Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

Lamb prices scale new heights

04 July 2018

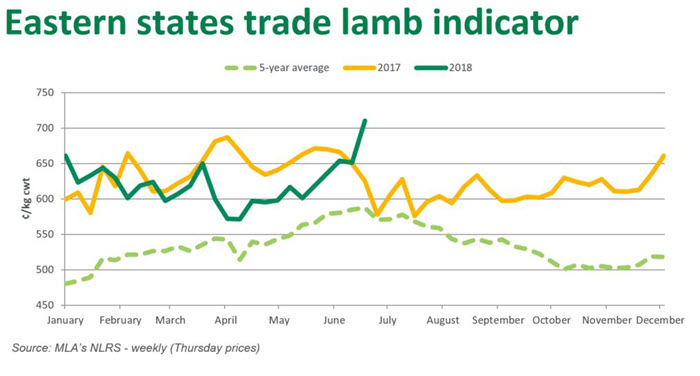

Scattered rainfall combined with tighter supply has boosted already-resilient saleyard prices, with the Eastern States Trade Lamb Indicator (ESTLI) reaching 721¢/kg carcase weight (cwt) on Tuesday, 9¢/kg higher than the previous record set on Friday.

Saleyard sheep and lamb prices have been resilient in 2018, despite abundant supply and limited restocker activity. In recent weeks, some rainfall in drought-affected areas combined with a slight tightening of supply has lit a fire under prices, with processors competing fiercely for finished lambs.

Winter rainfall scarce

While parts of central NSW received some helpful falls over the last week, over 99% of the state remains in ‘drought watch’ conditions or worse (according to NSW Department of Primary Industries). Elsewhere, parts of Victoria and SA saw a number of cold fronts induce rain in early June; however, meaningful falls have been scarce. Likewise, south-western WA received scattered falls throughout early June, although the season has been largely disappointing thus far.

Sheep yardings up, lamb numbers fall

The traditional winter shortage has begun to impact lamb numbers, while dry conditions in NSW have seen increased sheep yardings.

For the month of June, eastern states lamb yardings totalled 679,000 head, down 134,000 head (17%) year-on-year, driven by a 21% decline in NSW. Market reports suggest lamb supply has fallen across most categories, particularly in southern NSW saleyards where lighter weight lambs are often well-supplied at this time of year. Along with trade and lighter weight lambs, heavy lamb numbers have fallen, with reports the high cost of feed is limiting producer capacity to finish stock.

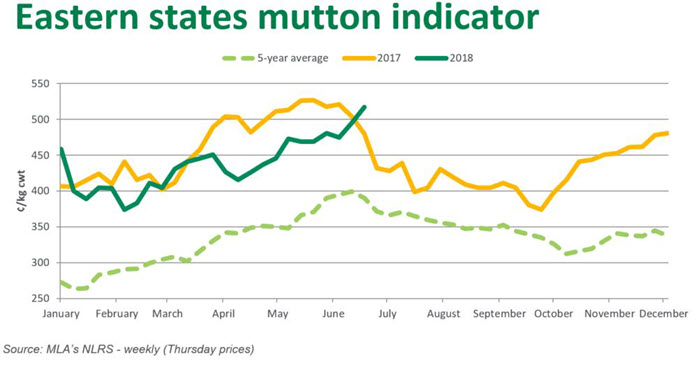

Unlike lambs, mutton has remained in reasonable supply. Saleyard throughput fell month-on-month, though not by as much as would usually be expected this time of year. Yardings for the month of June totalled 285,000 head, representing an increase of 54,000 head (24%) on June 2017 numbers.

Supply

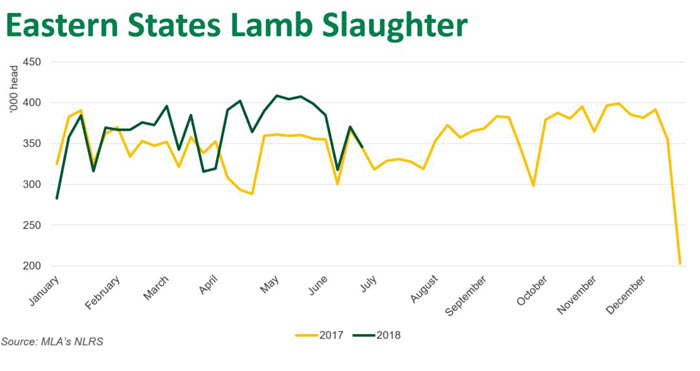

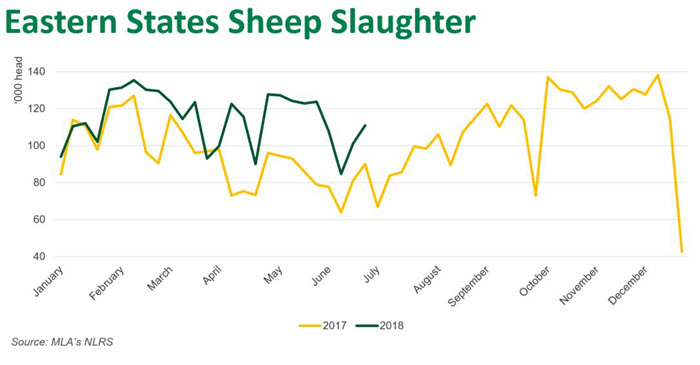

According to National Livestock Reporting Service (NLRS) data, weekly eastern states lamb slaughter has finally begun to fall back in line with 2017 levels, while mutton slaughter remains well up year-on-year.

After five months of increased slaughter, lamb supply is beginning to show signs of tightening (if only slight). June eastern states lamb slaughter totalled 1,420,000 head, which was up 4% year-on-year, though tracking closer to 2017 levels than previously.

Drought conditions across the eastern states, particularly in NSW, have forced many producers to destock despite booming sheepmeat and wool prices. June Sheep slaughter totalled 290,000 head, up 29% year-on-year. Slaughter has remained high throughout 2018, with year-to-date total up 21% year-on-year.

Prices break records in southern yards

Fierce competition among processors, combined with tighter supply has seen the ESTLI rise 100¢/kg carcase weight (cwt), or 16%, between 1 June and 3 July to a record 721¢/kg cwt.

All the major eastern states sheep and lamb saleyard indicators have rallied strongly since mid-April. A declining supply of finished lambs has seen the Heavy Lamb indicator perform particularly well, reaching 722¢/kg cwt on Tuesday, up 17% since 1 June. Strong export demand has translated into rising saleyard prices, with processors competing fiercely in the face of declining supply.

In another positive note for sheep producers, the Eastern States Mutton Indicator rose 10% since 1 June, closing Tuesday at 519¢/kg cwt – just 10¢/kg below the all-time high set in May 2017.