US cattle herd expansion slowdown

As the cattle herd in Australia shifts towards contraction, a similar scenario is playing out in the US, as both nations face drought conditions in key beef producing regions.

At this stage, the market sentiment points towards a slowdown in the expansion of the US herd as opposed to liquidation; however, the sustained dry period continues to present uncertainty as to when the expansion phase will halt.

Non-fed cattle slaughter in particular has evidenced the impact of the dry conditions in the US but also weaker than expected dairy prices have pushed more dairy cows to market recently. Total cow slaughter in the first half of the year was up 7.8% compared to a year ago, with dairy cow slaughter up 4.9% and beef cow slaughter 11% higher than last year.

For the first six months of the year, fed cattle slaughter tracked 2.5% higher, at 12.7 million head. Steer slaughter remained stable compared to the year prior, however heifer slaughter was elevated close to 8%. Furthermore, as a percentage of the total kill, female slaughter (on a rolling 52-week basis) sits at 46.7%, a clear indication that the expansion phase in this cattle cycle is coming to an end. Industry commentators note that if the current trends persist, a modest decline in the beef cow herd could be expected by next US summer, with a peak in the current cattle cycle occurring a year later.

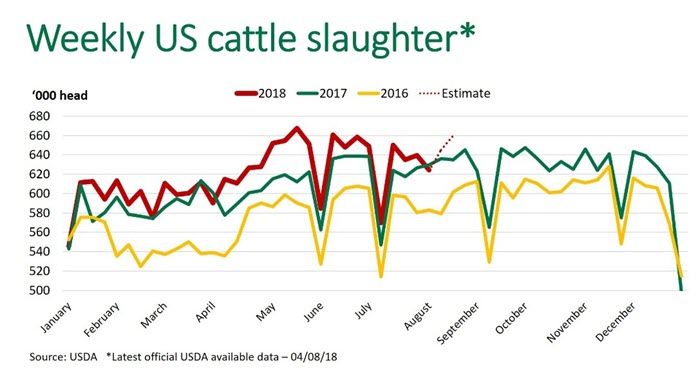

Current US weekly cattle slaughter estimates continue to show year-on-year increases, as the large feedlot inventory – a function of a larger calf crop – and robust beef demand are keeping marketing rates current. For the week ending August 18th, total cattle slaughter estimates were 660,000 head, 4% higher than last year. Seasonally, turnoff lifts at this time of year in the build up to the Labour Day holiday (3rd September).

The USDA will publish their latest feedlot inventory report later this week. Steiner Consulting Group forecast placements to increase close to 4% from last year, and marketings in July are projected 5% higher.

US imported beef

US imported beef prices edged lower this week as end users take a back seat in recognition of limited overseas supplies. A combination of New Zealand supplies nearing a seasonal low and robust demand from Asian markets for Australian beef underpins the supply constraints for imported grinding beef.

The imported 90CL beef indicator edged 1US¢ lower this week to US191.5¢/lb CIF (up AUD5¢ at AUD580.55¢/kg CIF).

Prices for fat beef trimming, in particular 50CL (chemical lean), has seen significant price increases in the last few weeks. The market sentiment attributes this to sharp price declines earlier in the summer, as the expectation for an oversupply of fat trimmings was priced into the market. However, ground beef demand throughout the summer has been buoyant and retailers appear intent to feature ground beef extensively in the lead up to the Labour Day weekend.

Market highlights for the week ending 17th August:

- Fat trim prices have increased sharply as spot supplies are limited and some end users are now short following the sharp decline in June.

- Spread of African swine fever in China could lead to significant supply disruptions and a decline in demand for pork, both factors that could bolster demand for beef in China.