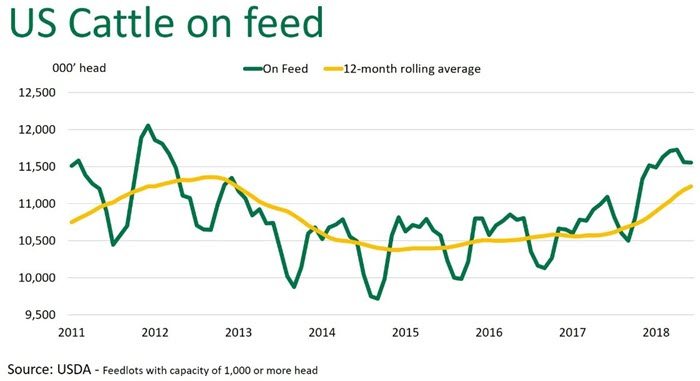

US cattle on feed exceeds market forecast

The latest United States Department of Agriculture (USDA) cattle on feed results show a larger than expected number of feedlot placements in May, bringing the total supply of cattle on feed at June 1 to 11.55 million head, 4.1% higher than year ago levels.

This is the highest 1 June inventory since the USDA report began in 1996 and accounts for the eighteenth straight month of year-on-year increases.

Industry consensus prior to the report’s release was that reduced placements compared to year-ago levels would cap the potential of significantly higher inventories, and that the expectation for higher marketings would also limit any upside for cattle on feed numbers.

At 2.01 million head, marketings in May were up 5.4%, modestly higher than forecast. Strong US processor margins have helped sustain the current marketing levels, however given where feedlot inventories sit, July and August marketings will be critical to ensure feedlots stay current.

US feedlots placed 2.1 million cattle on feed in May, 0.2% higher year-on-year, industry estimates were expecting a decline of between 4-5%. Deteriorating drought conditions –which continue to enhance the prospect of a US herd liquidation – have driven more light cattle into feedlots. However, larger feeder cattle imports from both Canada and Mexico supported the increase. Steiner Consulting Group reported imports of Canadian feeder cattle in May, close to 300% higher compared to last year.

US Production

US beef production is on course to exceed 12.3 million tonnes in 2018, according to the latest USDA projections. This actually represents a downwards revision from the May projection (12.5 million tonnes), as lighter carcase weights are expected to offset the higher, second quarter slaughter levels. However, the aforementioned supply of cattle on feed continues to support the year-on-year forecasts for growing US beef production.

Cold storage implications

The latest USDA cold storage report indicates that, as at 31 May 2018, total frozen red meat inventories in the US were 9% higher year-on-year. Frozen beef inventories, however, were up 13% year-on-year, at approximately 211,000 tonnes. An increase in US beef production lends itself to an increase in overall cold storage inventories, but the impact on cattle prices heading into the middle of US summer looks set to be negligible. The reason being US beef exports have surged in recent months and robust export demand sees a need for more beef to be transferred into cold storage before being shipped overseas.

Cattle prices

The US futures market fell by the permissible limit off the back of the USDA cattle on feed report. Escalating international trade dynamics have also been a prominent factor unsettling most commodity markets in recent days.

High inventories of cattle on feed would suggest cattle prices are unlikely to see any moves higher, certainly from a supply perspective. Therefore, how US demand tracks through the summer months will be critical.

However, with the prospect of lower US cattle prices – evidenced with August live cattle futures displaying a 5% discount – Australian cattle prices could follow suit as the correlation between the two markets settles closer to longer-term averages.

Historically, US cattle prices have carried approximately a 20% premium to the Australian equivalent. For the calendar year-to-date the US choice fed steer has averaged a 29% premium when compared to the Australian heavy steer, however when looking at the month of June in isolation the premium sits at 21%.

Therefore, applying the same 5% discount to the Australian heavy steer, currently averaging 204.76US¢/kg live weight (lwt), the aforementioned indicator would return an average price of 194.52 US¢/kg lwt in August. How the season plays out until then will be a pivotal factor and any decent rainfall will see Australian cattle prices trending higher. Global trade tensions will present another major curve ball.

US imported beef market highlights for the week ending 23rd June:

- Fed cattle slaughter last week was 532,000 head, 3.5% higher than last year and the highest in more than 5 years.

- Lower ground beef demand and higher supplies have caused the price of 50CL beef trimmings to decline 32% since May 1.

- Beef imports from grinding beef supplying countries in the last four weeks are up 23% compared to the same period last year and 40% higher than March and early April levels.

View the Steiner Consulting US imported beef market weekly update