US cattle on feed inventories lift

The latest USDA cattle on feed results show feedlot inventories on 1 October were 5.4% higher year-on-year. Fewer than expected placements throughout the month caused the overall lift in numbers on feed to be lower than originally forecast, bringing the total supply at 1 October to 11.4 million head.

Cattle on feed numbers continue to support robust front-end supplies and, in the short-term, have limited the upside for cash fed cattle prices. The supply of cattle that have been on feed for more than 150 days is estimated at 1.9 million head, 27.1% higher year-on-year, and the supply of cattle on feed for more than 120 days is estimated at almost 4.0 million head, 11.5% higher than a year ago.

The abundant supply and lower placements in September have underpinned the wide spread of US fed cattle futures contracts between October-to-December and February-to-April.

US imported beef market stable

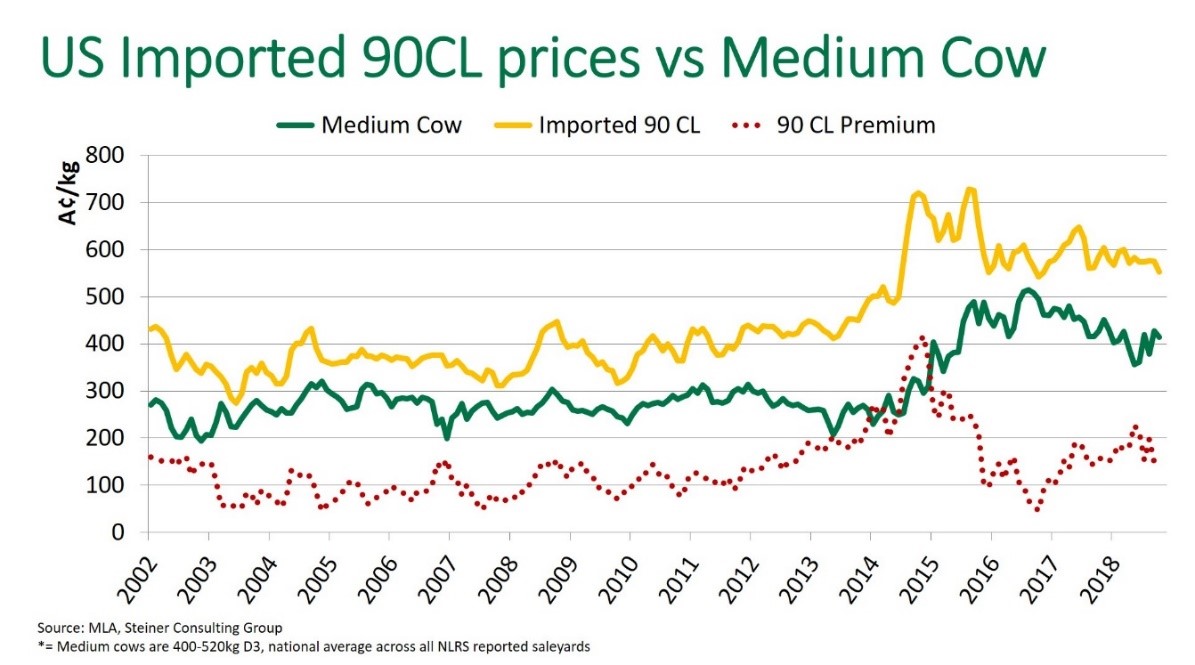

US imported beef prices remained relatively stable last week, as limited offerings from overseas suppliers, coupled with renewed end user interest, helped limit some of the early downward pressure. Concerns that New Zealand slaughter rates may not lift in line with previous expectations – improved weather conditions have contributed to reduced cow slaughter in the last six weeks – was a catalyst for renewed end user interest towards the end of the week.

The imported 90CL beef indicator declined 1US¢, to 177US¢/lb CIF (down 5A¢, to 548A¢/kg CIF).

US end users have for the most part been reluctant to accept higher offers from Australian suppliers, who have been encouraged by strong demand from Asian markets. The price of lean grinding beef in the US should be approaching seasonal lows and, with the prospect of improving cattle prices in Australia following recent rainfall, the 90CL–medium cow premium could diminish in coming weeks.