Lamb farm income just shy of 20-year high

Strong sheepmeat and wool prices have supported Australian lamb farm incomes, which remain at historical highs in 2016-17 and 2017-18.

The Australian lamb industry is a valuable contributor to the national economy, accounting for around 6% ($3.2 billion) of the value of Australia’s agricultural production.

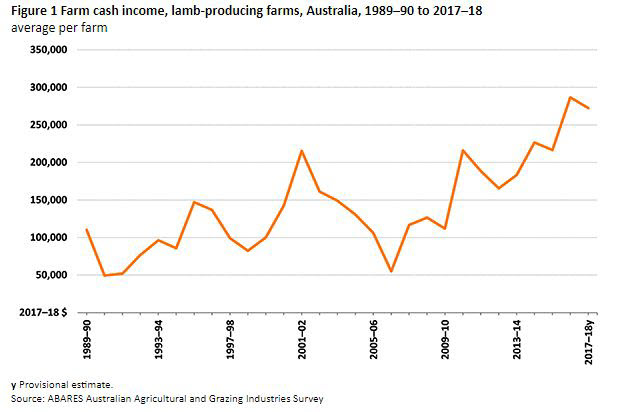

Since 2006-07, the average farm cash income of Australian lamb producers* has continued to trend upwards, reaching a record high in 2016-17 of $273,000 per farm – according to data collected from the ABARES Agricultural and Grazing Industries Survey (AAGIS).

ABARES has projected a 5% decrease in cash income 2017-18, with the tougher season in 2018 resulting in lower cash receipts from cropping. However, strong sheepmeat and wool prices offset this to an extent, with farm cash income in 2017-18 likely to be the second highest (in real terms) in more than 20 years.

Costs

Operating costs have been fairly stable from 2014-15 to present – with a 4% decline projected in 2017-18. Fertiliser, repairs and maintenance, crop and pasture chemicals, interest payments and hired labour made up the greatest proportion of total cash costs.

State by State

Victoria, NSW, SA and WA all recorded a significant increase in cash income in 2016-17 – with record-breaking winter crop production in some states driving higher total receipts and income. Tasmania fell slightly and Queensland failed to produce enough to achieve an accurate review.

In 2017-18, farm cash income is expected to decline in NSW and SA, but rise in Victoria, WA and Tasmania.

Rate of return

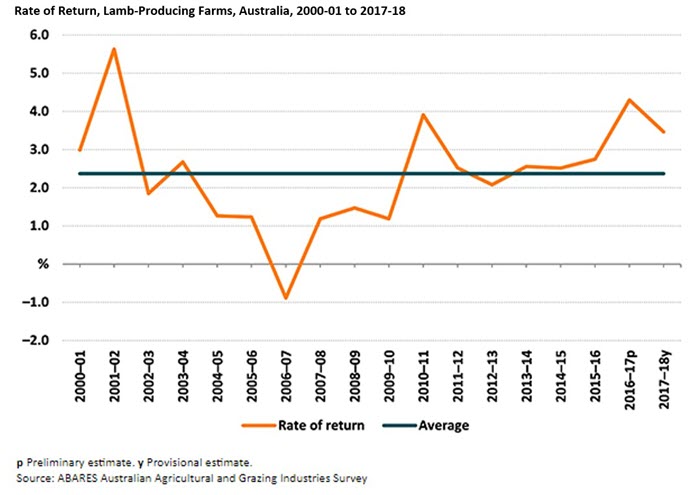

The average rate of return (gain on investment over time) in 2016-17 was 4.3% across all lamb producing farms, as a result of higher farm incomes – the highest since 2001-02. In 2017-18, the rate of return is projected to ease to around 3.5%, still considerably higher than the 20-year average of 2.4%.

Despite the slightly lower rate of return, an estimated 84% of lamb-producing farms will have a positive rate of return in 2017-18, with 8% having a return of more than 10%. There is quite large variation across the industry in terms of rate of return. Difference in seasonal conditions across regions, enterprise mix, and commodity prices impact individual farms differently.

Read the full ABARES report on Farm Financial Performance

* Note: ABARES Australian Agricultural and Grazing Industries Survey (AAGIS) classifies Australian slaughter lamb producing farms as those that sold at least 200 lambs for slaughter, including mixed enterprise operations also turning off beef and/or crops.