WA lamb prices outpaced by the east

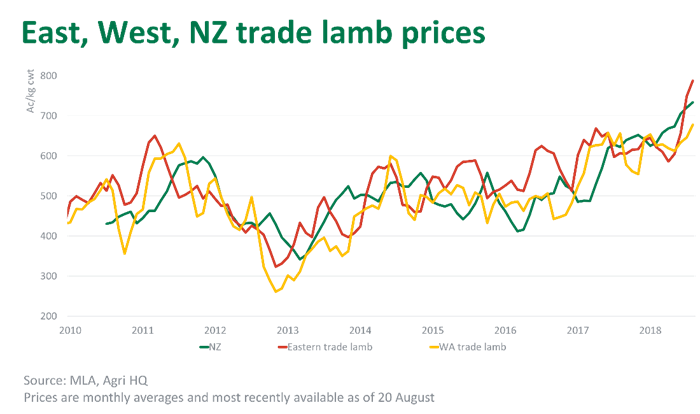

While the seasons are poles apart, WA sheep producers may be looking east in envy at record lamb prices making headlines. WA prices are good, by historical measures, but well behind the 800¢ on offer in the east.

At the close of Monday’s markets, the eastern states trade lamb indicator had hit 832¢/kg, while its WA counterpart trailed at 666¢/kg cwt. Outlined below are a few of the drivers behind this spread.

The bight that separates

WA acts, at times, in a partially isolated market – with different supply and demand fundamentals, and unique seasonal conditions. In fact, the Great Australian Bight can make the WA lamb market act as independently to the eastern states, as much as the Tasman separates the New Zealand market. Interstate transfers to the east can act as the equaliser but are limited by freight capacity and transport costs, and the timing of the seasonal onslaught of the new season lamb crop (peak WA lamb supply can often coincide with Victoria).

Given the isolated nature of the WA sheep industry, there is less ability to even out sheep and lamb slaughter over the year. In the east, varying climatic conditions between SA, Victoria and NSW, means kill floors can run more efficiently year-round by procuring animals from a broader regional base. This inflexibility in WA means processors build additional risk into year-round purchasing decisions.

Given WA is separated from the east and has a smaller flock and annual turnoff, it is also impacted by reduced economies of scale. Smaller processing plants and supply chain infrastructure will increase the cost base of getting WA sheepmeat through to the consumer.

In addition, WA has a smaller presence in premium markets: the domestic market accounts for just 23% of WA sheepmeat production (compared to 30% for the rest of Australia), and the US represents just 6% of WA exports (compared to 18% for the rest of Australia). Meanwhile, across live and domestically processed, about half of WA’s consumers are in the Middle East – in part, a reflection of the greater Merino influence on the flock. In 2017-18, the average sheepmeat unit export price to the US was A$10.73/kg, compared to A$7.22/kg to MENA and A$4.64/kg to China.

Additional costs in the supply chain and a consumer portfolio skewed towards lower value markets, means buyers have shallower pockets when it comes to purchasing sheep and lambs in WA.

But what’s driving the current divide?

The above reasons explain why the west can average at a discount to the east – which, in the long term, it tends to do. But what is driving the current more extensive divide?

An easy conclusion to draw is to point out the cessation of live export trade. The live trade is critical to WA, accounting for 23% of sheep turnoff last financial year, and it declined significantly in June then ground to a halt in July. Having a major buyer step back from the market can reduce competition and put downward pressure on prices but it is difficult to determine whether that explains the full extent of the current spread.

As highlighted in the latest WA Weekly Indicator Report, the cessation of the live trade has not seen an out of the ordinary surge in sheep or lamb slaughter, and prices have in fact risen since May. Rather, the spread is being driven by a surging east coast lamb market, which is currently experiencing completely different seasonal conditions and market dynamics.

The transition from winter to spring is often a volatile time for lamb prices on both sides of the country, as seasonal conditions dictate pasture availability and the price of grain to finish new season lambs. In the east, the NSW lamb crop is yet to hit the market due to disastrous winter rainfall and spiking grain prices – this often-reliable supply has caught processors off guard and underpinned the lamb price rise. Meanwhile, the WA lamb supply appears to be acting more in line with normal conditions, keeping a lid on price rises.

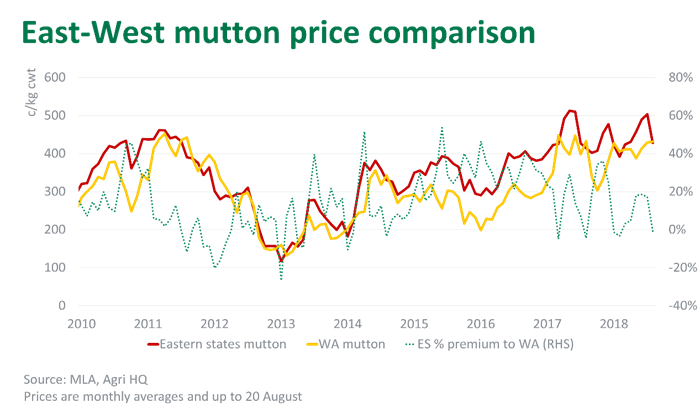

In addition, the east-west mutton price spread is far closer. The eastern states mutton indicator finished Monday at 439¢/kg, while the WA indicator lagged slightly, at 413¢/kg cwt. As illustrated below, both sides of the country have actually averaged near parity so far in August and are historically close. Given the mutton market has greater exposure to the live trade, this reinforces the recent shortage of east coast lambs is having a far greater impact on the market and driving the east-west divide.