New season lamb delay reflected in September exports

Australian sheepmeat exports in September totalled almost 34,000 tonnes shipped weight (swt), back 1% year-on-year. However, year-to-September sheepmeat exports were 14% higher year-on-year.

September mutton exports jumped 30% on 2017 levels, underpinned by a spike in sheep slaughter throughout August. For the week ending 24 August, the weekly NLRS eastern states sheep slaughter was 185,000 head – the largest weekly kill since March 2014 – and the monthly kill was almost double that of a year prior, with the dry being the catalyst for producers offloading poorer conditioned ewes.

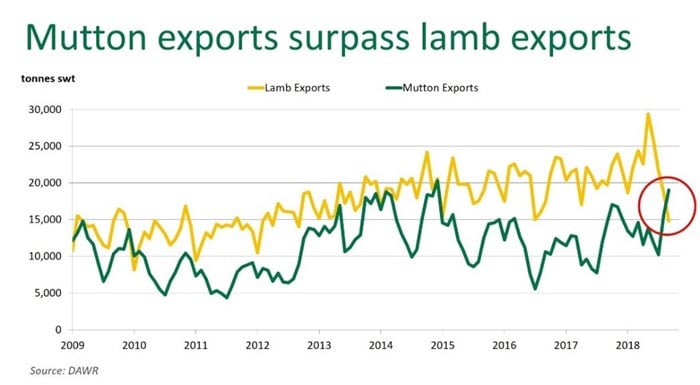

Mutton exports surpass lamb

For the first time since January 2010, mutton exports surpassed lamb exports. Despite mutton exports moving towards a four year high, it was the sizeable reduction in lamb exports that underpinned the crossover. Lamb exports declined 25% year-on-year, to 14,800 tonnes swt – a move below 15,000 tonnes swt for the first time since September 2012.

Extended drought in major supply regions across NSW, Victoria and SA during winter and spring has delayed the supply of finished lambs hitting the market. A combination of lower marking rates and producers struggling to finish stock to sale-ready weights translated into a sharp decline in lamb exports in September.

With the exception of China – the recipient of most of the additional mutton hitting the market – limited availability saw exports to the majority of markets decline in September. However, most markets have registered growth or maintained volumes over the year-to-date period.

Year-to-September lamb exports:

- Middle East - up 22%, to 56,500 tonnes swt

- China - up 15%, at 40,150 tonnes swt

- US - unchanged, at 41,000 tonnes swt.

Year-to-September mutton exports:

- Middle East - down 2%, at 34,500 tonnes swt

- China - up 113%, at 32,000 tonnes swt

- US - up 23%, at 12,800 tonnes swt

- Malaysia - up 38%, at 13,500 tonnes swt.

Australian sheepmeat exports continue to benefit from robust global demand, with surging demand from China and limited competition from New Zealand being the overarching factor elevating prices of late. In addition, further declines for the Australian dollar – now trading just above US70¢ (US10¢ below where it peaked in January) has supported exports.

Beef exports

September beef exports totalled 91,700 tonnes swt, a lift of 4% year-on-year. For the calendar year-to-September, beef exports have increased 12% year-on-year, to 840,500 tonnes swt, supported by elevated female slaughter, record numbers of cattle coming off feed and robust global demand for beef, in particular from Asian markets.

Year-to- September beef exports:

- Japan - up 7%, at 235,000 tonnes swt

- US - down 1%, at 180,000 tonnes swt

- Korea - up 15%, at 125,000 tonnes swt

- China - up 55%, at 116,000 tonnes swt

- Indonesia - up 20%, at 46,000 tonnes swt

- Philippines - up 17%, at 28,600 tonnes swt.