Lower NZ lamb crop puts pressure on global prices

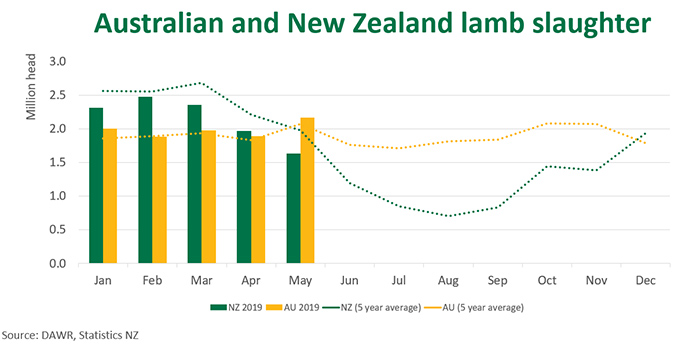

Lamb supply in New Zealand has begun dropping in the lead up to their winter seasonal low. NZ lamb production is much more seasonally pronounced than Australia, with an historical supply trough in August a mere quarter the size of peak production in March. Given that Australia and NZ account for more than 70% of global lamb exports, Australia is typically left to fill a large proportion of global demand through the southern hemisphere winter months.

However, dry conditions this year across much of Australia has made finishing what few lambs remain over winter a challenge and are expected to lead to a more subdued and delayed spring flush of new season lambs. Pressure on prices will likely remain on both sides of the Tasman until adequate supplies in either country hit the market later this year.

Furthermore, NZ’s 2018-19 (year ending September) lamb slaughter is estimated to be down 6% on the previous year, at 23.2 million. This decline is being driven by lower lambing percentages (down 2.6% on the previous year, at 129%) and a reduced ewe flock (down 3.6% on last year), as strong mutton prices incentivised an increase in ewe turn-off late last year.

Beef + Lamb NZ expect average carcase weights for the year to reach 19.0kg, with elevated prices and limited supply encouraging farmers to carry an increased number of lambs through to spring. Winter slaughter is expected to be lower than normal with recent reports from AgriHQ NZ confirming a 6% drop in lamb slaughter versus last year.

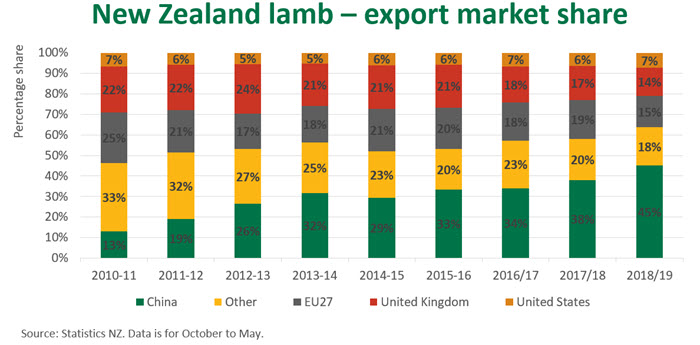

NZ lamb exports for this season (October-to-May) are 237,000 tonnes swt, up 1.8% on last year. July, August and September volumes will drop off in line with typical winter slaughter patterns before picking back up through mid-to-late spring as producers offload late season lambs.

China is now well established as NZ’s largest market, accounting for over half of all exports this season and up 21% year-on-year. This growth is coming at the expense of NZ’s other export markets. For example in 2010, the EU27 received 25% of NZ lamb exports, but has represented just 15% of shipments so far this season. A similar trend has been seen in the UK market.

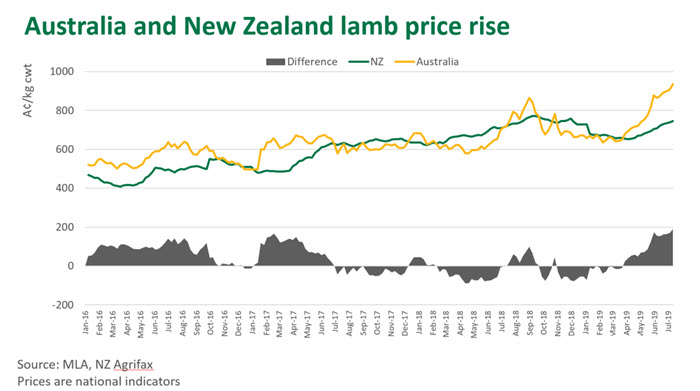

When considering a 12 month average for lamb prices, Australia and NZ tend to follow a relatively similar pattern. However, this does fluctuate throughout the season and in the last two months the Australian price has risen well above the NZ figure to its largest difference since 2011 (up 191¢/kg or 26% as of July 15). Given global demand remains robust and supply from both countries will be tight, price support should remain in the coming months.

© Meat & Livestock Australia Limited, 2019