Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

US imported beef prices still find support

04 April 2018

US imported beef prices continue to hover around AUD600¢/kg and have done so for the last seven weeks. During this period, overseas packers have remained firm with their asking prices, while US domestic users have been apprehensive about the potential supply outlook in the US.

Trading for grinding beef typically picks up in late March and early April, however this has not come to fruition this year. This is the result of the aforementioned trading environment but also as lower priced end cuts in May and June could bolster grinding beef availability.

The imported 90CL beef indicator eased US2¢, to US209¢/lb CIF (down AUD5¢ at AUD598.90¢/kg CIF).

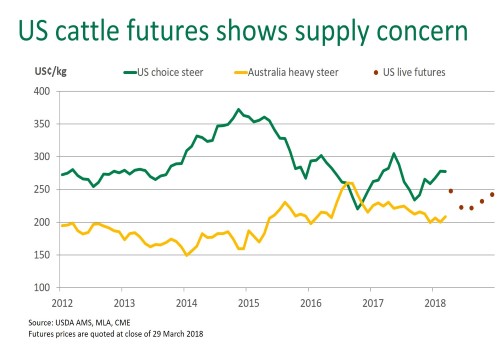

Cattle futures

US cattle futures for spring and summer contracts have continued to decline, as market participants fear an oversupply of market ready cattle will start to exceed available packing capacity. Concerns have risen as the lower than anticipated marketing rates in March – relative to the reported number of cattle on feed – create the potential for a backlog of market ready cattle.

Estimates from the US suggest that the supply of cattle that have been on feed for more than 120 days on April 1 will be around 24% higher than the same time last year. However, last week, estimated fed cattle slaughter was only 1.5% higher, at 488,000 head.

Highlights from the week ending 30th March:

- Lower fed cattle values and higher slaughter could affect the value of end cuts during Q2 and cause them to be under grinding values. US end users remain reluctant to bid on imported lean beef for delivery in May and June since lower priced end cuts could bolster grinding beef availability and pressure prices lower.

- Cow slaughter has also been trending higher due to both more beef cows (9%) and more dairy cows (9.6%) than last year. Higher feed costs and weaker dairy product values could potentially push more dairy cows to slaughter in the coming weeks, further adding to the beef supply available.

Click here to view the Steiner Consulting US imported beef market weekly update.