Subscribe to The Weekly e-newsletter

For in-depth red meat market news, information and analysis.

In depth: Australian red meat in MENA

04 July 2018

The Middle East and North Africa (MENA) is a large, diverse and complex region. Definitions of MENA generally include 19 countries, but can cover up to 36. The region is home to some of the world’s richest and poorest countries. The level of modern retail development is highly variable across the region, and generally quite fragmented even where it’s most advanced. In some countries, Western-style cuisine is increasingly available in the foodservice sector.

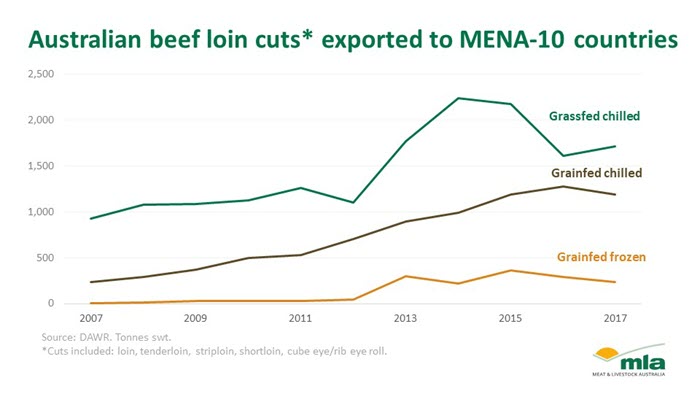

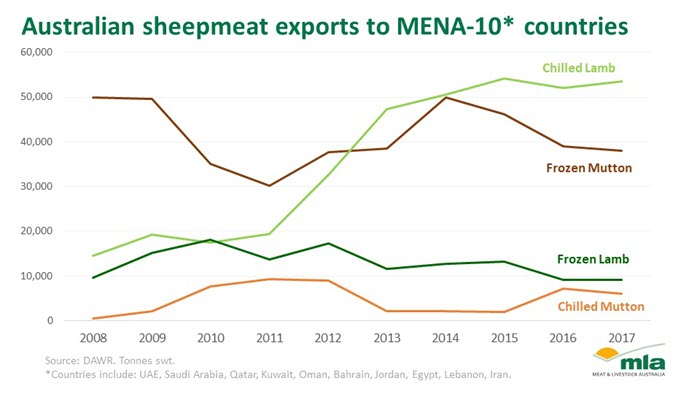

Australian sheepmeat exports to the region have been consistently strong and have been shifting to include higher proportions of higher value product. While Australian beef exports have come from a low base, they have seen significant growth in recent years, particularly at the premium end of the spectrum.

As an ‘Emerging Market’ region, MENA poses some unique and significant challenges. Although tariff barriers are generally not onerous, technical barriers to trade are variable across countries. The region itself has been intermittently impacted in some areas by conflict, while demand in some countries has been influenced by subsidy policies as well as fluctuating oil prices.

Most countries do not restrict market access and hence are very competitive markets. In modern retail, particularly in the Gulf States* for example, it’s common to see red meat products from all over the world. Australian beef shares the cabinet with product from countries such as Brazil, India, the EU, the US, New Zealand, Paraguay and South Africa. On sheepmeat shelves, Australian lamb shares the space with countries such as India, Pakistan, New Zealand and the EU, as well as Sub-Saharan African suppliers such as Ethiopia.

Understanding the MENA market

One of MLA’s challenges has been to find ways of helping Australian exporters better navigate and cut through the complexity of markets in the region, giving them insights to help identify and further explore potential opportunities. While MLA does include MENA countries such as UAE and Saudi Arabia in its annual Global Consumer Tracker study, both a broader scope and greater depth of research in specific cities across the MENA region is required.

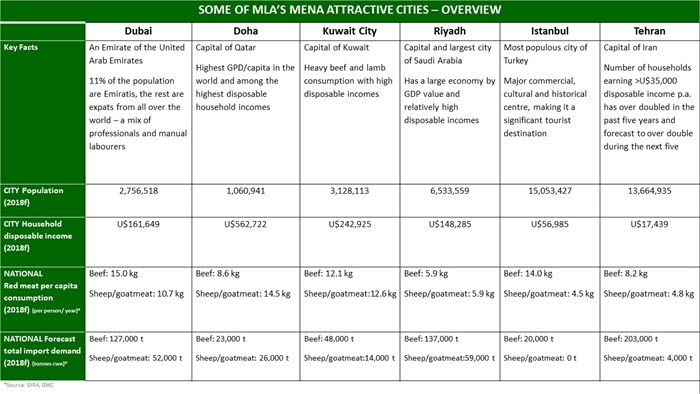

To meet this need, the MENA Attractive Cities Study has been conducted. This study was funded under the Department of Agriculture and Water Resources’ Rural R&D for Profit program, as part of MLA’s Insights2Innovation body of work, which also covered China. The objective of the MENA Attractive Cities Study has been to capture market insights, identify high value opportunities in export markets for the next 3–5 years and help producers and their supply chain partners respond effectively to those opportunities.

MLA worked with GlobalData to collect almost 1,800 data points across 31 MENA cities, covering political, economic, social, technological and environmental factors, with many projected to 2021. These were weighted based on their impact on driving Australian red meat import demand. This formed a comprehensive database, which was used to identify a short-listed five most attractive cities. Phase two of the study involved conducting consumer research in these five cities plus Tehran.

This resource will be shared with the Australian red meat industry targeting MENA markets and will inform the direction for MLA's investment in the region.

Stakeholders will have access to these insights in several key areas:

- WHO they should consider as their target customers and what they are looking for

- WHERE are opportunities likely to be of highest and fastest-growing value – which cities and which retail and foodservice channels

- WHAT products they should consider offering – species, categories, cuts and segments

- HOW can they most effectively communicate their offers in ways that appeal to their target customers and optimise their competitiveness in the marketplace

- For more market and consumer insights on MENA markets, view the MENA Beef Snapshot or view the MENA Sheep Snapshot.

- For the latest Australian export statistics to the region, view beef or sheepmeat.

*Gulf Cooperation Council members: United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain and Oman