Red meat exports expand in 2018-19

Australia’s beef exports topped 1.16 million tonnes swt during 2018-19, the third successive year of growth. For sheepmeat, exports reached 463,000 tonnes swt, a result of high slaughter levels driven by scarce and expensive feed. This was the largest volume of sheepmeat Australia has exported in a single financial year. Importantly, global demand for red meat was high at a time of elevated supply, with particularly strong growth from China driven by higher incomes, shifting diets and the spread of African swine fever.

Beef growth

Grainfed beef exports increased to a record 312,000 tonnes swt during 2018-19, representing 27% of all beef exports and a 23% increase on the 10-year average. With ongoing dry conditions nationwide and strong demand for grainfed beef in export markets, cattle on feed are expected to remain elevated. Heightened cattle turn-off has also driven growth in grassfed beef exports, which were up 7% on last year, reaching 846,000 tonnes swt.

There has been no significant shift in the chilled-frozen mix of beef exports, with 303,000 tonnes swt of chilled beef (26% of total beef exports) and 855,000 tonnes swt of frozen beef exported (74%) over the financial year – in line with the 10-year average split. China surpassed the US and Japan to become Australia’s largest market for frozen beef (Australia exported 186,000 tonnes swt of frozen beef to China), with the number of approved plants limiting growth in the chilled product. Meanwhile, Japan was the clear leader for chilled beef (127,000 tonnes swt, making up 42% of Australian shipments to the market), nearly double of Australia’s second largest chilled market, the US (66,000 tonnes swt).

Australian beef export volumes to major beef markets in 2018-19 were:

- Japan, down 1%, to 302,756 tonnes swt

- US, up 2%, to 239,614 tonnes swt

- China, up 55%, to 206,306 tonnes swt

- South Korea, up 13%, to 176,094 tonnes swt

- Indonesia, down 7%, to 54,417 tonnes swt

Sheepmeat shipments surge

Mutton exports surged 17% in 2018-19, reaching 188,000 tonnes swt, while lamb exports reached a record 275,000 tonnes swt. The massive sheepmeat export year was not surprising, given high levels of sheep and lamb slaughter recorded across the country, as producers culled stock due to lack of pasture and expensive feed There was a 60:40 percentage split between the volume of lamb and mutton exported in 2019-20, which is typical of the 10-year average. Volumes to almost all key markets grew in the last year with China (+12% for lamb and +51% for mutton) the standout performer followed by the US (+3% for lamb and +44% for mutton). This rapid growth in China means it now accounts for 27% of all Australian sheepmeat exports, up from 22% last year.

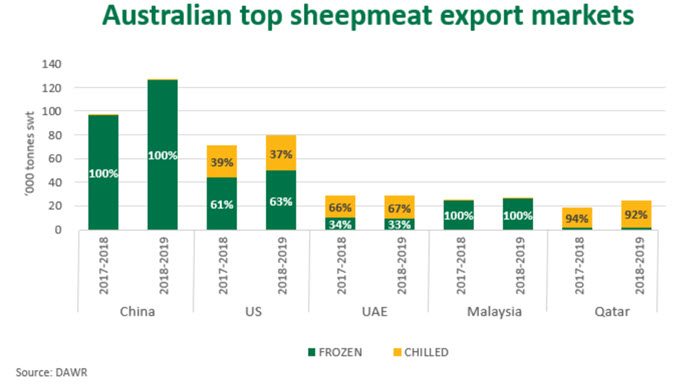

The chilled-frozen split for sheepmeat was typical of the 10-year average, with 26% of all sheepmeat being comprised of chilled product. Of all the chilled sheepmeat, 93% was lamb, highlighting the market preference for higher quality cuts of meat to be chilled rather than frozen.

Australian sheepmeat export volumes to major sheepmeat markets in 2018-19 were:

- China, up 30%, to 126,064 tonnes swt

- US, up 11%, to 79,258 tonnes swt

- UAE, down 1%, to 28,262 tonnes swt

- Malaysia, up 5%, to 25,845 tonnes swt

- Qatar, up 30%, to 24,290 tonnes swt

© Meat & Livestock Australia Limited, 2019