Competitor watch: Uruguay

Uruguay is a relatively small beef producer and dwarfed in tonnes produced when compared to its South America neighbours, Brazil and Argentina. In 2018 Uruguayan beef production is estimated to total just above 575,000 tonnes carcase weight (cwt), according to the USDA – this would represent a 3% decline on the year prior and 2019 is forecast to decline a further 7%.

For context, Brazilian beef production is forecast to increase 3% next year, adding an additional 300,000 tonnes cwt of beef into the market.

Despite its status as a small producer, Uruguay’s position as a leading exporter of beef is widely regarded, underpinned by strict sanitary standards, as well as extensive transparency along the supply chain.

These standards support Uruguay’s access into a number of Australia’s key markets, namely the US, China and EU. Even with a forecast decline in beef production and exports (back 5%) in 2019, Uruguay will remain a strategic competitor for Australia.

For the calendar year-to-September, Uruguayan beef exports totalled 238,000 tonnes shipped weight (swt), up 3% year-on-year with China accounting for 53% of all exports.

Cattle prices

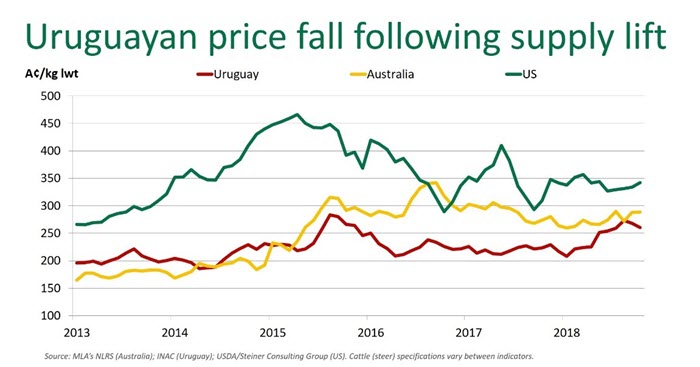

Dry conditions have hampered the supply of finished cattle in Uruguay, particularly in the northern parts of the country and finished cattle prices maintained a steady increase until September – demand from China also supported finished prices. In fact, steady cattle price rises saw finished cattle in Uruguay on parity with their Australian counterparts, on a currency adjust basis, for the first time since 2015.

More recently, excellent spring conditions and abundant forage availability – driven by the southern regions – further supported prices. However, steer slaughter started to increase throughout October and appears to have halted the upwards trend in the finished market. Reports suggest that producers who were holding onto stock in hope of improved finished values may now look to sell, with further downwards pressure upon prices expected due to the seasonal supply increase.

Looking ahead, finished cattle prices could find support heading into 2019. The weekly female kill in Uruguay has remained elevated year-on-year since July but, if seasonal conditions allow, producers will look to rebuild herds next year. Growing live cattle exports over the last three years have also reduced the pool of market ready cattle – 430,000 head are estimated to be exported in 2018, a 30% lift on the year prior.

Growing demand from China, yet to show signs of letting up, will continue to support cattle prices, and Uruguay and neighbouring South American suppliers will look to increase their presence in the market as traditional destinations present headwinds of one form or another. However, beef from Uruguay, a primary competitor with Australia in the Chinese premium beef cabinet, will continue to be constrained by supply.