Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Eastern states lamb market hits the brakes

01 August 2019

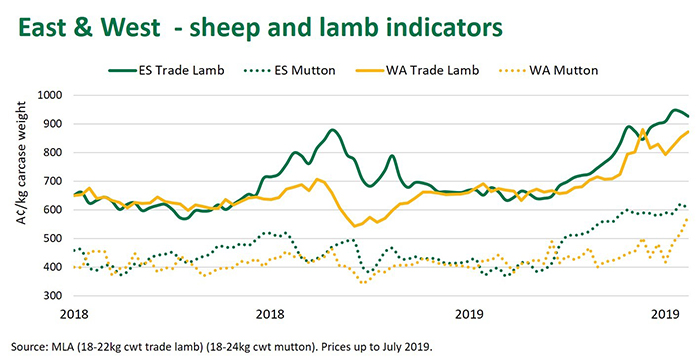

The Eastern States Trade Lamb Indicator (ESTLI) eased to 895c/kg carcase weight (cwt) on Tuesday, while the WA equivalent finished at 850c/kg cwt, as the spread between the two indicators closed, largely driven by a cooling of eastern markets.

Eastern states and WA sheep and lamb prices generally follow a similar course but the ESTLI has averaged a 44¢/cwt premium to its western counterpart over the last five years. East coast mutton markets have averaged a 60¢/cwt premium to the west. At the close of Tuesday’s markets, eastern states trade lambs were at a 45¢ premium and mutton at a 12¢/cwt premium to WA, underpinned by sharp gains in the west closing the gap in recent weeks.

WA sheep and lamb slaughter recently entered a seasonal supply trough and prices have responded accordingly. However, the impact of the east coast sheep and lamb market on WA cannot be understated. WA prices have gained additional momentum from tighter-than-usual east coast supplies, similar to the scenario that played out in 2018. The rally has been more pronounced this year, as global demand factors have also accelerated prices on both sides of the country.

Eastern states weekly lamb slaughter continues to track well below year-ago levels, reported 19% lower last week. The latest available data in WA demonstrates a similar slaughter lamb shortage but did show signs of a recovery last week.

Despite slaughter levels remaining subdued in the east, prices across most categories eased in the last week, as the market appears to be taking stock from the record levels. The arrival of a NSW lamb crop will, as was the case last year, underpin any further prices movements in the coming weeks. Processors have been anticipating the current supply shortage and should there be a significant delay in finished new season lambs hitting the market, robust competition at saleyards could drive prices forward.

© Meat & Livestock Australia Limited, 2019