatpackers, as a strong Brazil domestic market combined with Chinese competition means they’re struggling to get a look-in. While Brazilian exports to the Middle East have remained steady for much of the year, volumes to the Middle East may ease unless Chinese demand softens.

Argentinian beef production is currently flourishing, albeit uncertainty surrounding future agricultural reform exists with the new incoming president. Domestic prices for cows have just exceeded steers, highlighting the demand for manufacturing beef and subsequently driving slaughter levels in October to the highest point since 2009. Export volumes to China are up 105% on 2018 for the year-to-September, making Argentina the top supplier of beef to China.

The supply situation in Uruguay is tight, as slaughter figures are back 6% on 2018. It appears that with China taking precedence as an export destination this year, export volumes to other top markets, such as the US and Israel have come off the boil. High demand from China drew 82.5% of all Uruguayan beef exports in October. Meanwhile, frozen exports to the EU have dropped off as a result of the draw from China, 44% down on 2018 year-to-October figures.

Traditionally, New Zealand has been a key supplier in the US market; however, with their focus shifting to China, their percentage of exports to the US has declined from 46% in 2018 to 30% this year. Cow and bull slaughter is expected to pick up over the coming months, yet buyers are sceptical about the volume of product that will make its way into the US market. Strong competition from China will continue to limit US imports, potentially leaving gaps in the market for imported beef.

Impact for Australian markets

While South American suppliers may be flooding Asian markets with beef, Australia can continue to leverage off this increased competition to obtain value across its many key markets, namely the US, Japan and Korea.

For Australia, a diverse portfolio of buyers will ensure no exposure to one single market, should shocks occur. Strategically targeting markets which offer the best value will continue to be a priority for Australia at a time when domestic supplies are expected to tighten.

© Meat & Livestock Australia Limited, 2019