Market watch: US imported beef

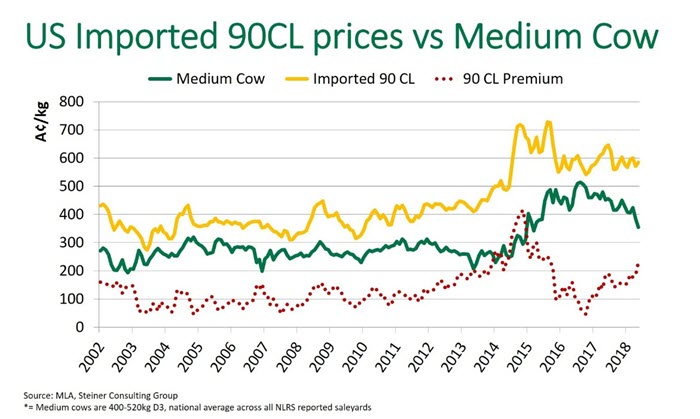

The imported US 90CL beef price indicator – a key benchmark for Australian manufacturing beef exports – has shown relative stability so far in 2018, averaging 583.7A¢/kg CIF, in the face of growing US beef production.

In contrast, Australian cattle prices have trended lower since the turn of the year, driven by sustained dry conditions and subsequent supply lift. As a result, the imported 90CL and Australian medium cow indicators have diverged, with a 230A¢/kg premium currently reflected between the aforementioned indicators. The gap between the two indicators is the largest since September 2015 – at this time, the 90CL indicator reached record highs, as US import demand spiked after the US herd reached a cyclical low. In the five years prior to 2013, the 90CL indicator averaged a 120A¢/kg premium.

Market influences

Critical to US imported beef prices remaining stable, US beef demand has remained strong and there have been excellent retail features in the lead up to and during peak demand summer ‘grilling’ season. The price of US domestic round cuts has also remained firm, which has further underpinned imported prices.

Strong demand from Asian markets has also supported beef prices into the US. For the calendar year-to-April, Australian manufacturing beef exports to Asia (all markets) have lifted 22%, to 65,000 tonnes shipped weight (swt), with overall exports to the region totalling 232,000 tonnes swt, up 19%. Total US beef exports to Asia have also increased 14% for the calendar-year-to-March, which has helped divert more beef from the domestic market hence contributing the stable imported prices.

Outlook

Poor moisture conditions in a number of the largest US cattle producing states has seen beef cow slaughter accelerate in recent weeks. Beef cow slaughter in the four weeks ending 12 May averaged 60,400 head, 13.5% higher compared to last year.

Furthermore, dairy cow slaughter also seasonally declines through the US summer but for the aforementioned four week period has still averaged 57,500 head, up 3.5% year-on-year.

In the latest USDA cattle on feed report, marketings in April were reported to be 6% higher year-on-year and market expectations are for slaughter numbers to stay above year ago levels throughout the summer. Therefore, imported prices could come under pressure as a result of further increases in US slaughter but demand remains a critical component.

Market highlights for the week ending 24 May

- The imported 90CL beef indicator declined 2US¢, to 198US¢/lb CIF (down 9A¢ at 577.4A¢/kg CIF).

- Memorial Day (28 May) was the most important beef consumption holiday of the year. US end users were focusing on clearing product over the long holiday weekend.

- Fed cattle slaughter for the week ending 25 May was estimated at 520,000 head, 3.1% higher than a year ago. Non-fed slaughter for the week was an estimated 127,000 head, 7.6% higher than last year.

- CME fed cattle futures rallied earlier in the week on strong beef wholesale prices and robust packer margins.