Increased southern yardings impact lamb market

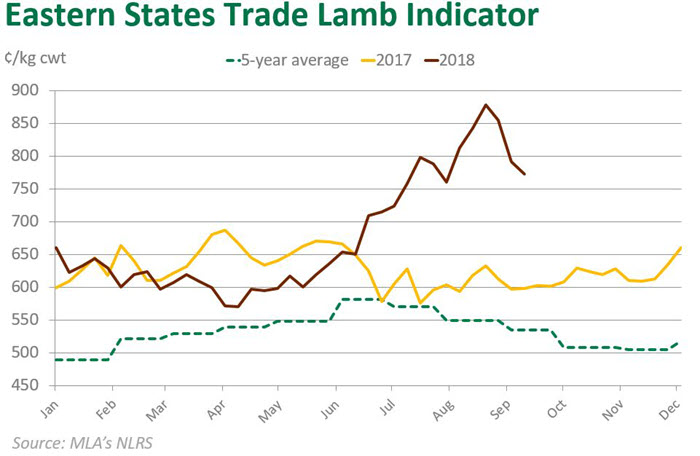

Although new season lambs reached southern saleyards a little later than usual this year, yardings rose strongly during the last fortnight. Prices responded accordingly, with the Eastern States Trade Lamb Indicator (ESTLI) falling 151¢/kg carcase weight (cwt) since the end of August, to 733¢/kg cwt on Tuesday. Despite the fall, the indicator sits 37% above the five-year September average.

Saleyard throughput

Turning to recent lamb yardings across the eastern states, high throughput in SA and Victoria are partially offsetting reduced numbers in NSW.

Lamb numbers moving through NSW yards have been steady through August and September. For the week-to-Tuesday, throughput totalled 109,000 head, down 26% on the same week in 2017. NSW supply will remain difficult to estimate during spring, with market reports suggesting the poor season has led to a substantial fall in marking rates for some regions.

Further to the south, the story is reversed, as yardings have been on the rise since late August. On Tuesday, combined weekly throughput in South Australian and Victorian yards totalled 86,000 head, up 23% on the previous week and up 31% year-on-year. This figure includes Monday’s Bendigo sale, which saw almost 28,000 lambs penned.

Slaughter

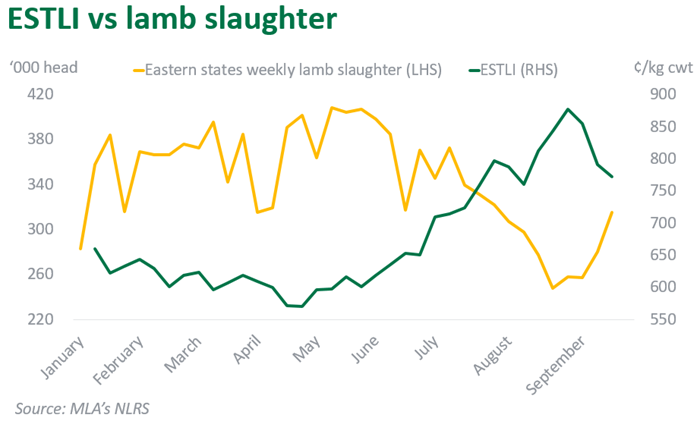

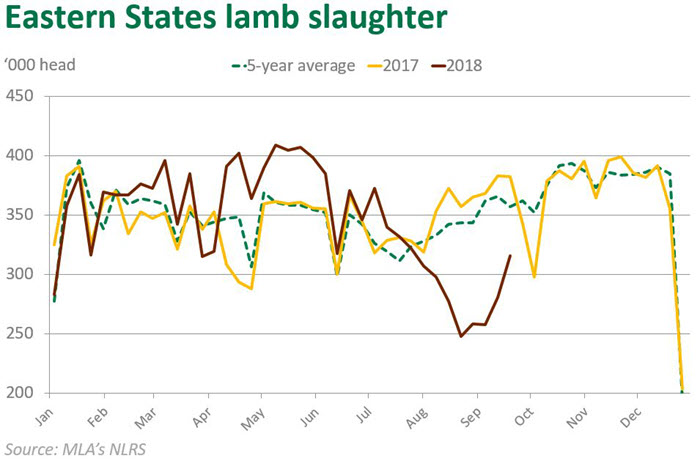

Following a major supply shortage of finished lambs during August, eastern states weekly slaughter has been rising since the beginning of September. While numbers are on the rise, total lamb slaughter for the first three weeks of September was 25% below 2017 figures (MLA’s NLRS).

Prices

Since 31 August, when the ESTLI reached record high of 884¢/kg cwt, all eastern states saleyard lamb indicators have experienced falls of between 14–20%.

While the easing market will no doubt be disheartening to producers, an examination of historical prices paints a brighter picture. Based on monthly prices from 2013–2017, on average, the ESTLI fell 8% between June and September. This year, prices bucked the trend and rose strongly during the winter months. The ESTLI averaged 656¢/kg cwt in June, compared to 807¢/kg cwt so far in September, which represents a rise of 23%.

The reaction of prices to supply changes this year is highlighted in the chart below. The ESTLI has responded quite symmetrically to the availability of slaughter ready lambs this winter. Moving forward, supply will no doubt have a similar impact on saleyard prices, hence seasonal conditions during spring will, as always, be pivotal.