Mutton prices close in on lamb

Key points

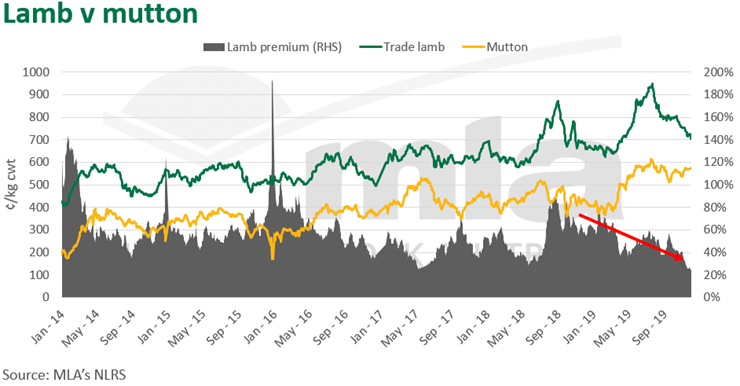

- The premium of lamb to mutton is now just 25%, the closest it has been and well below the five-year average of 57%

- While lamb prices have come back to around 700¢/kg cwt, mutton prices have remained stable

On Tuesday this week the sheep market reached an interesting point. It marked the closest that mutton prices have ever been to the trade lamb indicator; just under 25% below. This is particularly impressive considering the current strength of the lamb market in a historical sense.

While mutton prices have eased slightly from July when the indicator surpassed 600¢/kg cwt, they have generally remained elevated above 550¢, a price which in itself would have been almost incomprehensible before 2019.

With muttons stability, it is the waning trade lamb prices that is the biggest factor in prices for sheep young and old becoming more aligned. The National Trade Lamb Indicator (NTLI), decreased to 706¢/kg cwt on Tuesday, the lowest point since April.

The strengthening of the mutton market, while not always being obvious, is a trend that has been occurring for over 12 months.

The main driver for the mutton market is the strength of international demand. China in particular is going from strength-to-strength as a trading partner, the destination for 42% of 2019 mutton exports, while Malaysia and the US also playing a significant role.