Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Lamb prices ease from records

06 June 2019

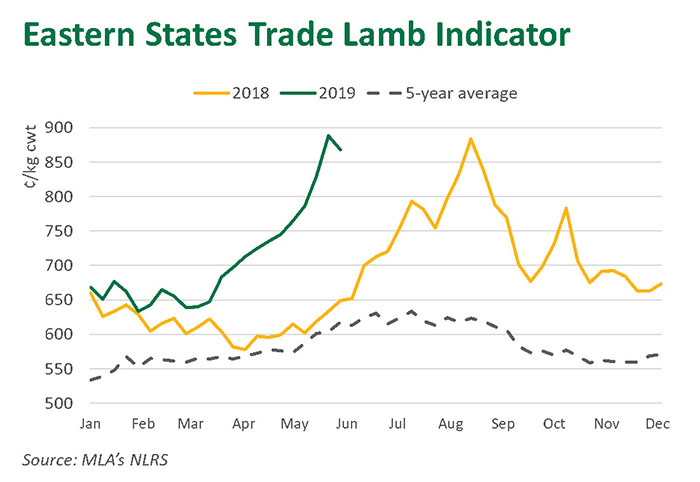

After reaching a high of 889¢/kg carcase weight (cwt) on Friday, the Eastern States Trade Lamb Indicator (ESTLI) has eased 21¢ this week. Prices edged lower following some very high saleyard prices over the last fortnight, with a single lot of extra heavy lambs at Griffith reaching a national record for NLRS reported saleyards of $345/head.

Prices

All lamb indicators increased by over 10% throughout May. Heavy lambs (over 22kg cwt) in particular performed strongly, up 206¢ or 29% over the month. Trade lambs (18.1-22kg cwt) also increased significantly, up 153¢ or 21%, and restocker lambs climbed 109¢ in May to 863¢/kg cwt.

While these prices are indicative of the average, record highs for single lots have been set in all states over the last fortnight:

|

State |

Saleyard |

Price |

Date |

|

New South Wales |

Griffith |

$345/head |

31/5/2019 |

|

Victoria |

Swan Hill |

$326/head |

30/5/2019 |

|

South Australia |

South Australia Livestock Exchange |

$336/head |

28/5/2019 |

|

Western Australia |

Katanning |

$260/head |

28/5/2019 |

|

Tasmania |

Northern Tasmania |

$266/head |

04/6/2019 |

Restocker lambs have also had support as there remains a margin in finishing lambs. The eastern states restocker lamb indicator increased 14% over the month of May. On Tuesday the indicator reached 855¢/kg cwt, 3% down from its peak in August 2018.

Supply

There has been no shortage of lambs entering saleyards. Yardings last week totaled 225,000 head, just below the yearly high of 228,000 in the first week of May. Expectations for tightening supplies remain given the tough breeding conditions that have persisted.

As mentioned last week, it is likely the high numbers entering saleyards are a result of elevated saleyard prices relative to over-the-hook indicators, prompting producers to sell through the saleyards rather than go direct to the works.

US market comparison

Prices for finished lambs in the US are following a similar trend, with finished lambs rising sharply over the past few months. Slaughter lamb prices on a formula basis are currently 12% higher than in early March and 6% above year-ago levels (Steiner Consulting). This has been attributed to an increase in demand over the Easter period, as well as decreased numbers of lambs on feed.

© Meat & Livestock Australia Limited, 2019