In depth: Beef exports to South East Asia record strongest growth

Key points

- South East Asia (SEA) recorded the strongest percentage growth across all of Australia’s beef export markets in Q1, 2018

- Increasing demand and a limited domestic supply has underpinned this growth

- As a region, SEA has emerged as the EU’s third largest beef export market

Boasting more than 600 million people and one of the world’s fastest growing economic regions, SEA is an increasingly attractive beef market with strong growth potential.

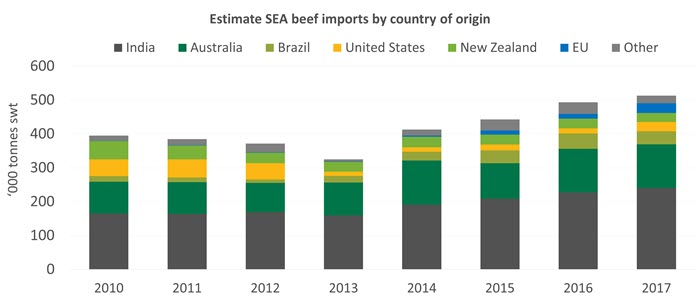

The rise of middle class consumers has been a key growth driver for beef consumption in the region. SEA’s beef imports have increased at an average annual growth rate of 7% over the past five years. SEA has become the third largest beef import market in Asia, after China and Japan, with roughly 513,000 tonnes swt of product entering the region in 2017.

Source: GTA, UN Comtrade, Vietnam Customs. * Vietnam imports exclude re-exports. Import figures exclude live cattle.

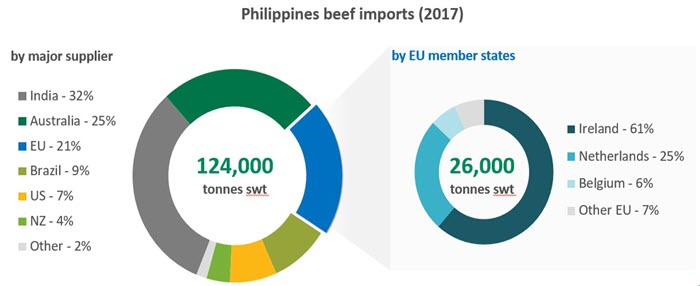

Increased competition from the EU

SEA has emerged as the EU’s third largest beef export market (external EU trade), after Hong Kong and Bosnia & Herzegovina, mostly underpinned by the increased demand from the Philippines. In 2017, Filipino beef imports from the EU more than doubled to a record 26,000 tonnes swt. Strong EU competition is expected to continue following the re-entry of UK beef to the Philippines in late 2017. While a highly price-sensitive market, the Philippines remains an attractive destination for beef exports alongside the other key markets in SEA, partly attributed to a burgeoning fast food sector.

US beef exports to the region also increased strongly, up 86% to 28,000 tonnes swt. Indian buffalo meat exports maintained a stable growth (at 6%, or 240,000 tonnes swt). On the other hand, imports from Brazil and New Zealand declined sharply by 16% (38,000 tonnes swt) and 8% (27,000 tonnes swt) respectively.

Source: GTA, UN Comtrade, Vietnam Customs.

Source: GTA

Australian beef exports to SEA

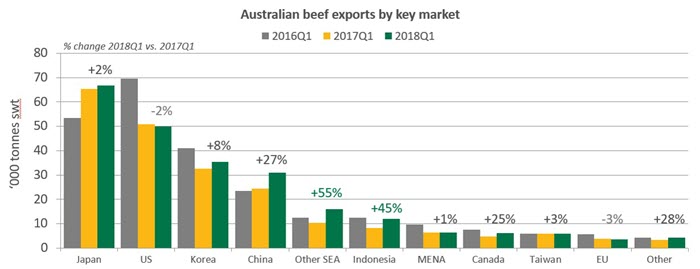

Low Australian supply and increased competition in the region resulted in a 7% decline in Australian beef exports to SEA in 2017, to 111,000 tonnes swt. Strong competition from Indian buffalo meat in Indonesia and imported beef from Brazil, US, and EU in Singapore affected Australian exports to these two markets in particular. Meanwhile, exports to other SEA markets such as Malaysia, the Philippines, Thailand and Vietnam remain steady.

Despite the rising competition, Australian beef exports to the region increased significantly in the first quarter of the year, supported by a recovery in local production. Growing at 51%, first quarter Australian exports to SEA (28,000 tonnes swt) grew at a faster rate than Japan (2%), Korea (8%) and China (27%).

Source: DAWR

Find out more