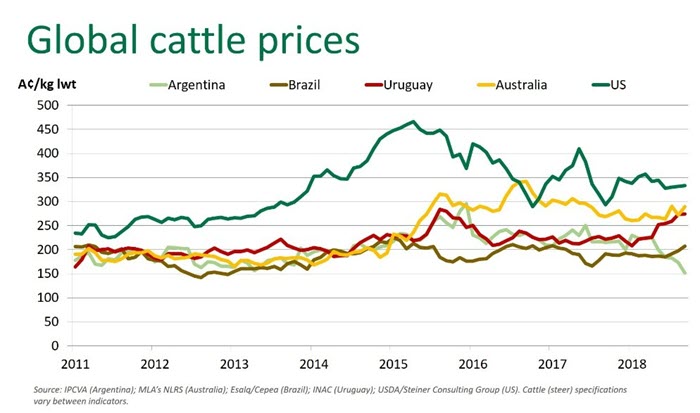

Comparing cattle prices in key global markets

Finished cattle prices are holding firm in Australia and the US, with South American prices less stable in recent weeks. Here Prices & Markets takes a closer look at some of the key international cattle markets.

Australia

Australian finished cattle prices remain resilient at a time when the sustained dry has hampered young cattle markets.

The national heavy steer saleyard indicator finished Tuesday at 289¢/kg live weight (lwt), up 27¢/kg on last year.

Processors grids have lifted in line with sustained demand for product destined for key export markets. The national heavy steer over-the-hook indicator has trended higher throughout September, averaging 502.42¢/kg for the month so far – up 9¢/kg carcase weight (cwt) on August and breaking 500¢/kg for the first time this calendar year.

US

Finished cattle markets in the US have continued to defy front-end supplies throughout the summer, as both domestic and international demand has kept finished cattle prices firm. International demand in particular has seen exports surge and the US cut-out value continues to hold above year-ago levels. Foodservice sales have increased sharply in recent months, the result of a booming US economy, coupled with low unemployment rates and lower taxes bolstering the foodservice sector.

The total supply of cattle on feed in the US as of 1 September was 11.1 million head, 6% higher than last year, while marketings in August were identical to year ago levels. Demand will be a critical factor for beef/cattle prices going forward.

South America

Finished cattle markets across South America have fared indifferently in recent months.

Brazilian cattle prices have recorded a modest uptick, as key exporting states have been increasingly eager to source more beef, in order to service growing overseas demand. A further tightening of supplies has helped push prices higher.

Sao Paulo state steer prices averaged 207.46A¢/kg live weight (lwt) in September, up 8% year-on-year and representing a move above 200A¢/kg (lwt) for the first time since March 2017.

A sustained lift in Uruguay finished cattle prices since the turn of the year has come to a halt, as prices stabilised in early September and have since started to decline. Supplies in Uruguay appear mixed, with drought conditions still hampering the supply of finished cattle in the northern parts of the country, while southern regions have seen a lift. There is an expectation that prices will continue to decline due to the seasonal supply increase.

Argentine finished cattle prices on a currency-adjusted basis have declined sharply, underpinned by a heavily depreciated peso. The economic turmoil has affected all sectors of the economy, including cattle markets, with buying and selling operations helpless in current conditions. However, Argentine beef exports could benefit from a depreciated peso, despite exports taxes recently reinstated as part of new economic measures applied to curb spiraling inflation.