The Malaysian market

During times of drought, developed export mutton markets in Asia and the Middle East are key to alleviating farm gate price pressure in Australia.

Even with sheep slaughter forecast to finish 2018 up 23% year-on-year, the national mutton indicator has nudged record territory this year, hovering between 400–500¢/kg carcase weight (cwt) to date – a stark contrast to the 2002 and 2006 droughts, where the indicator averaged 165¢ and 141¢/kg cwt respectively.

Earlier this year Prices & Markets discussed the drivers at play within Australia’s largest mutton market, China. Here we explore the consumer landscape, opportunities and challenges within Australia’s second largest mutton market, Malaysia.

Highlights

- Malaysia is Australia’s second largest mutton market and primary live goat destination – a market worth A$310 million in 2017–18, accounting for 3% of Australia’s total red meat and livestock exports.

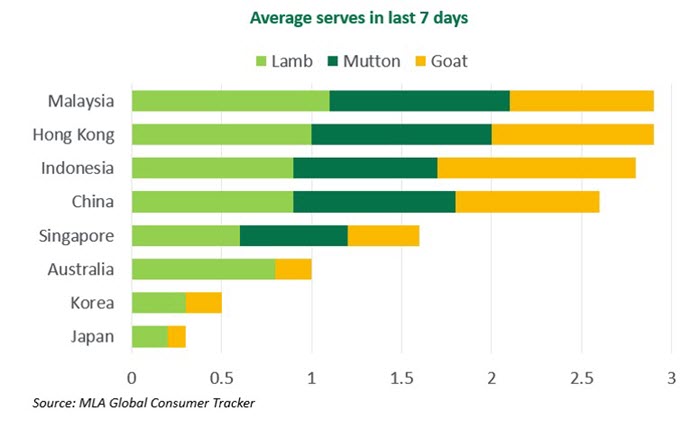

- Despite being niche proteins, the frequency of sheep and goat meat consumption is relatively high in Malaysian diets.

- Malaysia’s sheepmeat consumption volume is at approximately 43,000 tonnes carcase weight equivalent (cwe) in 2018 and forecast to grow 4% by 2022.

- Australian lamb is perceived as a ‘family favourite’ by many Malaysian consumers, the most important attribute when selecting between proteins.

Sheep and goat meat consumption in Malaysia

Malaysia is a multicultural nation with a population of approximately 32 million people. Not only is sheep and goat meat popular within the Muslim community – which accounts for about 60% of the population – but they’re also enjoyed across other consumer segments due to lack of religious taboos.

The expansion of contemporary, western-style restaurants, tourism and an expatriate population are key growth drivers for sheep and goat meat consumption.

Malaysia has the second largest number of households with annual disposable incomes exceeding US$35,000 in South-East Asia (approximately 1.4 million), and is forecast to surpass its wealthier neighbour, Singapore, by 2022 (approximately 2.5 million).

The country’s top five economic cities – Kuala Lumpur, Penang, Johor Bahru, Kuching and Malacca – have a high proportion of wealthy households (GlobalData) and present targeted growth opportunities for high value sheep and goat meat products.

Although consumed far less than chicken, fish, seafood and beef, sheep and goat meat are relatively popular in Malaysian diets compared to many other Asian markets. Lamb, in particular, is perceived as a superior meat among many consumers, for which they’re willing to pay a premium (MLA Global Consumer Tracker Malaysia, 2018).

Consumption channels: challenges and opportunities

Sheep and goat meat is utilised across retail and foodservice channels. Although, these sectors remain fragmented and dominated by traditional formats, Kuala Lumpur and other major large cities have relatively developed networks and infrastructure.

Consumers purchase sheep and goat meat through a mix of retail formats, from supermarkets and hypermarkets to butchers and wet markets. It’s served across a wide range of foodservice formats, from western-style restaurants to ethnic cuisine – lamb is more popular in high-end foodservice, while mutton and goat meat are common in low-to-middle end segments.

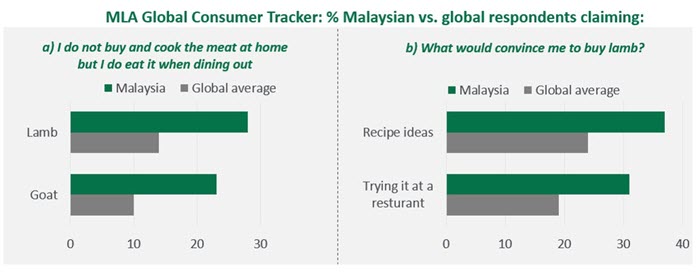

While consumers’ lack of knowledge on how to cook sheep and goat meat remains a challenge for retail, foodservice presents opportunities to grow and to encourage consumers to try the product. A substantial portion of Malaysian consumers surveyed in MLA’s Global Consumer Tracker claim they do not buy and cook lamb and goat meat at home but they do eat them when dining out, and that trying the meat at a restaurant would encourage them to purchase in future.

Supply and the competitive landscape

Malaysia depends heavily on sheepmeat imports due to low domestic supply capacity.

Imports make up about 93% of total Malaysian sheepmeat consumption (GIRA), with Australia and New Zealand being the two largest suppliers. Despite a leading position in the market, Australia is facing increased competition from New Zealand and new suppliers.

New Zealand, although having a smaller share than Australia, it’s the largest supplier of frozen mutton carcases, which accounts for about 20% of total sheepmeat imports to Malaysia (GTA, Department of Statistics Malaysia). However, the New Zealand sheep flock continues to decline, limiting growth potential, while China has emerged as major buyer, bidding strongly for product traditionally destined for markets such as Malaysia.

Australia has long been the largest supplier of both live goat and goatmeat to Malaysia, contributing approximately 20% of total goatmeat consumption and mainly competing with local Malaysian goat.

However, recent high goat prices in Australia have led Malaysian importers to seek alternative sources.

With mutton and goatmeat used interchangeably in many Malaysian dishes, Malaysia has started importing live sheep from neighbouring Indonesia, through a two-year contract with quota for the first year being approximately 60,000 head (AsianAgribiz).