Lot feeding outlook: what lies ahead?

While growing Asian demand continues to drive investment in the lot feeding sector, uncertainty surrounding cattle and grain supply could provide a challenge in 2019.

A declining Australian dollar and expanding export opportunities have supported finished cattle prices for the last two years, while feeder cattle (a major feedlot input cost) have eased. These dynamics have helped support feedlot margins; however, elevated grain prices continue to represent a major challenge.

Looking ahead, the supply of quality feeder cattle will likely be impacted by adverse weather conditions across many production regions.

Numbers on feed

Cattle on feed numbers are expected to remain close to record levels when the results of the latest ALFA/MLA lot feeding brief are released. Should numbers on feed remain above one million head for the December 2018 quarter, it would be the first time numbers on feed remained above one million head for the entire year.

Grain outlook

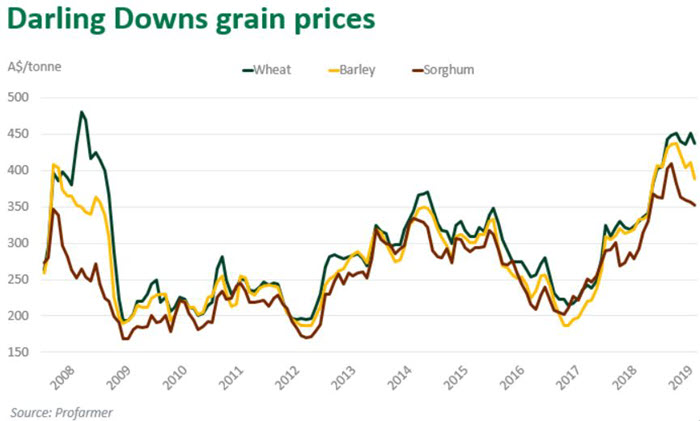

While barley and sorghum have eased from their October peaks, wheat remains close to record highs. Looking to Darling Downs delivered grain prices on 15 February; sorghum fell 18% since the start of October 2018 to $347/tonne, barley declined 13% to $384/tonne and wheat eased just 7% to $430/tonne.

Turning to the prospects for late-planted sorghum in northern NSW and southern Queensland, a recent ABARES crop report suggests the prolonged dry spell and high daily maximum temperatures have reduced yield potentials. As the window for beneficial rain for summer crops rapidly closes, grain growers now turn their focus to the winter cropping season.

With grain production significantly reduced during 2017 and 2018, end users across the eastern states have been relying on shipments from WA for months. Any alleviation in supply pressure will now likely be reliant on good autumn rain to kick off winter cereal crops. However, even if this was to eventuate, harvest generally doesn’t start before October.

Feeder and finished cattle prices

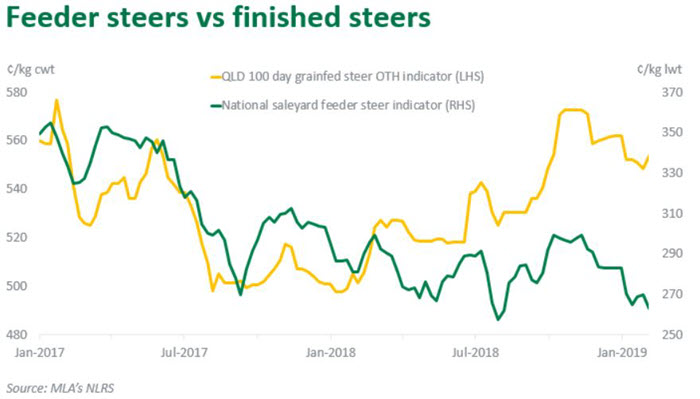

Feeder cattle prices have followed the wider young cattle market downwards this year, while finished cattle remain relatively well supported. This divergence would have gone some way to alleviating the cost pressures associated with spiking grain prices during the last two years.

The national saleyard feeder steer indicator averaged 263¢/kg live weight (lwt) on 18 February, just 2% above a two-year low of 259¢/kg lwt (August 2018). In fact, the indicator has fallen 24% since January 2017.

On the other hand, the Queensland 100-day grainfed steer over-the-hooks indicator sat at 554¢/kg carcase weight (cwt), just 4% below a two-year high of 577¢/kg cwt (reached in February 2017).

Grainfed beef exports

In 2018, grainfed exports rose 12% year-on-year to surpass 300,000 tonnes shipped weight (swt) for the first time. All three of Australia’s major markets recorded strong gains, with volumes to Japan and Korea both lifting 8% year-on-year, while volumes to China leapt 87%. Growth in the Chinese market has meant that Japan and Korea now account for less than 70% of all Australian grainfed exports, compared to 95% in 2004.

Faced with mounting competition stemming from the US, Australian beef continues to benefit from a lift in overall demand in Japan – especially among the younger generations. Between 2016 and 2018, total Japanese beef imports (from all suppliers) grew 21% to reach the highest calendar year volume since 2001, the year in which Bovine Spongiform Encephalopathy was first discovered in Japan.

Korea’s high-earning consumer base with a preference for grainfed beef supports the high quality beef trade from Australia. Grainfed product accounted for 37% of Australian beef exports to Korea in 2018.

Demand from China has been a major boost for the industry in recent years; however, a number of uncertainties remain in this market. Trade access negotiations and the potential impacts of a trade war with the US will be key areas to watch as 2019 progresses.

More information

For market information tailored to you, head to MLA Market Reports & Prices