Dry conditions continue to drive red meat exports

BEEF

Beef exports continue above 100,000 tonnes swt – levels not seen since 2015.

Australian beef exports continued to track well above 2017 levels, passing 100,000 tonnes shipped weight (swt) for the second month in a row as ongoing dry conditions continued to influence cattle supply. In fact, at 101,200 tonnes swt, it was Australia’s third largest June on record and larger than any month prior to 2013. June exports were down on May, but were up 6,700 tonnes swt or 7% than June last year.

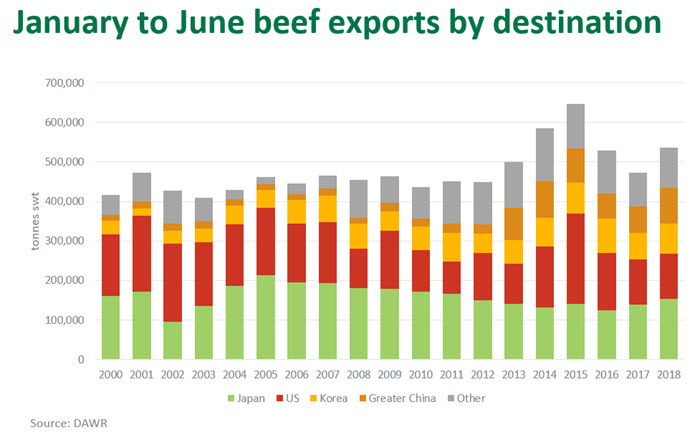

The year-to-June total for beef exports is now at 536,700 tonnes swt, an increase of 13% on 2017 levels. This continues to be Australia’s third largest start to the year, behind both 2014 and 2015, as all key export destinations are experiencing some level of growth on last year.

Both chilled and frozen beef exports are contributing with increases of 8% and 15% respectively. Manufacturing beef is currently growing in line with broader beef exports at 13% with markets such as Japan, China, Indonesia and Philippines growing close to or above this level.

The drop in the value of the Australian dollar through June from A$75.7c down to A$74c also assisted Australia’s global competitiveness.

Key international markets

- Australia’s beef exports to Japan totalled 154,400 tonnes swt for the year-to-June, an increase of 11% year-on-year.

- This was followed by the US, totalling 113,800 tonnes swt for the year-to-date, which was 1% up on year-ago levels.

- Volumes to Korea rose 11% from year-ago levels, to 75,200 tonnes swt.

- China, increased by 46% year-on-year to 74,400 tonnes swt getting close to Korea’s total and to becoming our third largest beef trading partner; however, the split of our exports to these two markets is quite different with almost all the demand in China mostly for Australia’s frozen beef.

Other notable increases for the year-to-June

- Indonesia, up 38%, to 30,900 tonnes swt

- The Philippines, up 24%, to 17,200 tonnes swt.

SHEEPMEAT

Sheepmeat exports down from record highs, but still well above year-ago levels.

Australian sheepmeat exports in June totalled almost 37,600 tonnes shipped weight (swt) – back from May’s record month, but 29% up on the same month last year.

It was mutton that saw the larger increase this month, 43% above June 2017 levels to 11,900 tonnes swt. This was broadly expected considering the large increases in slaughter due to dry conditions across many supply areas. Lamb exports were also down on May, but still recorded their second largest month of exports ever reaching 25,700 tonnes swt, 23% up on June last year.

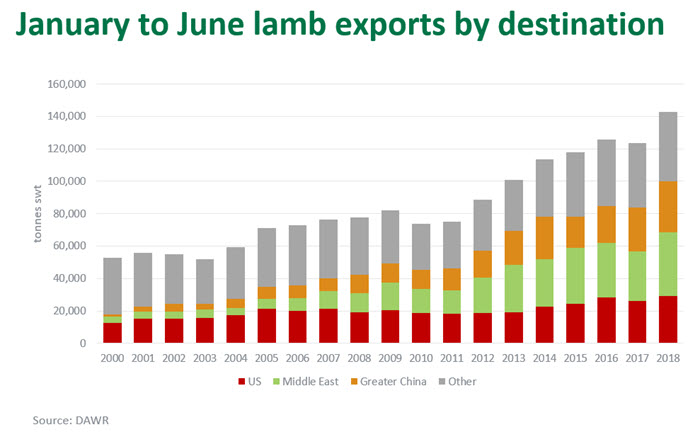

This month brought year-to-date lamb exports to 142,800 tonnes swt, an increase of 15% on 2017 levels. This year-to-June total is the largest ever start to the year and has been driven by growth in all key destinations Middle East, China and the US. Positively for lamb, it’s the chilled segment driving this, up 18% with frozen growing 13% in comparison. The Middle East has been the main contributor for the growth in chilled lamb increasing imports from Australia by 35% versus the same time last year with renewed exports to Iran a key area for growth.

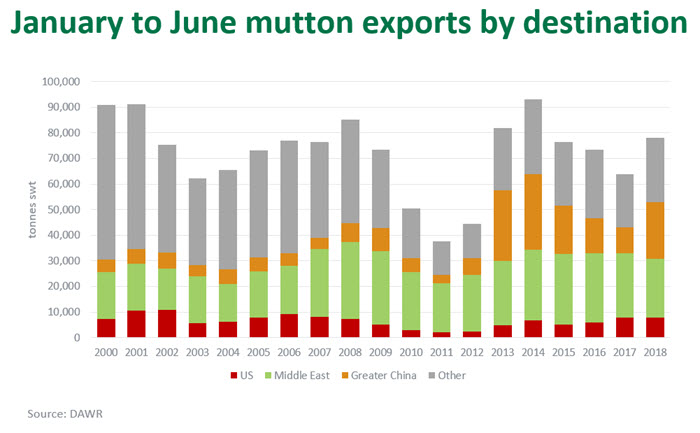

Mutton year-to-date exports are 22% up on 2017 levels reaching 78,100 in June. This year-to-June total is the largest since 2014 and has been predominantly driven by China.

There was some scattered rainfall in June, which did see some reductions in supply; however, slaughter levels are still tracking well above last year’s levels. For the year-to-June, eastern states lamb slaughter has lifted 8% with mutton even higher at 22%. The lift in supply continues to flow through to increased exports as robust global demand for sheepmeat is sustained.

June year-to-date lamb exports:

- Middle East, up 29%, to 39,500 tonnes swt

- China, up 16%, to 28,800 tonnes swt

- US, up 11%, to 29,300 tonnes swt.

June year-to-date mutton exports:

- Middle East, down 9%, to 23,000 tonnes swt

- China, up 112%, to 18,200 tonnes swt

- US, flat at 7,900 tonnes swt.