Cattle on feed underpinning US beef exports

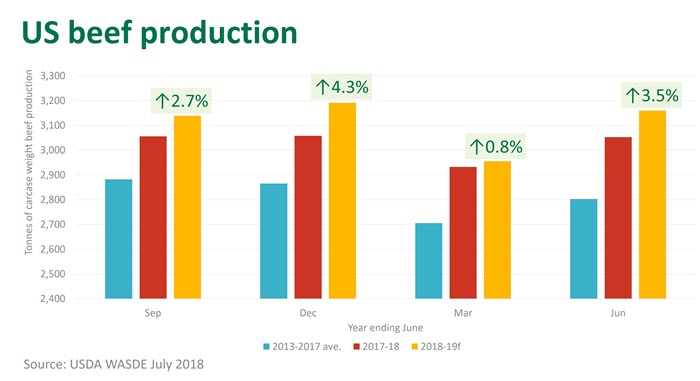

Half way through 2018, US beef production continues on its growth path, underpinned by increased cattle on feed and, more recently, a lift in cow kills as herd growth slows. While US domestic beef demand has been strong, thanks to a humming economy, additional supplies continue to push onto the export market.

Supply pivot

Last week, USDA released midyear herd and feedlot inventories. Cattle on feed on 1 July totalled 11.28 million head, up 4.3% year-on-year and 8.9% above the five-year average. In particular, the supply of market-ready cattle on feed for more than 120 days is 28.3% above year-ago levels, ensuring kills will remain elevated in the short term.

Cow slaughter has also remained high in 2018 due to lower cow-calf profitability and poor pasture conditions in key cattle areas. The 1 July herd inventory report reflected some of this shift; replacement beef cow numbers declined 2.1% year-on-year to 4.6 million head. The aggressive herd expansion witnessed between 2014 and 2017 is over and herd growth will likely be limited, or may even contract, in the next two years.

Nevertheless, greater calf numbers will continue to come forward out of the current supply base, keeping feedlots full and pressuring production and export growth over the next year.

US exports expand into Japan, Korea

The US is Australia’s greatest competitor in global beef markets, particularly when it comes to premium or grainfed product, and nowhere else is this competition witnessed more clearly than in Japan and Korea, where Australia and the US compete over the lion’s share of the imported beef market.

US beef exports increased 14.5% in the first five months of 2018, to 402,000 tonnes swt. Export growth has been led by Korea, which increased 36.2% over the period, and Japan has been a key market, up 5.7%. Fortunately, Australia has recorded 11% growth into both north Asia markets in the first half of 2018, as both imported beef markets expand.

Safeguard at play in both markets

Safeguard is a mechanism that bounces up an import tariff rate, when imports exceeded an agreed trigger level between countries.

The US has a high safeguard trigger volume under the Korea-US Free Trade Agreement (KORUSFTA), almost twice the size of the one negotiated under the Korea-Australia FTA (KAFTA). While the US exporters have little concerns about potential higher tariff rate for the reminder of the year, Australia has already used 70% of the annual safeguard volume, halfway through 2018.

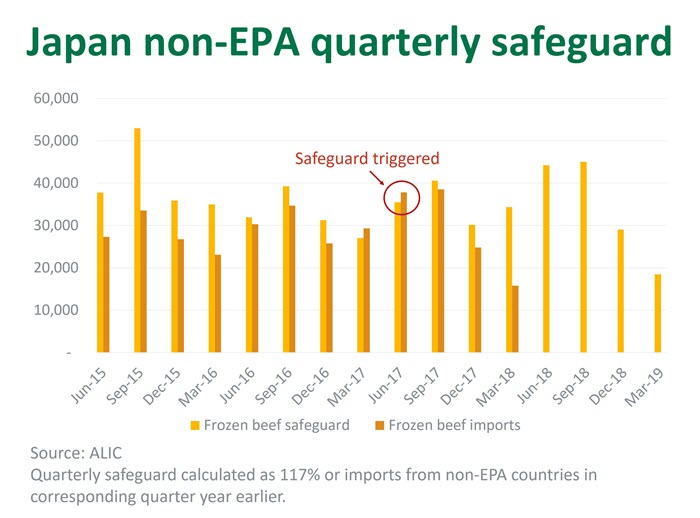

In contrast, the safeguard dynamics worked in Australia’s favour in Japan over the last year. Countries with no Economic Partnership Agreement (EPA) triggered the frozen beef safeguard last year, which resulted in higher import tariff for frozen beef from these countries, including the US (Australia is exempt from this system due to Japan-Australia EPA). The safeguard could be triggered again if US beef continues to pour in, with the December 2018 and March 2019 quarter safeguard triggering volumes noticeably smaller.

Importers managing inventory and attempting to avoid a second-time trigger of the safeguard will provide some shelter to Australian exports entering the market. Making things challenging for the US will be the 4.3% year-on-year production expansion expected in the coming December quarter.