Global grain outlook

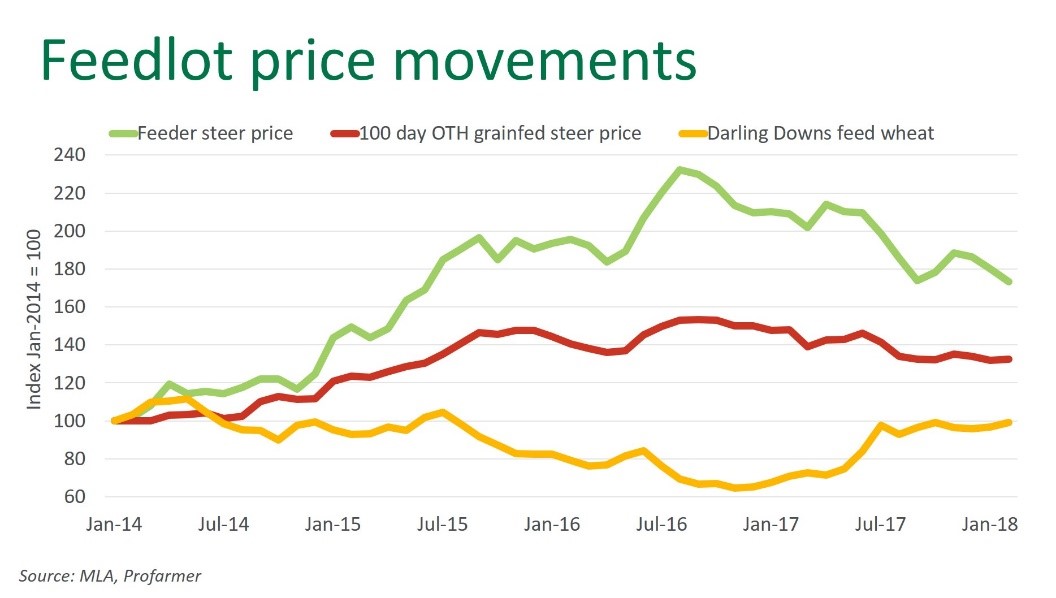

For the lot feeding sector, feed grain prices play a pivotal role in the outlook of feedlot margins.

Results from the latest ALFA/MLA lot feeding survey highlight the impact of an unfavourable shift in feedlot input costs. Diverging cattle saleyard and over-the-hook prices, combined with a rise in feed grain prices during the quarter has been reflected in lower numbers on feed.

The recent rainfall will also see feeder buyers find increased competition off the back of renewed restocker activity. This has been evident in the last seven days as the national saleyard feeder steer indicator has lifted 4% to 293.8Ac/kg live weight. Queensland’s 100-day grainfed steer over-the-hook indicator has followed suit, at 521Ac/kg carcase weight, up 2% on the week prior. However, the rainfall could also provide a timely boost for current crop production.

ABARES Agricultural Commodities Report: March Quarter 2018

ABARES, in their Agricultural Commodities Report: March Quarter 2018, predicts world coarse grain prices to increase in 2018–19 and continue to do so out to 2021, as demand is expected to outstrip supply. Increasing demand for protein is expected to drive demand for coarse grains for livestock feed in developing countries.

World corn production is forecast to fall 2% in 2018–19, as average yields in Brazil, US and Ukraine are expected to move lower from historically high yields in the last two years.

World barley production is forecast to increase by 4% in 2018–19 to around 148 million tonnes, underpinned by producers responding to higher prices by increasing the area planted by an estimated 3%. Global wheat prices are projected to rise modestly in 2018–19 before declining out to 2021.

World wheat production is anticipated to grow in the medium-term – the result of higher yields, particularly in the Black Sea region.

In addition, concerns over dry conditions in Argentina (soybeans) and the US (wheat) also support the market sentiment of a modest rise in grain prices throughout 2018. Global grain market yields will likely return towards trend-line averages (BMI Research).

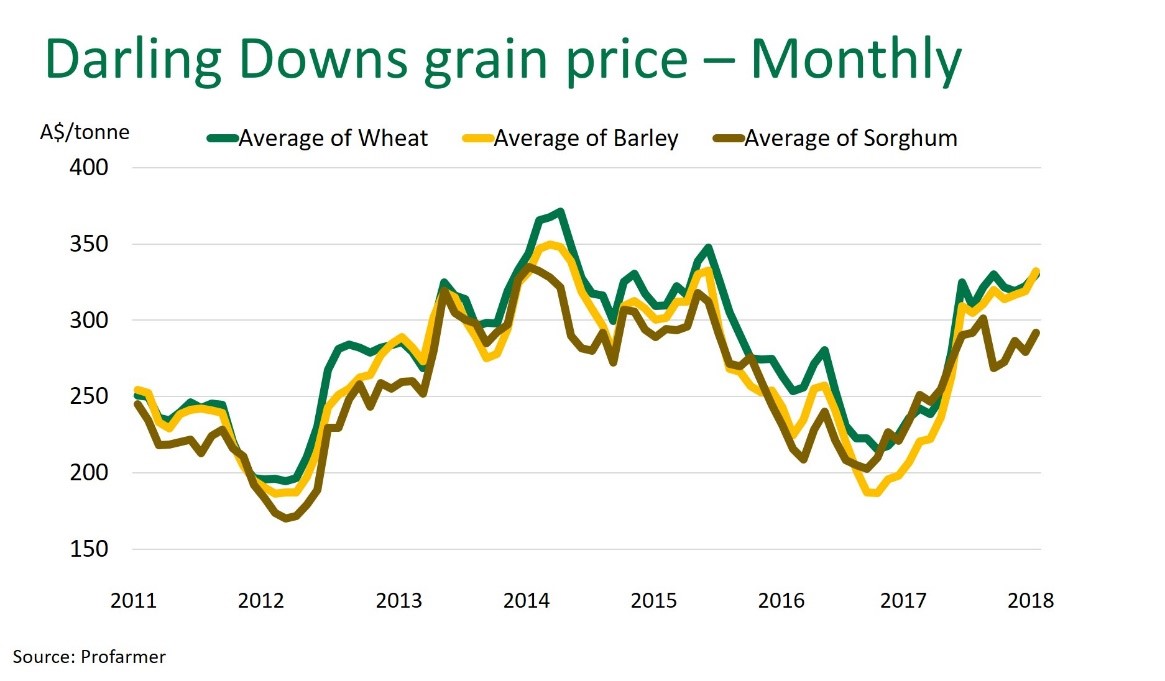

In Australia, Darling Downs (Queensland) wheat prices averaged $330/tonne in February, 2% higher month-on-month and a considerable 40% increase year-on-year (Profarmer). Seasonal conditions and global grain price movements have played a fundamental role in this price shift.