Cattle exports post recovery from 2017 slump

The live cattle trade has faced its fair share of challenges over the last few years, however the tight supply that affected 2017 appears to be over.

Where has the supply come from?

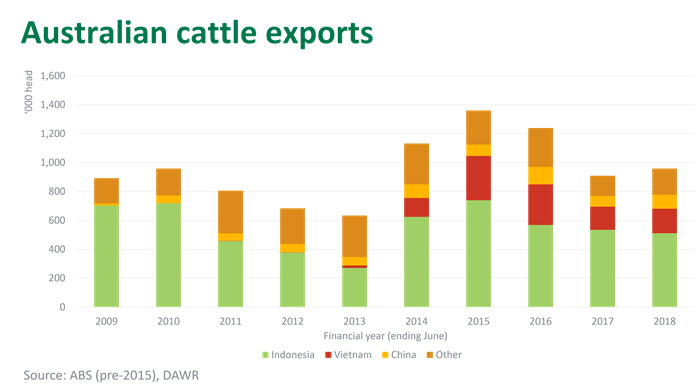

Australian cattle exports during the 2017-18 financial year, at 958,000 head, increased 5% on the previous year – the first year of growth since 2014-15 and a stark contrast to the 27% contraction recorded during 2016-17. The growth in 2018 has been underpinned by a lift in numbers over the last six months; exports between January-June were up 23% year-on-year.

After a couple of reasonable wet seasons across the NT and Kimberley, the pickup in 2017-18 exports was led by increased throughput out of Darwin (up 2%, at 354,000 head) and Broome (up 28%, at 91,000 head). Meanwhile, the expansion of sea-freight slaughter cattle shipments to China and re-entry of Russia as a feeder buyer saw exports out of Portland lift 80% year-on-year, to 105,000 head.

In contrast, shipments out of Townsville declined 5%, to 182,000 head, amidst supply shortages of export suitable cattle across Queensland, particularly in the first half of 2017-18, and strong competition from the processing sector.

The lift in supplies has been reflected in cattle prices across Australia. Export feeder steers out of Darwin have tracked below 300¢/kg live weight for the last three months and are now aligned with the eastern states feeder market. While high export cattle prices were a boon for northern producers (Darwin feeder steers peaked at 370-380¢/kg at the start of 2017) it has put pressure on segments down the supply chain selling into price-sensitive Southeast Asian markets.

Indonesia challenges remain

Trading conditions in Indonesia remain difficult for cattle importers, however some respite has come from easing cattle prices out of Australia.

Wet market beef prices, a key priority for the Indonesian government, remained stable during Ramadan, with additional imports of low-cost Indian Buffalo Meat supplementing supply and tempering the additional demand over the festive period. Of the 110,000 tonnes of Indian Buffalo Import permits issued earlier this year, it is estimated close to 10,000 tonnes were realised up to May with the remainder expected to enter the market throughout the second half of 2018. In the lead up to general and presidential election in April 2019, affordable beef prices will remain a focal point of discussion in Indonesia.

Meanwhile, cattle exports to Indonesia in 2017-18 declined 4% year-on-year to a five-year low, at 511,000 head, but the last six months fared better with shipments close to par with year-ago levels. The 5:1 (feeder-breeder policy) remains in place but breeder shipments since October 2016 are well below target levels (by about 116,000 head) required to offset the number of feeders that have already entered the market – that number of breeders will be a challenge to procure before the end of year deadline.

Lastly, while Australian export cattle prices have drifted lower, an easing Indonesian Rupiah against the US greenback and, to a lesser extent, Australian dollar (as have other Southeast Asian currencies amid fears of the impact of trade war) has offset some of the benefits for importers buying cattle in the current market.

Vietnam stabilises but China emerges

After enormous growth between 2012 and 2015, exports to Vietnam contracted 43% in 2016-17 but stabilised in 2017-18, to 169,000 head of mostly slaughter cattle. Early growth in exports to Vietnam reflected a market in its infancy, also supported by Australia’s coinciding herd liquidation, but now it has switched from growth to maintenance phase.

Almost three years since initial health protocols were signed, and following a string of early air shipments, the slaughter cattle trade to China has now developed into a more regular sea-freight business. In 2017-18, almost 25,000 head of slaughter cattle were exported to China, and the bulk of that trade took place in the last six months as the market has ramped up and cattle have become more affordable in southern Australia.

Behind Vietnam, China has grown to become Australia’s second largest slaughter cattle market. The growth in the slaughter cattle China trade has come at a time when beef and dairy breeder exports have also cooled off, with the dairy trade impacted by reduced profitability in the Chinese dairy sector.

Live share of turnoff

The lift in export numbers is occurring as kills across Australia have also picked up. While ABS June slaughter data is yet to be published, 2017-18 kill numbers will likely finish close to 7.56 million head, an 8% lift on the previous year (2016-17 was the lowest slaughter year since 1995-96). That will bring total turnoff (the number of cattle leaving the system via a boat or kill floor) to 8.51 million head, well below the 2014-15 10.78 million head recorded during peak liquidation but roughly in-line with the pre-drought ten-year average.

Going forward, the Queensland herd remains on a knife-edge with many parts of the state still grappling with drought. While other key live export regions have fared better, when Queensland has a solid season we may see northern supply, once again, tighten as producers look to replenish depleted herds.

The live share of turnoff in 2017-18 was 11.2%, below the 13.1% peak in 2015-16 but still historically high.

View MLA's monthly trade summary - Australian livestock exports